Pension Wise will make people Pound Foolish

by Gareth Morgan on February 15, 2015

There are big changes coming in April to the way in which people, from age 55, can access their ‘money purchase’, or ‘defined contribution’ pension savings. These are pensions where the amount you get is decided by the amount that you’ve paid in to your ‘pot’ – the total value of your pension savings. The changes don’t, in the main at the moment, apply to occupational or ‘defined benefit’ pensions where what you get is linked to your pay.

These changes, announced in the April ’14 Budget, will give much more freedom to people who would previously have had to buy an annuity. Now they will be able to take their pot in many different ways. 25% of that pot will be tax free but the rest will be taxed, as extra income in the year it’s taken, whether it’s taken as income or as capital. That means that it can be easy, when taking capital, to see it taxed at higher rates. Pension pots vary enormously in size but the average used for an annuity before the budget announcement was £33,400 according to the Association of British Insurers.

The government recognised that these freedoms required people to have access to guidance about the new options that were open to them. They are funding a new service, Pension Wise, which can be accessed on the internet at https://www.pensionwise.gov.uk/ (provided by the Money Advice Service), by telephone where the service is going to be delivered by The Pensions Advisory Service or face to face at 44 Citizens Advice Bureaux delivery centres across England and Wales and CABx in Scotland.

I’ve been working on the ways in which people will be able to understand the effects of the various options that will be open to them. It’s crucial that people understand one thing,

What you take from your pension pot is not what will end up in your pocket

Some of what you start off with will normally see tax taken off it. The more you take, the more likely that some of it will be taxed at higher rates. At larger amounts, the money you take will reduce your tax allowance making even more of a deduction.

Even more importantly for many people with lower value pots, the money that you take, whether as income or as capital can affect your entitlement to many benefits.

That makes it really, really important that when people are thinking about what to do with their pension pot, they have help to understand the final value of income and capital that they will end up with – the ‘bottom line’. Without that bottom line figure, it’s going to be too easy to make wrong, uninformed and potentially very bad decisions.

My hope has been that the Pension Wise guidance sessions and website would recognise that and include it as part of their service. I’ve become less and less hopeful that they will include this essential part of guidance as April comes nearer. Now with the launch of the Beta website I’ve become sad and angry as it looks like they won’t be doing anything to help people understand their real position.

They do mention benefits on the website

Your eligibility for some benefits depends on what other income you have. Any income you get from your pension, eg a guaranteed income (annuity), will count towards the income these benefits are assessed against.

Your eligibility for some benefits is affected by what benefits you already get or by your other circumstances (eg savings, or if you have a disability).

ExampleYour income is £125 per week. You get Guarantee Credit (a part of Pension Credit), which increases your income to £148.35. You then buy an annuity and your income increases to £220 per week. As you now earn more than £148.35 – the Guarantee Credit threshold – you don’t qualify for Guarantee Credit any more.

But that’s pretty much it. They do point to online benefit calculators but that can’t do the necessary sums; as I’ll show later.

They then go on to completely ignore the existence of benefits in the information they provide. Here’s an example they give on their web page Work out how much money you’ll have in retirement

Pension Wise Example

You’re 65 and you decide to stop working. You have the basic State Pension and your pension pot.

What you have

Amount

Full basic State Pension per year

£5,881.20

Your total pension pot

£30,000

What you do with your pension pot

You decide to take 25% of your pot tax free and take money from this amount every year. You buy a single annuity with the rest. This kind of annuity won’t continue to pay to your spouse or partner after you die.

What you do with it

Amount

25% tax free

£7,500 in one go

You buy an annuity with the remaining pot of £22,500

This will pay £1,125 per year until you die

What you get from 65 onwards

Income

Amount per year

Basic State Pension

+ £5,881

Annuity income

+ £1,125

Your total retirement income

= £7,006

Your income is below the tax-free Personal Allowance of £10,500, so you won’t pay tax on it.

You also have the £7,500 tax-free money to supplement your income.

Note the line – Your total retirement income = £7,006. That’s it! Then it’s on to the next subject.

Take that advice and the reader is going to join the third of people who don’t claim the benefits that they are entitled to.

Even if we assume that this person has no other needs; has no housing costs, no disabilities, no partner or dependent children and is not a carer then they’re still entitled to help.

They’d qualify for £13.62 a week, or £708 a year, Guarantee Pension Credit (GPC), a nice top-up to their annuity bringing their total income to £7,714 a year.

The income without the annuity would be £7,714 a year too. The Pension Credit top-up would be higher at £1,833 a year or £35.25 a week. If they only had a partial, or no, State Pension the income would be … £7,714 a year. That’s how means testing works.

