Childcare and the 2023 budget -still real problems

by Gareth Morgan on March 15, 2023

Today’s childcare announcements in the budget are welcome, they are more helpful than the current support. The changes will make a real difference.

- Piloting incentive payments for childminders, increasing funding to nurseries providing free childcare, and changing minimum staff-to-child ratios from 1 staff member for every 4 children to 1 to 5 may help increase availability.

- Parents on universal credit can have childcare costs paid up-front and increase the maximum they can claim

- Wrap around care, allowing, from 2026, pick up and drop off before 8am and after 6pm may ease time pressures which make full-time work difficult.

- From late 2024, eligible households with children under three will be entitled to 30 hours of free childcare for each child over nine months.

- Parents on universal credit can now have their childcare costs paid in advance and the maximum help is increased substantially

They haven’t solved all the problems however and one major issue will still cause very serious concerns.

This government, and this budget makes it clear, want people to work more. For those receiving Universal Credit, where increasing the rates of pay is likely to be much more difficult than for those with higher paid, more skilled jobs, there is still a real problem.

Childcare support, at 85% of the actual cost, still has a maximum amount. The 22/23 maximum amounts were £646.35 for one child and the amount for two or more children was £1108.04. Once those amounts were reached, support ended and full costs descended on the parent. The increases to £951 and £1,630 are almost 50%.

It is still a maximum though, and that’s where the problems still occur. Looking first at the current 2022 / 2023 situation.

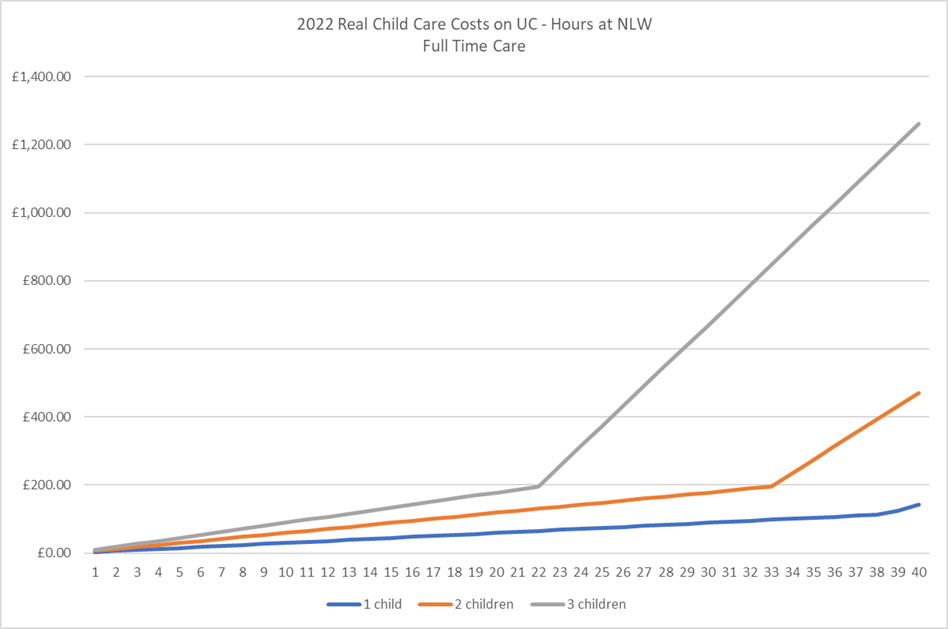

If we assume that an hour of childcare is needed for each hour of work, then, at National Living Wage levels of pay, £9.50 an hour, we can see the results. The chart shows the additional payment required by the parent after the Universal Credit 85% support has been applied.

Figure 1

The steep increase in the actual amount that needs to be paid by the parent for child care is clear and the effect where increasing numbers of children require childcare shows the impact clearly. The full-time care costs used are the Family and Childcare Trust’s 2021 figure for a full-time registered childminder, outside London, of £227.79 a week for 50 hours, or £19.74 an hour.

