Irregular UC and regular pay – A solution that also ends the 5 week wait?

by Gareth Morgan on March 24, 2020

(I’m posting this in the hope that it will generate some interest. I’d be grateful for comments, whether pointing out flaws or errors, or suggestions. Given the current situation, this could be implemented rapidly if workable. By all means, point and laugh but, please, do think about what could be done)

I looked in some detail in a post last month – https://benefitsinthefuture.com/universal-credit-rent-landlords-be-cautious-about-being-helpful/ – at the problems faced by people with regular earnings and regular outgoings, in particular rent, and how Universal Credit turns them into irregular income.

I expanded on that in my written evidence to the House of Lords Economic Affairs Committee enquiry into the economics of Universal Credit. That’s been published at https://bit.ly/3biC7ww .

On the basis of that, I was invited to give oral evidence to the inquiry on 17th March, with a particular brief to consider “How can this be resolved, does it mean changing the assessment period, and if so to what?”

A good question. I’ve talked previously about ways in which the irregularities might be smoothed, by averaging or adjusting the periods that were used; but always in very broad terms. This request spurred me to see if I could put some concrete ideas and numbers in place to demonstrate whether there might be a workable solution and how difficult it would be to implement.

So last weekend, I fired up Excel and set to work. Somewhat surprisingly, I think I came up with the basis for a workable solution. Almost as a side-effect, it seems also to remove the necessity of a 5 week wait before Universal Credit is paid.

I set myself a couple of aims

- it can be done with existing data

- it smooths the result

I also took account of the ‘Johnson case‘ [1] where the High Court found

On a proper interpretation of regulation 54 of the 2013 Regulations, read in context, the amount of the earned income of a claimant in respect of an assessment period is to be based on, but will not necessarily be the same as, the amount of earned income actually received in that assessment period. There will need to be an adjustment where, as in the present case, the claimants actually received two months’ salary in one assessment period but the combined salaries do not, in fact, constitute earned income in respect of the period of time included in that assessment period. The defendant, therefore, erred in treating the combined salary for those two months’ as earned income in respect of that assessment period for the purposes of calculating the amount of universal credit payable.

Although the government have been given leave to appeal this decision, I also wanted to respect the logic of the court’s findings, which meant that I excluded averaging over longer periods.

Unfortunately, the session was cancelled while I was en-route, but it has given me the chance to expand more on my thoughts.

A proposal

The existing data consists of that passed across to HMRC by the employer and HMRC’s calculation of tax and National Insurance (NI), which together provide the net income figure used by DWP. Other income and expenditure, such as pension contributions, fall outside this exercise.

The employer submits, using a payroll software package, a Full Payment Submission (FPS) to HMRC on or before the date an employee is paid. This provides details of the employee, their pay and deductions. Employers and pension providers have to send an FPS ‘on or before’ they make a payment to an employee.

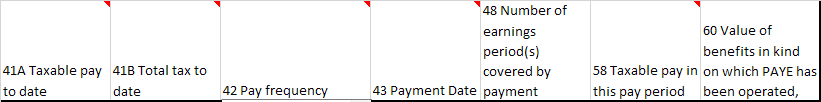

The relevant fields, and field numbers, in the FPS are shown in table 1 below

Table 1

The employer submits gross taxable pay which HMRC passes across to DWP after deducting tax and NI. For my purposes, I have assumed that the pay is in respect of a period ending on the payment date. While there have been many concerns about employers incorrectly using the date in field 43, to record the date that they make their payment to the employee, the correct usage is to enter the date that pay is due. This removes problems caused by such issues as weekends and bank holidays. HMRC guidance is clear.

You must enter the usual date that you pay your employees, even if you pay them earlier or later. For example, if you pay your employees early because your usual payday falls on a Bank Holiday, you should still enter your regular payday.