It was the same under the previous rules but, then, people had to take an annuity, with few exceptions, so there were no options – now there are.

If people aren’t aware of the effects of taking an annuity, or not taking it, they can easily make choices that won’t be very wise. The same is true about other income choices or their options around taking capital instead, or as well.

Remember the average pot size is £33,400. At the 5% rate used by Pension Wise in their example, that would generate income of £1,670 a year or £32.12 a week. In the simplest Pension Credit case, with no extra needs at all and a basic State Pension, there’d still be an entitlement to Guarantee Pension Credit of £163 a year or £3.13 a week.

That means that anyone with, or less than, the average sized pension pot will not gain one penny from taking an annuity at Pension Wise’s example rate. Not .. One .. Penny!

That’s not something you’ll find out from looking at the Pension Wise web site.

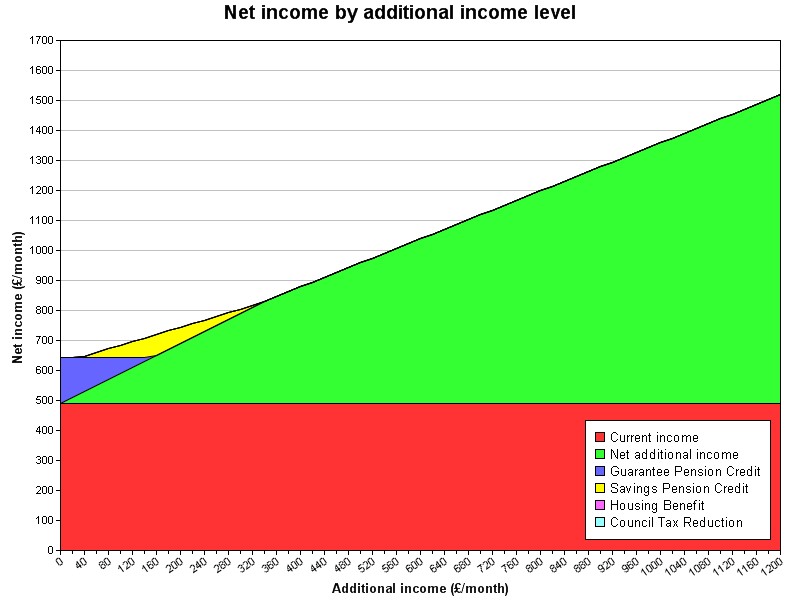

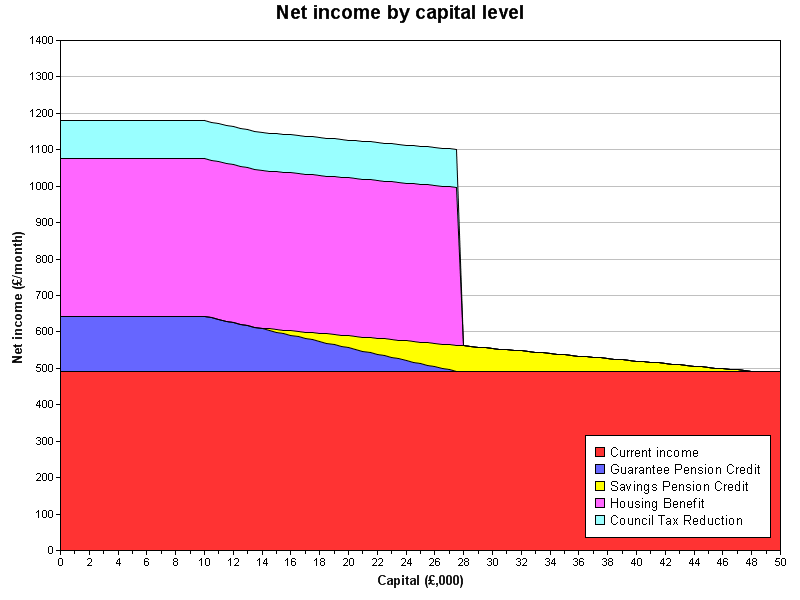

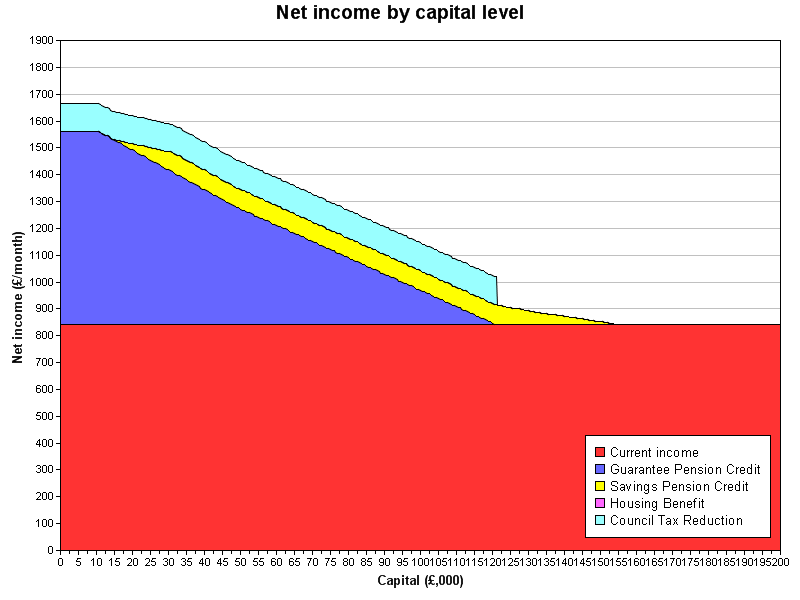

In actual fact it’s not that simple, that’s only true for people under 65. The extra income would generate, for those over 65, an entitlement to Savings Pension Credit (SPC) which was designed to stop