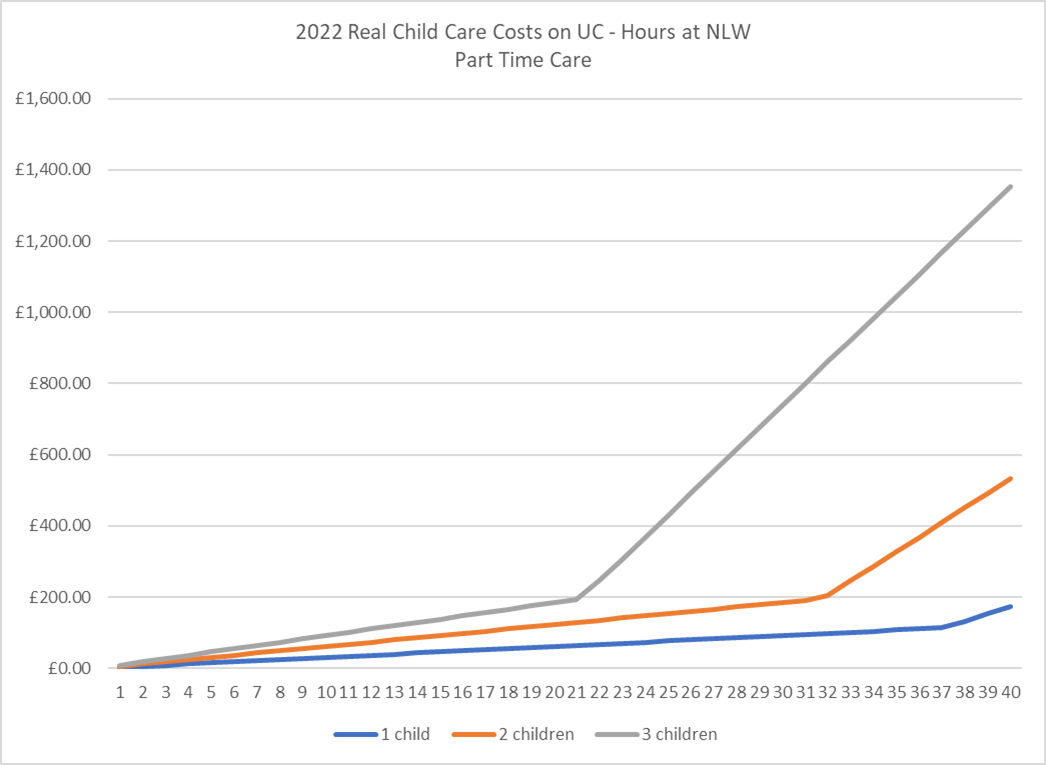

For part-time care of 25 hours a week with a weekly figure is £118.30 or £20.51 an hour. The slightly higher hourly rate brings the number of hours worked at which maximum support is reached down a little.