Early reporting

You can send an FPS before your regular payday, for example if your payroll staff are going on holiday.[2]

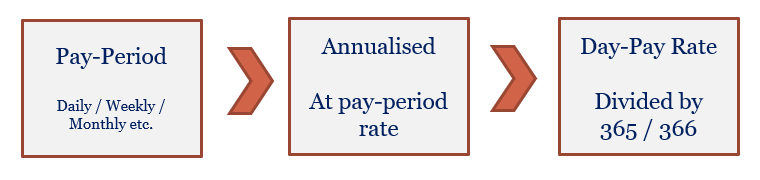

These data items mean that I am able in my model to assess the dates for which pay is made, assuming that it ends on the date submitted. From that, I can determine the number of days falling within each assessment period (AP) for each pay period. That gives me the number of paid-days in total within each AP. I use a rather crude calculation for the day rate of:

Figure 1

This generates what I call the Day-Pay Rate (DPR), which is the daily net pay for that pay period. It’s important to stress that there may be different pay periods, varying in length or rate of pay, running within, or across, APs and thus each with potentially different DPR’s.

If HMRC collected the start and end dates of the period for which he has been made, it would enable a much more accurate assignment of earnings, for example, a common practice is to make a payment on the 25th of the month for a period covering from the 1st to the 30th. Many software products collect and use the dates, for assessing maternity pay dates for example.

The current system of assessing earnings within an AP generates irregularity from a regular pattern of earnings because of its inflexibility. It takes account only of the date paid. Because of that, within the calendar month, which may start on any day of the month, there can only be whole pay periods used within the assessment. Table 2 shows the rigid results that creates.

| Pay period | Number of periods used |

| Weekly | Four weeks or five weeks |

| Two weekly | Four weeks or six weeks |

| Four weekly | Four weeks or eight weeks |

| Monthly | Zero, one or two months depending upon the date of pay and date of UC claim |

Table 2

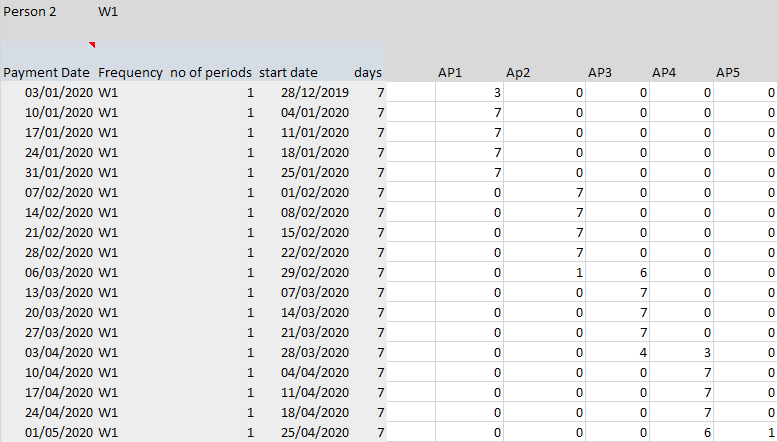

Contrast that with table 3 which shows that it is possible, given existing data, to place the number of days within weekly pay periods into a UC AP.

Table 3

The matrix shows, in the columns, the days within each assessment period which are composed of days within pay periods and, in the rows for each pay period, how many DPR’s fall into each assessment period.

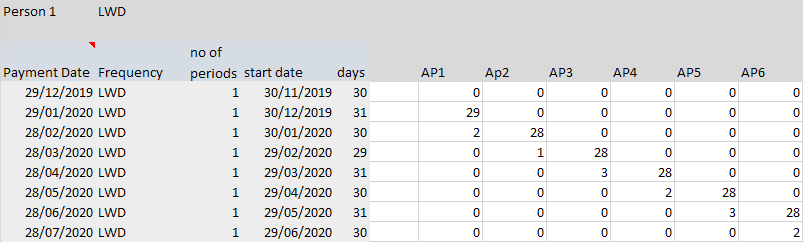

Table 4 shows the same for a monthly cycle.

Table 4

This approach brings a number of advantages over the current system. Where people are regularly paid, and will therefore have consistent DPR, the assessment period will simply have that rate times the number of days in the period. Under the current system there can be anything from no days pay to 62 days pay used in the assessment. People are paid three monthly, six monthly or annually, as payroll systems permit, the situation can be even worse, as all the pay is compressed into one assessment period. Although employers have to calculate their own day rate sometimes, for example when people start or leave employment mid-month, this is not passed to HMRC.