the penny for penny deduction for those with a little extra income or capital over State Retirement Pension level. Over the last few years though the rates of SPC have been cut to keep GPC in line with the pensions’ triple lock so it doesn’t always work. The chart below shows how this works.

About the first £40 a month of income, from an annuity or other source, gains the person nothing but after that Savings Pension Credit begins to kick in.

In their example the person would have a Guarantee Pension Credit entitlement of £35.25 a week, after taking into account the state pension. Taking an annuity of £32.86 a week would reduce the Guarantee Pension Credit to £2.39 but would create a Savings Pension Credit entitlement of £15.37.

The net increase in income from taking an annuity of £32.86 (assuming no tax liability) is £15.37.

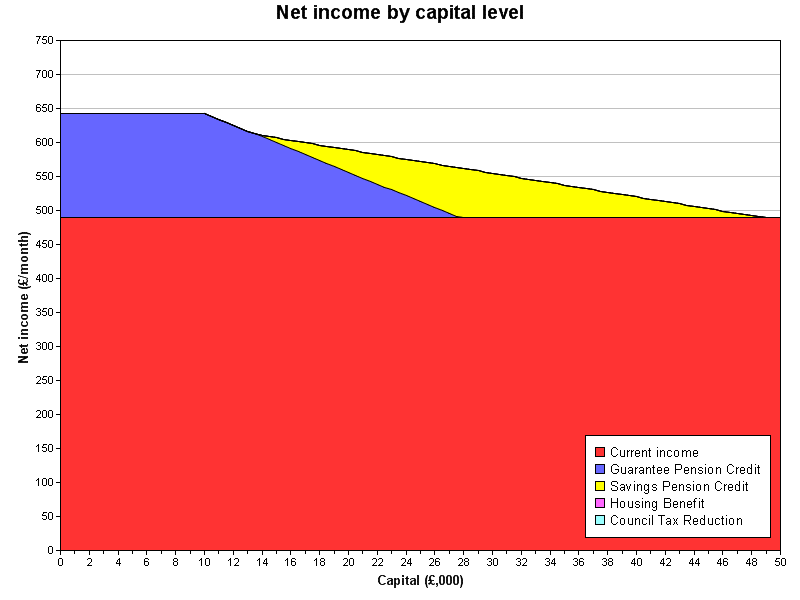

What if they took capital instead? The chart below shows the effect.

There is no reduction in benefit, or total income for the first £10,000 of net capital withdrawn from the pot and held. After that a notional income is calculated with reduces GPC and, at first, increases an entitlement to SPC.

If someone is under 65, the qualifying age for SPC, then that benefit vanishes and the 100% deduction applies for much longer.

