Notional income from pension pots

by Gareth Morgan on December 22, 2015

Before the pension freedoms of April 2015, the practical reality, for most people with pension savings, was that they had to take an annuity. For those with benefits entitlements that was often a pretty poor bargain. The annuity was taken penny for penny from any means tested benefit entitlement that they had, whether Pension Credit for older people or Jobseeker’s Allowance, Employment and Support Allowance or Income Support for those of working age.

For a single healthy person with a basic state retirement pension and no other income then that meant the first £35.25 of an annuity was just handed straight back to the state. There was, for some, a small offset from Savings Pension Credit but that has been reducing for several years and will disappear completely for those receiving the new state pension after April 2016.

With the pension freedoms, things have changed. People are now able to exercise many more options, take capital in one lump sum or in multiple drawdowns or just leave their pension savings where they are.

Leaving the pension savings where they are, once somebody is able to make use of them, does not mean that they are ignored for benefits assessments. Somewhat unusually they are not treated as a capital lump sum but they are treated as producing a notional annuity value.

This notional income only applies to those claiming Pension Credit. For those getting working age benefits, there is no effect from untaken pension savings, even if they can be accessed. Only actual sums taken from those savings have an effect on the benefits assessment.

The notional value for Pension Credit claimants is calculated using tables produced by the Government Actuary’s Department, and depends upon the amount of money in their pot, their age and the current yield from 15 year Gilts. The tables and Gilt yields produce a notional annuity value for each thousand pounds in the pension pot and this is used to determine the notional income for benefit purposes.

No notional capital value is applied to the pension pot.

The effects

In many cases this might be seen as a relatively straightforward calculation. It can however become quite complicated when people start to make use of the money in the pension pot, because then the notional annuity value changes.

Taking capital

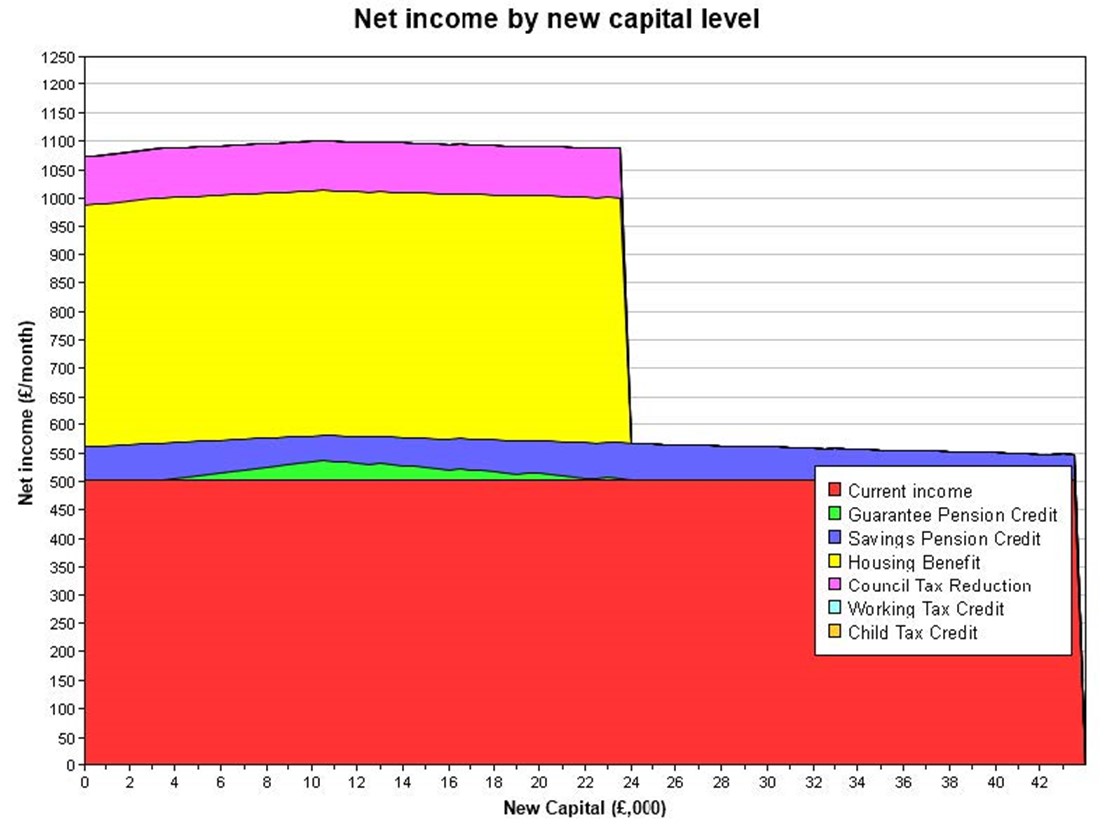

The chart below shows the, initially rather puzzling, situation where someone can take capital out of their pension pot and

- increase the amount of their benefits

- gain access to passported benefits

- have a higher overall income

- have a substantial capital sum in the bank

This is because of a number of factors. In this example the pot size starts at £35,000 and the new capital axis shows the amount withdrawn from that.