Where pay or periods are not regular, the DPR approach deals much more satisfactorily with changes in dates of pay or in amounts of earnings (see responsiveness later). This approach works particularly well for couples with different pay cycles where the current system may produce exaggerated differences.

Figure 2, below, shows the current Universal Credit entitlement for the couple in the previous post. They both work on the 2019/20 National Minimum Wage level of £8.21 an hour. One works for 35 hours a week, paid monthly, and the other works for 10 hours a week paid weekly. They have two children and pay rent to a social landlord of £150 a week.

The full-time worker is paid £1116.31 a month net and the part-time worker earns £355.77 a month net. Their rent works out to £650 a month. On the basis of those figures, they would be entitled to £907.70 Universal Credit every month.

That would leave them with £1,779.78 after paying their rent. Having consistent income and outgoings would make their budgeting and planning much easier.

Under the current rules, using all income received during the assessment period, their earnings are treated as being irregular, because the weekly paid worker will have either four or five pay days in each period and the monthly worker will have no paydays one payday or two paydays, because they are paid on the last working day of the month and the Universal Credit claim was also made at the end of the month. The very large difference in earnings used, month-to-month, creates a consequential large difference in Universal Credit.

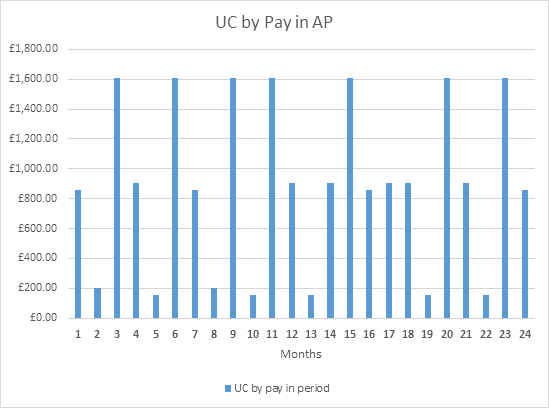

Figure 2

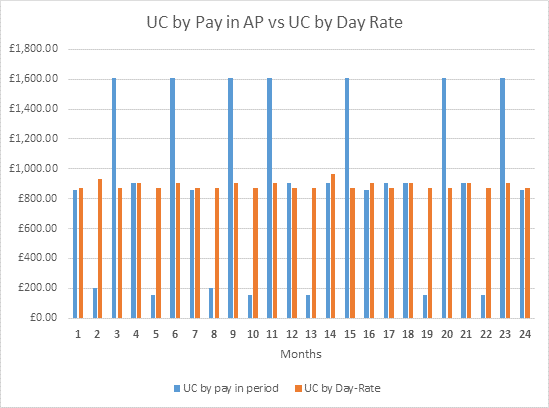

Using a day-rate calculation instead, smooths the entitlement almost entirely as shown in figure 3. The small variations are due to the varying number of days in the AP.

Figure 3

For reasons best known to themselves, but probably the assumption that housing costs are more predictable, Universal Credit takes rent into account by assessing an annual total and dividing by 12. For people with weekly rent cycles this can mean that they will have either four or five rent days in each AP and the Universal Credit assessment will use a figure slightly more than four weekly rent amounts.

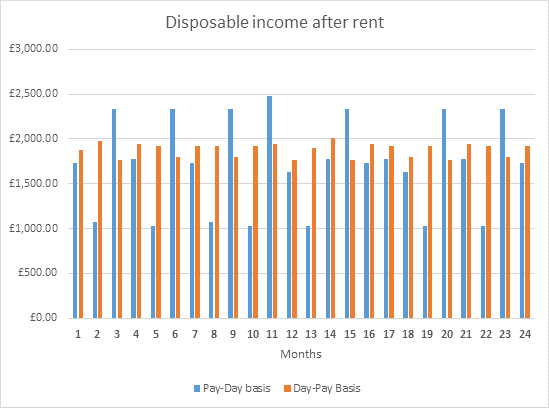

Figure 4 shows the current and day rate income, from earnings and Universal Credit, that is left after meeting the rent payments in each AP.