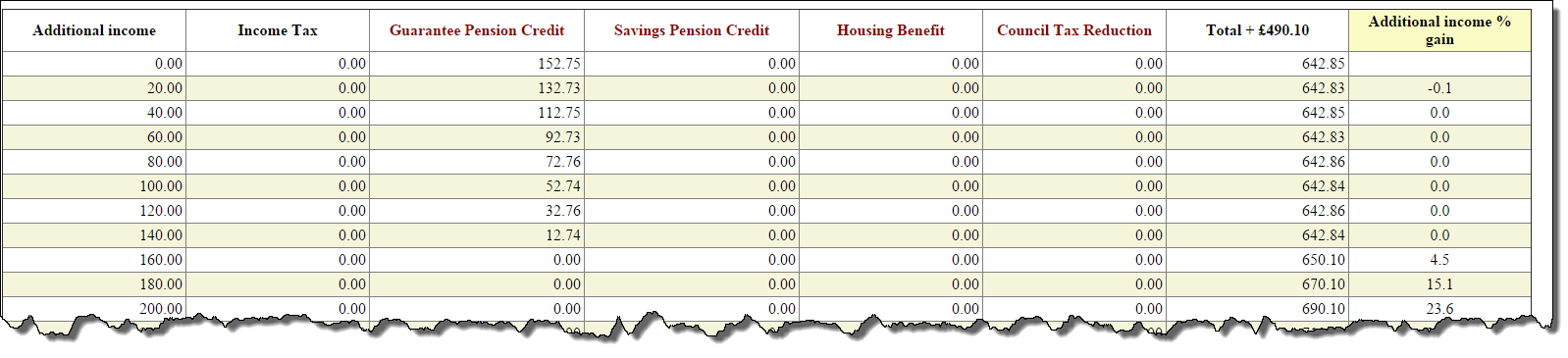

As the table above shows there is no gain for a pensioner under 65 until their income reaches £160 a month. For them taking capital, and keeping the amount held under £10,000 is a much better choice … but not one that Pension Wise will show them.

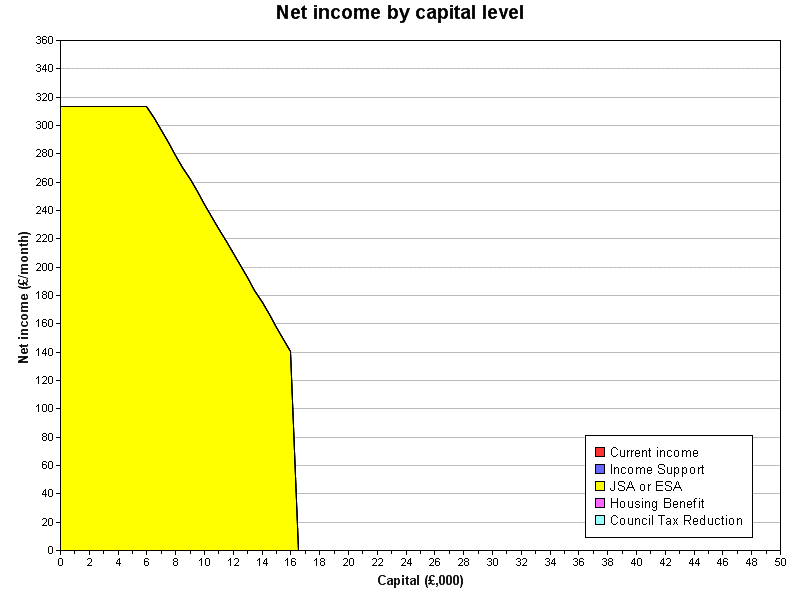

Working Age Pensioners

It’s not just people above pension age who will need to know what their options are. Anybody over 55 will be able to make use of the new freedoms. For them, up until they reach the qualifying age for Pension Credit (currently 62 and a half but increasing to 65 by 2018, then 66, then 67), their benefits will be the much less generous ones like Jobseeker’s Allowance (JSA) or the new Universal Credit (UC). Benefits whose basic rates are about half those of Pension Credit.

Benefits, also, with much harsher rules around capital. The working age benefits have an absolute cut-off from entitlement at £16,000 and a much higher notional income rate.

Baroness Hollis said, in a debate on the Pensions Schemes Bill on February 5th,

“It is essential that anyone on means-tested benefits at 56 knows what the hit will be for accessing their pension pot”.

The question is who will tell them?