Figure 2

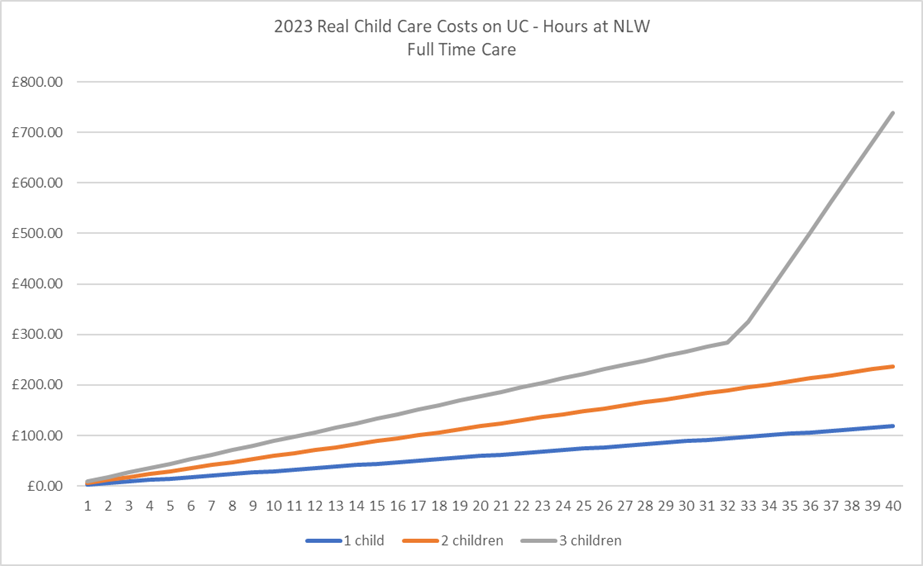

Today’s changes have improved the situation as has the increase in National Living Wage from £9.50 an hour to £10.42.

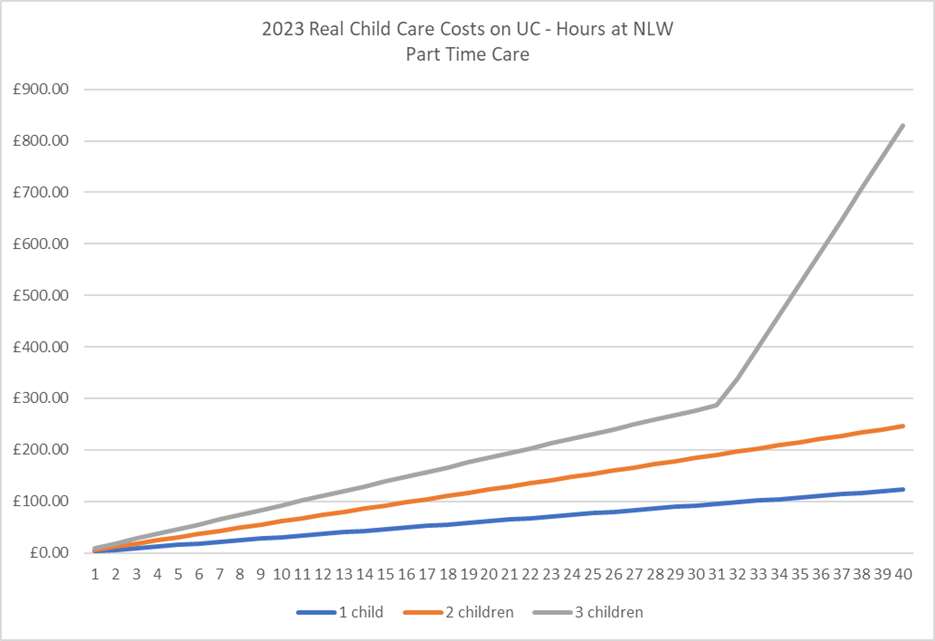

Figure 3 shows the new full-time situation and figure 4 that for part-time care rates.

Figure 3

Figure 4

As the charts show, the increased maxima will, in this example, continue to receive support at 85% of the cost where one or two children are being cared for. With a third child the maximum is reached over 10 hours of care later than at present but, for those in full-time work, there will still be hours of care when the full costs must be met from earnings.

If they can be met.