At first, the capital withdrawn is disregarded, as the amount taken is below the £10,000 level that is ignored for Pension Credit.

The reduction in the pot size also reduces the notional income which is used in the benefits assessment.

Benefits increase as there is less income taken into account.

When somebody has more than the disregarded £10,000 of capital then a notional income, called deemed or tariff income, begins to be taken into account. In Pension Credit that is calculated on the basis of £1 a week for every £500, or part, above £10,000.

When deemed income begins to be taken into account the increase in that income at each step is higher than the reduction in notional income because of the reduction in the pot size. That means that benefit entitlement begins to fall.

In the chart, it can be seen that the reduction in the notional annuity figure, as the value of the pension pot reduces, actually produces an entitlement to Guarantee Pension Credit with the passported entitlements which accompany it.

Taking income

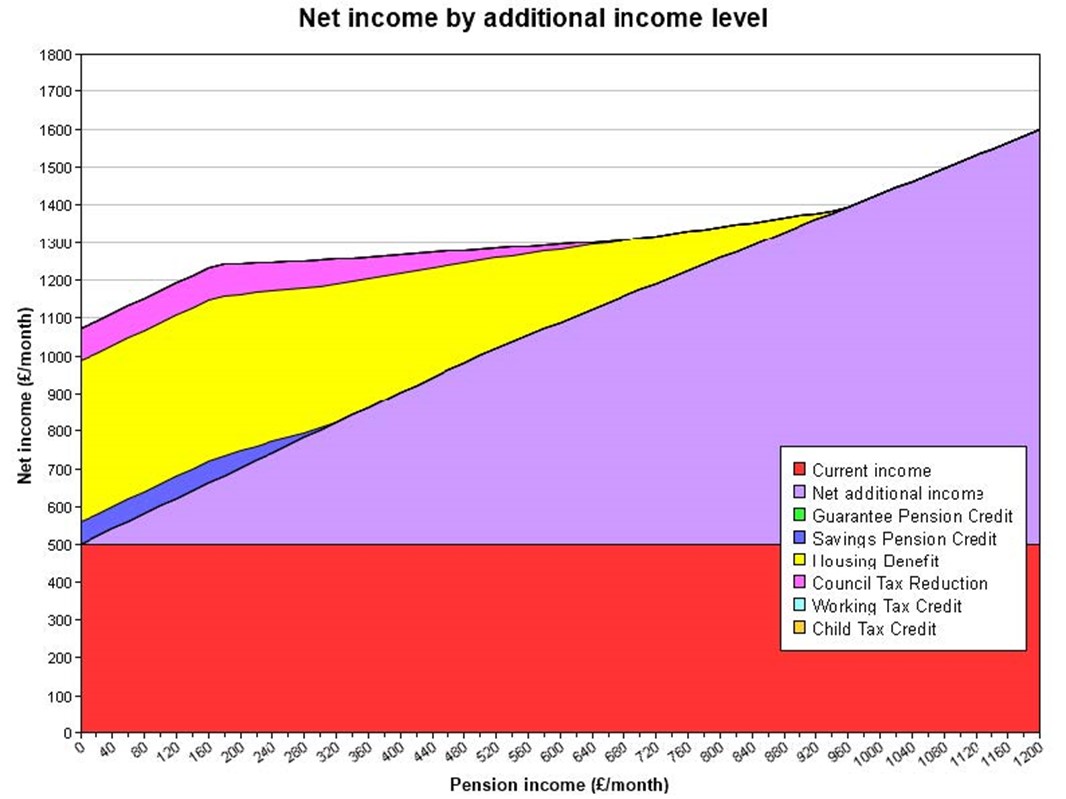

When taking increasing amounts of income from a pension pot then, for benefits purposes, there can be a steep initial rise in net income, which later becomes more gradual. An example of this is shown in the chart above.

The steep gain in net income initially happens because while the income taken is less than the notional income level, the calculated notional income is used in the assessment of benefits.