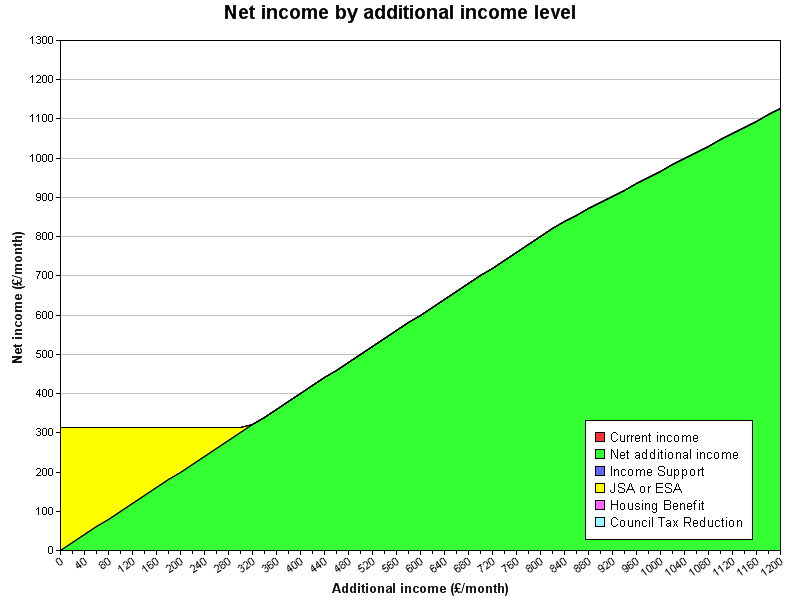

Look at the chart below, again for someone with no extra needs, dependents, savings or housing costs who is unemployed and claiming JSA.

Until any extra income or annuity is more than £300 a month, after tax, no increase in bottom line income happens. £300 a month would, on the figures used in the Pension Wise example need a pot of £72,000 (after taking 25% capital tax free). That’s over twice the average pot size.

Taking 25% of the original pot of £96,000 would give the person £24,000 of capital in one lump.

The effect of that is shown in the next chart,

Over £16,000 stops entitlement to JSA, and other working age benefits, immediately and completely.

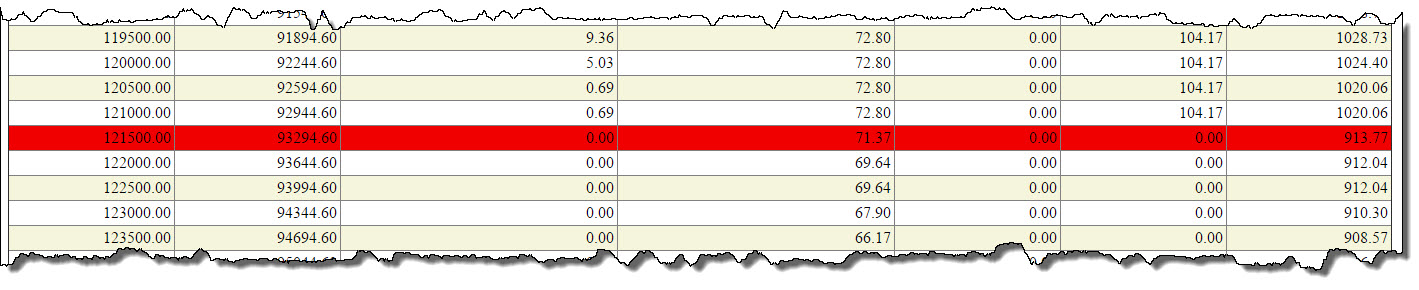

Even for pensioners the effects of capital can be equally severe, once entitlement to GPC stops. The chart below brings in Housing Benefit (HB) and Council Tax Reduction (CTR) which become subject to the same cut-off once GPC stops.

One pound too much held by the claimant can almost halve their income.

These are complex calculations but they are vital ones. Knowing that you can take an annuity, can take some capital tax free, can leave it in place or can draw it down in stages is important but ultimately, if you don’t know what that means to your overall situation, worthless or even dangerous. The figures matter and, if Pension Wise won’t give them then other advisers must.

The calculations need to be personal to each case, there are too many factors to be able to generalise.