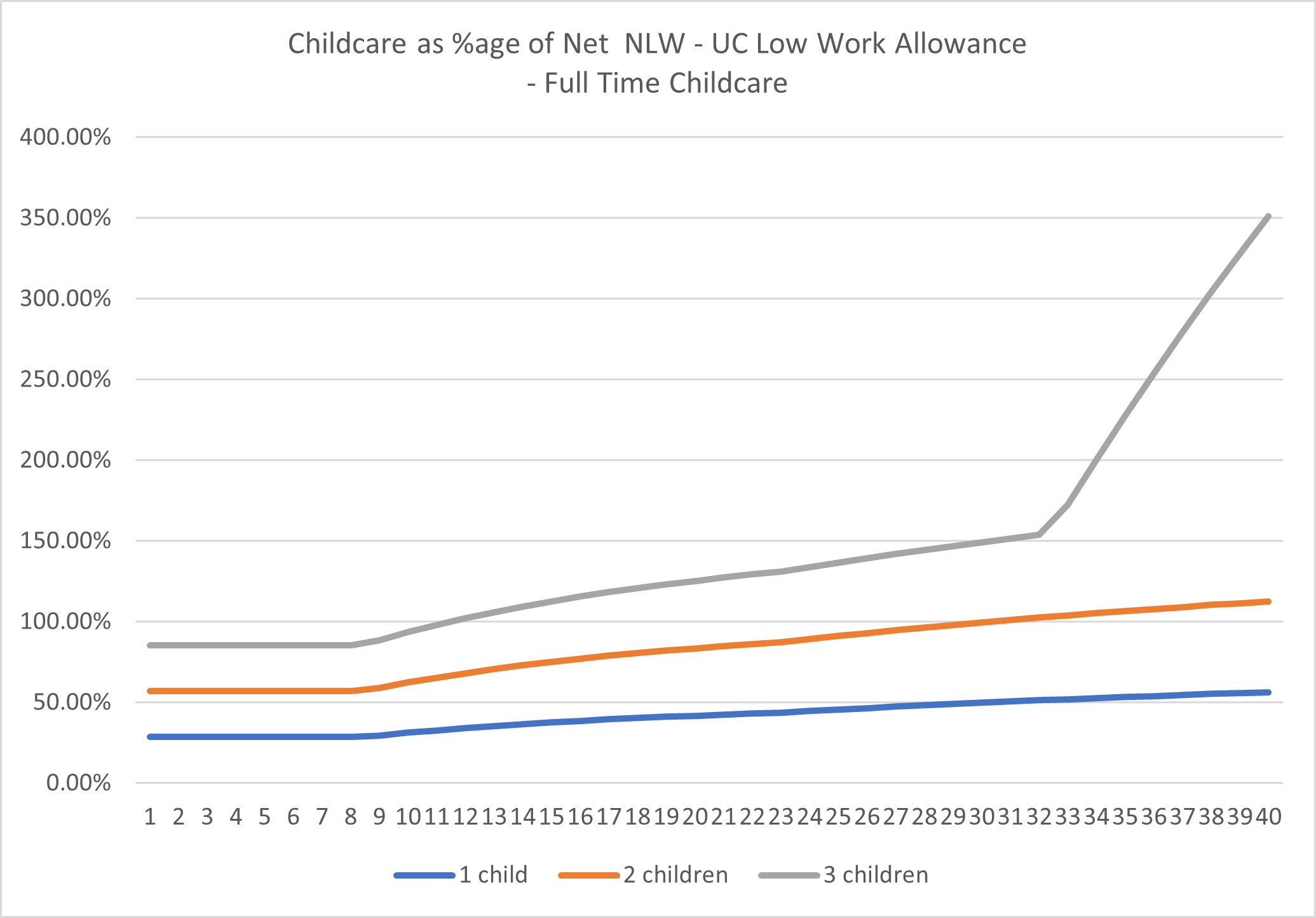

Figure 5 shows the percentage of net earnings, after tax and National Insurance and the Universal Credit taper have been applied.

Figure 5

Where there is only one child being cared for, the percentage of earnings needed to contribute to childcare reaches 50% at 28 hours of NLW pay. For two children it reaches 100% at the same time. For three children, 100% is reached at just over 10 hours and for somebody working for 40 hours, with care for the same period, over 3 ½ times the net hourly pay is required to pay for care.

If the government’s drive to increase the hours of work for those on Universal Credit continues then it becomes clear that there is, for many, a point at which the work that they would have to undertake is, considering childcare alone, seriously loss-making.

Add to that the other costs associated with work, such as transport and clothing and we are likely to see a stark and unsustainable choice facing people – work more and have less money or face the increasingly harsh sanctions, referred to in the budget, for not complying with conditionality.

Leave a Reply