The actual amount of income taken is ignored for benefits purposes but produces an increase in real net income.

Once the real income taken is higher than the notional income level for the pot, the real income is used in the calculation and the benefits level reduces with the income increases rather than having been constant with a fixed level of notional income.

The notional value of the pot reduces by the amount by which the real income is greater than the notional income.

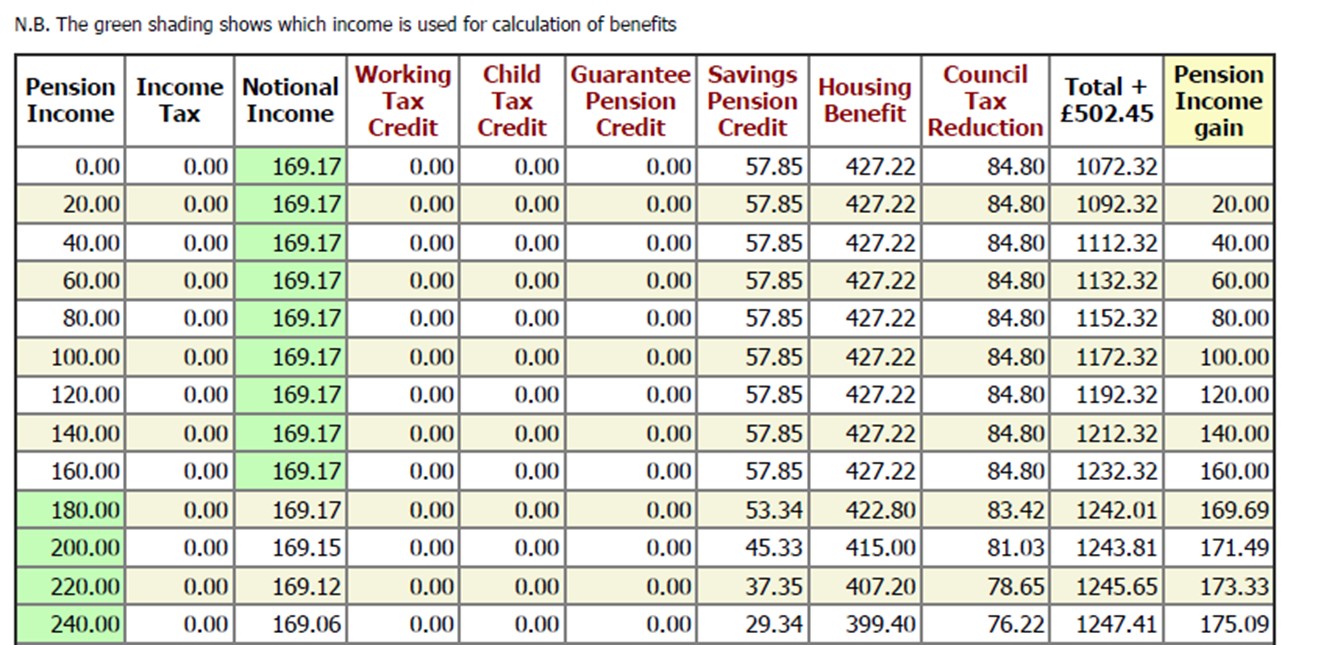

The table above shows the result and the way in which the switch from notional to real income occurs in the benefits assessment.

The charts and tables are produced by Ferret’s pensionForward advice system which calculates the tax and benefits impact of the pensions options open under the new freedoms.

Conclusion

The new pension freedoms have opened up options which can allow those on benefits to see less impact from their pension savings than was previously the case.

The new options introduce more complexity into the assessment of benefit entitlement and into the advice needs of clients. In order to provide an accurate picture of the effects and impacts of the different options, complex calculations are needed. This is particularly the case where notional income from untaken pots needs to be considered.

Comments

A very interesting article that is helping me challenge the Pension Service in my claim for Pension Credit. Staff at the DWP said I had to get a statement of how much I could get from my SIPP, but provided me with no information on the basis for the calculation.

For example they could not say if they wanted an income figure based on an annuity, income drawdown, or lump sum payments. After many weeks of phone discussions, they sent a PPR1 form – but it was dated 02/11 – long before the changes to the pension regime of 04/15. The form is to give my pension provider, asking them to to state the MAXIMUM AMOUNT PAYABLE!

Well, since April 2015, the maximum amount payable would be to withdraw the entire the whole pension pot meaning I would not qualify for Pension Credit at all.