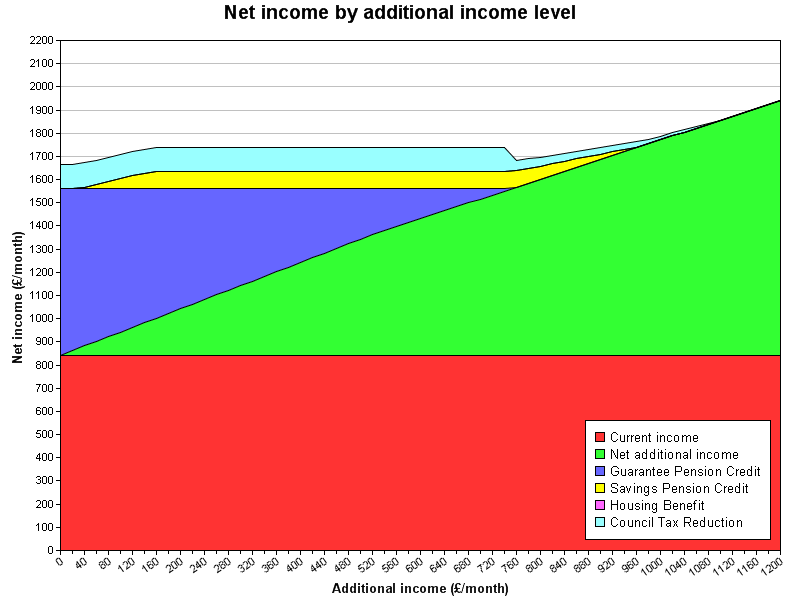

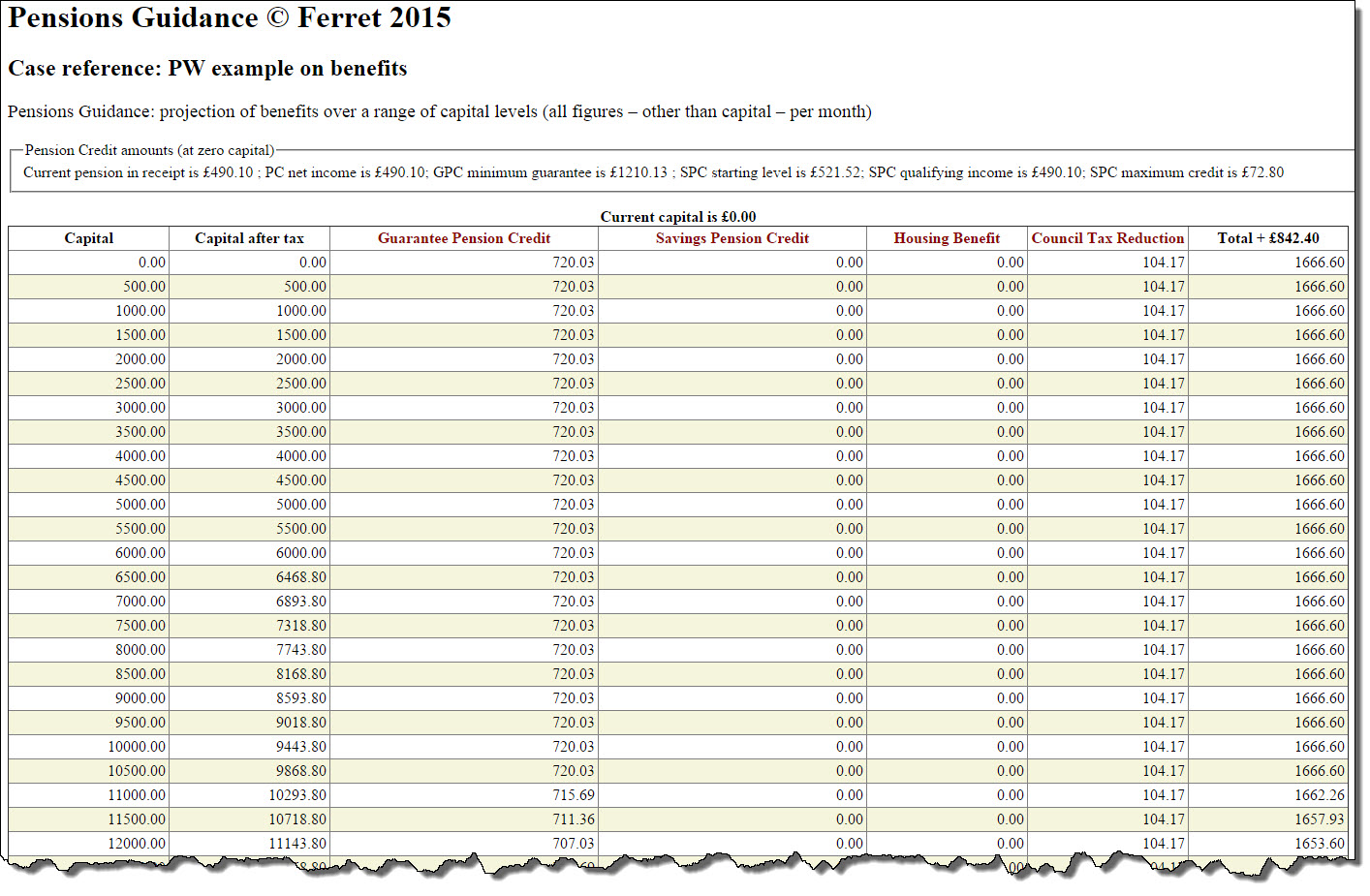

Consider a 65 year old single person, severely disabled with a mortgage of £100,000.

