The government is going to be extremely generous…?

by Gareth Morgan on November 15, 2022

A tweaked version of the blog which was posted here on November 15th. This now uses the NLW figureof £10.42 an hour, announced in the Autumn Statement of 17th November. The differences are small but deserve precision.

Another update to my previous postings, looking at the real gains (and for whom) of increases in the National Living Wage (NLW). You can read those in my blog at https://benefitsinthefuture.com/national-living-wage-cui-bono/ and https://benefitsinthefuture.com/the-government-is-still-extremely-generous/

The Times of November 15, 2022 says that it has been “…told that the government will accept an official recommendation to increase the living wage from £9.50 an hour to about £10.40 an hour – a rise of nearly 10%. The move will benefit 2.5 million people. One government source suggested that the increase could be even higher.”

The same story says that the government are expected to implement an array of “stealth taxes”, including freezing threshold for income tax, National Insurance, VAT, inheritance tax and pensions savings.

Does this mean that, on the one hand, the government are generously giving to the lowest paid while on the other they are surreptitiously taking from everyone?

The answer, unsurprisingly, is no. These are all stealth tax measures.

With the removal of the short-lived NI levy, and assuming, as announced, that tax and NI rates and thresholds will remain unchanged in 23/24, it’s worth looking at the effects of this change.

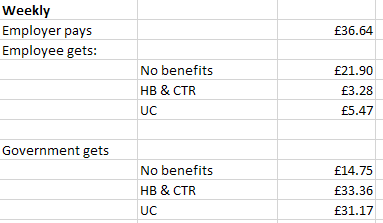

Consider the effect of earnings at the NLW level for somebody working 35 hours a week. All the figures in the tables are weekly.

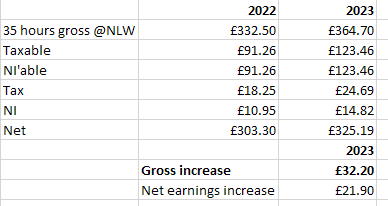

Table 1

Table 1 shows that someone working at that level will see an increase in their take-home pay of about £21.90 a week in April 2023.

That’s not going to help meet all the cost of living increases that are facing people but it is something. After all, these are amongst the poorest workers that the government is trying to help.

The government is already helping many of them, of course, through the benefits system and the extra net earnings are going to be very welcome – or they would be if they were extra.

The reality is that the government gives with one hand and, often, takes with two.

Most means tested benefits, unsurprisingly, pay you less when your resources increase.

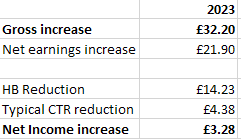

The increase in net earnings will change any means tested benefits that are being received. If somebody, typically, is getting help with rent through Housing Benefit (HB) and council tax through Council Tax Reduction (CTR) then 65% of any increase in net income is taken away from HB and another 20% typically, from CTR.

That changes the picture a little.

Table 2

The 2023 increase of over £30 a week in gross earnings becomes a less impressive £3.28.

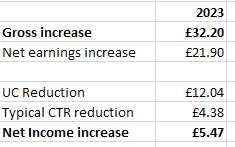

If somebody is getting help from the newer Universal Credit, the figure’s similar if a little more generous, thanks to the reduction in the taper rate introduced during Covid.

Table 3

Remember that those receiving Universal Credit lost the £20 a week uplift that had been given to them as part of the Covid response.

Qui reddit?

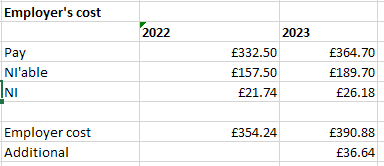

We can see who benefits, if at a much lower level than has been claimed, but it’s also worth considering who pays. Tax cuts and benefit increases, along with changes to minimum wages, are presented as government generosity. Sadly, this doesn’t stand up to examination. Wages are paid by employers, from which employees pay deductions including tax and NI. Employers pay an additional NI amount. That adds to the cost of any increase in NLW.

Table 4

Table 4 shows the additional weekly cost to the employer of the increase in NLW and employers NI.

Table 5 shows a summary of the 2023 changes and the consequential effects. Remember that, at NLW levels of pay, it is very likely that there will be an entitlement to means tested benefits.

Table 5

We can see that the government the government requires employers to pay over £36 a week extra to full-time workers on the NLW. The worker on means tested benefits may get as little as 9% of that with the government receiving, or saving, the other 91%.

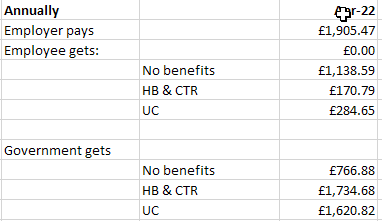

This is what it looks like annually:

Table 6

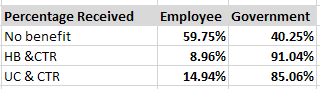

In percentage terms that becomes:

Table 7

It’s difficult not to admire the skill with which the government presents themselves as giving generously, actually gives the worker little, makes the employer pay all the costs and takes the bulk of the money for themselves.

This should not be taken as an attack on NLW, or any suggestion that it is not worthwhile. As it increases, more workers will be lifted off means-tested benefits and then see the benefit of the higher rates of pay. I simply want to puncture the ‘government giveaway’ message, show the much smaller gains for the lowest paid and note who pays.

While this looks very, very like a stealth tax on employers, consider what is causing some of the increases in inflation in the cost of living. Increases being passed on by employers facing extra costs in their workforce.

A vicious circle?

Leave a Reply