I am not sure if they are just incompetent or are deliberately trying to use old rules. Under the old rules I would not get PC (at least not the guaranteed element) but under the new notional rules linking annuity rates to gilt yields, I suspect I may qualify.

Have lodged a formal complaint and the correctly dated PPR1 form should be in the post soon.

Many thanks for such a brilliant article!

“This notional income only applies to those claiming Pension Credit. ”

It applies to Housing Benefit and Council Tax Reduction too (after reaching State Pension Age, i.e. coming off Pension Credit).

I saw somewhere that after the 2015 Pension changes it is “100% Annuity” that is applied, suggesting that before then it was assumed 25% tax free lump sum was taken => 75% annuity… but I never got anyone from Motherwell to call me back to explain how their notional incomes were computed (because even then there were variables like increasing annuity rates, spouse benefits, etc which would affect any actual annuity rate)

Your link to the latest version of this paper doesn’t work… the FWP have asked me to ask the Pension Providers for the Notional Income but their Customer Services say they don’t do that and I inferred from mention of GDA tables that it is the DWP who compute it from 100% of the Pension Pot values… but mention of Canada Life income means it was Equitable who provided that, Legal General income from Old Mutual… so how do I as a retiree get them to supply the Notional Income now?

Thanks Ron, I should have said ‘applies to those over Pension Credit age” rather than ‘claiming’.

I need to sort out links as Dropbox have disabled the old links recently and I will try to work through them all when I can.

I’m not clear who FWP are (DWP?) and I believe that it is the provider who is meant to provide the income figures using the GAD tables. As this will be a constant value regardless of provider, then it shouldn’t matter which of the providers does it. Of course, if you have multiple pots of untaken savings then each provider will need to do this.

I’m trying to find out whether it is worth a disabled 55 year old on means tested benefits cut fly with full housing benefit and council tax relief to save £4k into a pension. Assuming they have £6k in savings as they reach state retirement age, would they be any better off either by taking it all as a lump sum at pension age or occasional drawdown of part of their pot? I can’t work out whether this would reduce their means tested benefit income (housing benefit and council tax reduction) and/or push them into income tax liability. I know thresholds and rules could change in the coming years, but the best we can do is try to grasp the current rules then consider any likely changes. I don’t want to get the person’s hopes up by mentioning it while I’m not sure myself.

I can’t look at individual cases but you need a lot more detail about circumstances to consider the options. At pension age, under current rules, £10K capital in total wouldn’t impact any Pension Credit entitlement.

Can’t understand why DWP allow people on income related benefits who are under state pension credit age to defer occupational pension because when the person eventually claims the occupational pension the DWP say all the income related benefits have been overpaid? They say that any deferred payments of occupational pension that have accrued and are paid in arrears as a lump sum are treated as past income if they cover any period that means tested benefits were paid. So anyone who thought they were saving their deferred payments up are actually overpaid. Don’t think the rules state this anywhere, so if you have this type of pension where it pays arrears to you from age 60 until you eventually claim it then beware! So much for the Government wanting people to savefor their retirement!

I am in this position. I am 62 and through a three year recovery after an accident I have used up savings and had to go onto universal credit. I have a small Final salary pension that became available to draw down on and I have not touched it nor considered this until a contact told me to inform DWP about it today. I called them and they said, its fine. You are under the state pension age so it doesn’t affect things. I feel very uneasy. I have been unable to find any content on this , apart from that term notional income, which means when I retire they will recall it all back. Which is fair enough, I just dont wish to be in any trouble

If you are under state pension age then untaken pensions are ignored for benefits calculations. If you take any income from a pension then it is deducted penny for penny from most means tested benefits as it is treated as income. Once you reach pension age then it starts to be counted but remember that if you are getting Universal Credit, you will move onto Pension Credit which is paid at a much higher rate.

Yes Tracey, it means that a massive overpayment will have been incurred when you eventually claim it and any arrears are paid. They say it’s fine to not touch it whilst under state pension age but if this results in any back payments/arrears for any period that ESA/UC, Housing Benefit, Council Tax Support has been paid then the deferred pension is treat as income and all these benefits have been overpaid. They do not treat it as a lump sum capital.