Their income includes Attendance Allowance of £81. 30 a week and their full state pension of £113.10 a week. When we look at the effect of taking income from their pot we see the following in a chart.

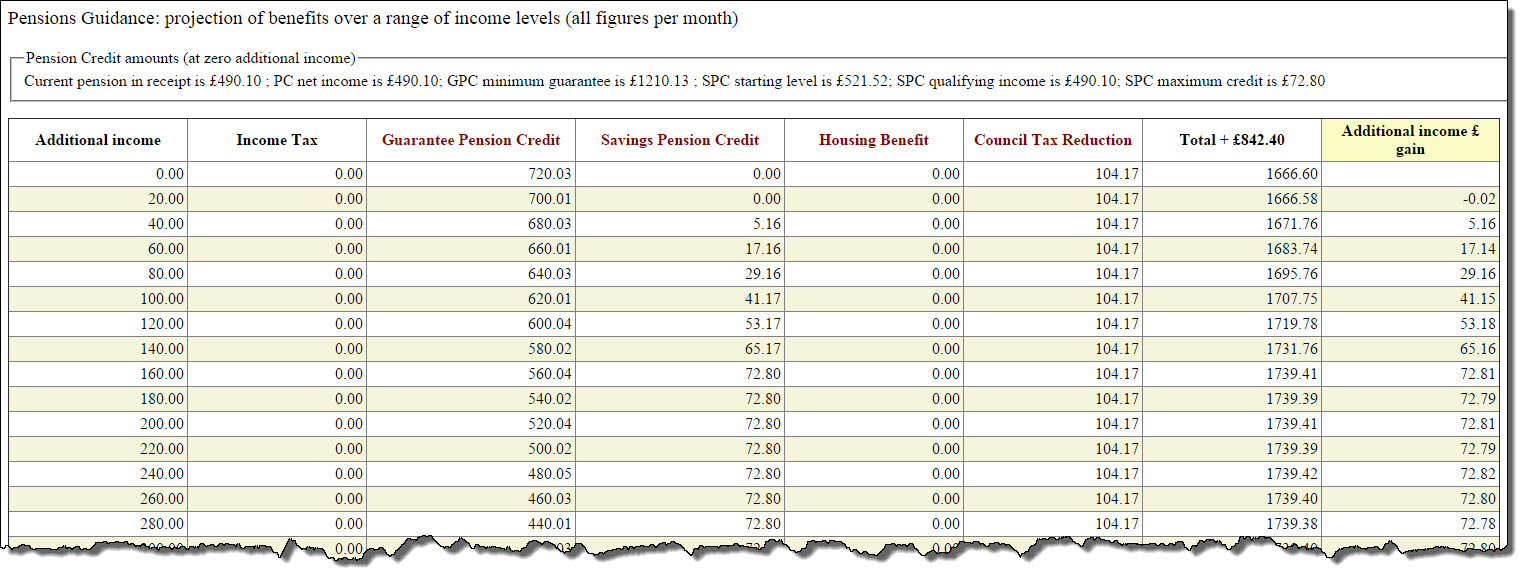

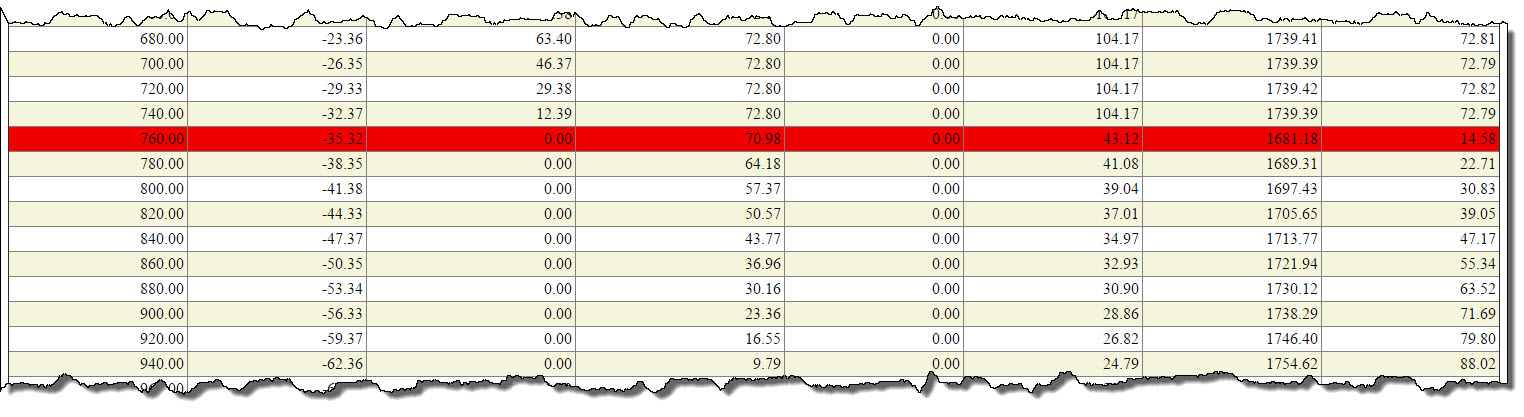

Looking at those figures in detail shows the level of actual income which they will receive from increasing the income or annuity level that they take.

They gain from taking income up to £160 a month, which generates a net increase for them of about £72.80 (the variations in pence in the table come from rounding tapered amounts).

After that they gain nothing at all from taking extra income up to £740 a month. Taking £760 a month sees a reduction in real income of almost £60 a month, as passported Council Tax Reduction stops. It takes an income of £920 a month before that drop is recovered.

At that point the marginal deduction rate, from tax and benefits, is 91.3%.

The importance of understanding the effects over a range of incomes is clear; checking the effect on tax, benefits and overall income for any one amount tells very little. Knowing that you will get the same income if you took £740 a month from your pension as if you took £160 a month, tells advisors and pensioners much more. Knowing that if you took £760 a month, it would reduce your income by almost £60 compared to taking £160 a month is a real factor in aiding decision making.

When the same case is looked at for capital options, a very different picture is seen

There is no effect on income at all until net capital, after any tax has been applied, passes £10,000. There is then a gradual reduction income as the notional interest on increasing capital reduces the Guarantee Pension Credit. When that benefit ceases there is a cliff-edge drop in income of £106 a month as Council Tax Reduction also stops.

It should also be noted that there is still some benefit entitlement with capital of over £113,000 which would take £153,500 in pot value before tax is applied in this year.

The calculations depend upon the complex, real life, circumstances of individuals and families and generalisations or ‘traffic light’ advice will not suffice.

They must cover current entitlement to means tested benefits for both working and older people, with all the complexities of dependants, disability, housing type and costs, and other factors. They must then look at the effects of taking capital, income or both from pension pots, calculate the tax on them and the tax free amounts and assess the effects over a range of amounts so that the cliff-edges and flat lines can be identified and informed choices can be made.

Throwing in a quick advert, the tables and charts in this note are all produced by pensionsForward, Ferret’s new system which does all these calculations and produces detailed reports, tables and charts. It’s also great for doing what-if assessments for changes of circumstance.

I’ve also produced some notes covering other areas around the changes and advice and information.

You can download them from the links below.

Pensions Guidance Information and Consequences.pdf

Pensions Guidance Considerations of the Future.pdf

Pensions Guidance consequences.pdf

Pensions Guidance Support for Providers.pdf

Comments

Great article. I’ve added a link to it in my blog looking at the specific topic of using pensions “freedom” to pay off debts: http://debtcamel.co.uk/2015-pension-changes-a-new-option-for-paying-off-debts/

[…] became law. And on the subject of pensions, here is a detailed blog published last month on how withdrawing money from pensions will impact on means-tested benefits – an important topic that is largely ducked by Pension […]

[…] you take a lump sum from a pension. This may happen even if you use the money to pay off debts. This article looks at the topic in more detail, but you need advice on your own situation – go to your […]

Excellent analysis, and very useful. Small point though, the ‘government’ aren’t funding anything at all. The taxpayer is doing the funding. The government is spending that funding.

Hi Gareth, really thought-provoking article on pension freedoms and impact on benefits. I have not seen any mention of notional income (in relation to annuities) for Tax Credits claimants who are over Pension Credit age. Do you know if the same notional income rules will apply to pension pots for Tax Credit claims? CPAG handbook suggest not.

Thanks Maria.

Capital is used in the Tax Credits system in a very different way. The rules are common for both younger and older people. The actual amount of capital is ignored but the real income from that capital is taken into account as income for Tax Credits. Thus interest, dividends or rental income will be used for the Tax Credits calculation.

There is no capital disregard or cut off within the Tax Credits system. There is a £300 a year disregard for some types of income, including from pensions, which is shared between partners in joint claims.

What that means is that there is no concept of notional income from capital within the Tax Credits system. Only real income counts. There are a few little quirks about when capital is treated as income – mainly around regular withdrawals but that’s pretty much it.

Thanks Gareth, that’s what we thought here but there is always that nagging worry that you haven’t read every SI cover to cover (which of course never happens……!) Have a good weekend.