Dear Tracey Evans, I did reply to you but it’s not shown?? I just wanted to warn you that DWP have confirmed that any deferred payments of occupational pension for people under state pension age that have accrued and are paid in arrears as a lump sum are treated as past income if they cover any period that means tested benefits were paid. So anyone who thought they were saving their deferred payments up are actually overpaid. Don’t think the rules state this anywhere, so if you have this type of pension where it pays arrears to you from the normal retirement age for the scheme until you eventually claim it then beware! They treat it as income and not capital. So you can think it’s safe to defer when in actual fact you can be building up a massive overpayment! It might be worth checking with your pension people if they will be repaying you any arrears/backpayments.

What happens if the pension is not taken until state pension age? Will the esa people still want all the money back in this type of case?

It should be treated as capital when received, as a lump sum. Untaken pensions are completely disregarded until state pension age is eached.

Thanks, would you be able to provide a link to any guidance, legislation or case law that confirms that any arrears/back payments of deferred occupational pension payments are treated as capital when received for income related benefits under state pension age.

Universal Credit , like Pension Credit , defines what is taken into account as income, unlike most legacy benefits where what isn’t taken into account is defined and everything else counts. UC doesn’t define lump sums from deferred pensions as income.

Thank you. Can you confirm how any arrears/backpayments of deferred occupational pension payments are treated for income related ESA and contribution based ESA under state pension age,

I’m afraid that this is getting too detailed, and too close to advice, which I can’t give. Have a look at https://assets.publishing.service.gov.uk/media/66a36f16ce1fd0da7b592d9f/adm-chapter-v1-esa-amounts-of-allowance.pdf as a starting place.

Thanks. It was just a general answer that I was hoping to get. I did try reading the information contained in the link and for me it is as clear as mud! I’m beginning to think that it is impossible to find this information out.

Does the example in V1142 of that link not help?

Thanks. I did see that example but again it was as clear as mud. I even asked someone else to have a look and they weren’t sure how to interpret it correctly?

I’m afraid that I cn’t get into more detail, as I can’t give advice on this blog. If you have a specific query then asking an advice centre would be best.

Thanks for the reply. It wasn’t advice I was asking for, just general information. However, DWP are still insisting that for someone under state pension age any deferred payments of occupational pension that have accrued and are paid in arrears as a lump sum are treated as past income if they cover any period that means tested ESA has been paid. Was just wondering if you have a calculator for sale that will work out the overpayment?

I think that I’d advise to get in touch with AgeUK. I know that their central office specialists are up to date with this.

Unfortunately AgeUK agree with DWP on this one. Thanks for your help though.

Tracey Evans I just wanted to warn you that DWP and AGE UK have confirmed that any deferred payments of occupational pension for people under state pension age that have accrued and are paid in arrears as a lump sum are treated as past income if they cover any period that means tested benefits were paid, this is ESA or UC. So anyone who thought they were saving their deferred payments up are actually overpaid. Don’t think the rules state this anywhere, so if you have this type of pension where it pays arrears to you from the normal retirement age for the scheme until you eventually claim it then beware! They treat it as income and not capital. So you can think it’s safe to defer (this is for people under state pension age) when in actual fact you can be building up a massive overpayment! It might be worth checking with your pension people if they will be repaying you any arrears/backpayments.

As previously requested do yo have a calculator for sale that will work out the overpayment?

I’m afraid not.

Thanks anyway. I will just have to trust the DWP’s calculations on this. They say because it’s an arrears/back payment of deferred occupational pension payments it is NOT treated as capital when received for income related benefits under state pension age, this is for ESA, UC, HB and CTR. Instead they are treating the lump sum arrears payment as unearned income. I think the DWP should warn people about this clause before they say people can defer their occupational pension under SPA in order to stay on means tested benefits. It has caused an enormous amount of upset for the person involved because their rules do not state this anywhere. The person thought it would be ok for their unclaimed occupational pension payments to accrue because the DWP said it was fine for them not to claim this income under SPA,

Riley said on 6/7/25 “What happens if the pension is not taken until state pension age? Will the esa people still want all the money back in this type of case?”

I would also be very interested to know the answer to this.

Many Thanks

Regarding Riley’s question on 6/7/25

I would also be very interested to know the answer to this.

Many Thanks

Saw this and wondered if anyone knows the answer? Saw this in newspaper https://www.thisismoney.co.uk/money/pensions/article-14114353/Taking-NHS-pension-Universal-Credit.html?ico=authors_pagination_desktop which confirms it’s ok to defer NHS pension with a normal pension age of 60 which is the 1995 scheme. Therefore, it’s one that will be backdated to NPA if claimed after spa.

So is it ok to defer this until after spa and receive all the backdated payments at that point without it affecting benefits that were paid when nhs pension was in deferral?