Figure 4

It is clear that, even after the variations caused by the number of rent days, the resultant disposable income is much more even, easily understood and amenable to budgeting and planning.

Irregular earnings and periods

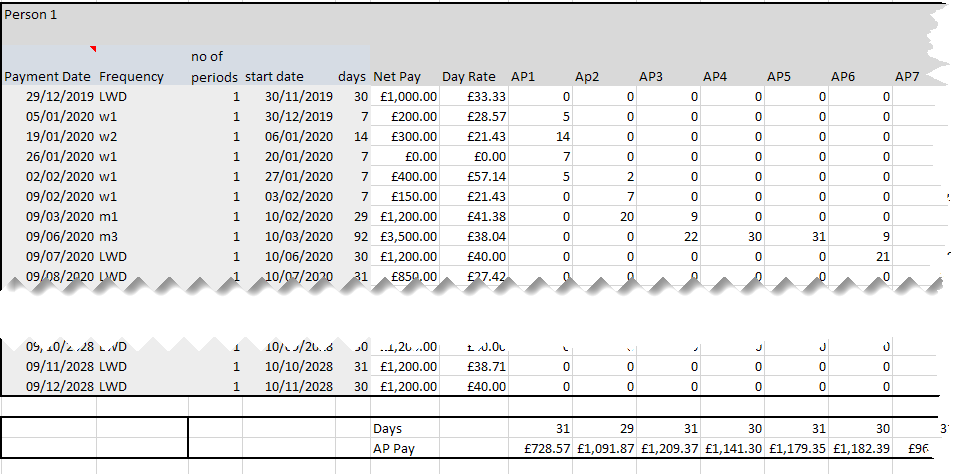

The day rate approach is not limited to regular periods or regular earnings. It works very well as a method of assessing periods of different lengths and of different, or no, earnings. The example in table 5 shows some output from my model with these variations.

Table 5

Different frequencies of payment are shown in the table, ranging from weekly to 3 monthly and including two weekly, calendar monthly and last working day payments. Each of these has a separately calculated day rate and the number of days in each assessment period, at the relevant day rate, is used to determine total net pay within the AP.

It is likely that there could be a smoothing effect from this approach, but varying earnings within a means tested benefit must be reflected in the amount payable.

Reconciliation

The glaring problem of this approach is, of course, that the income, taken into account in an assessment period, may not actually have been paid, or even earned, yet.

That means that an assessment may need to use an estimated day rate for some of the assessment period.

That is unlikely to be difficult in practice where, as in most of these examples, pay rates and periods are regular but a move to a day-pay assessment would need to be applicable across the wide range of earnings and pay periods that can exist.

That will inevitably mean some form of reconciliation, where the estimated day rates differ from the actual amounts paid later. The estimated rate could be derived from a period of past earnings that was long enough to reflect patterns of employment, such as seasonality. In new employment, or changed pay or hours, the expected pay could be used. Even the worker’s expectations, particularly, for self employment could be used, as it is, effectively, in tax credits.

Reconciliation could also take place over a more extended period. This is the approach that has been used with Tax Credits for many years. Implementing it within the monthly AP can be expected to make the assessment more responsive to change. To an extent, this already happens, for example, employers use the previous 52 weeks’ pay to determine the value of a week’s holiday pay.

The issue is more difficult with self-employed earnings where it can be very difficult to attribute earnings to a particular period. In Universal Credit it’s also necessary to decide on a tax and NI figure that leaves net earnings in the assessment, unlike tax credits where gross earnings are used. Universal Credit’s ‘all-income’ vs ‘all expenses’ approach also means that expenditure has to be assigned to an AP as well. A longer period of estimation and assessment may be the only practical approach.

Responsiveness

Universal Credit, although intended originally to quickly reflect changes in earnings and circumstance, is poor at responding to such changes. It depends upon a single day’s snapshot of circumstances during the month, as well as its crude capture of all payments within that period.

Its harsh rigidity takes little account of possible patterns of life and work outside its monthly ideal. It is clear that attempting to impose this ideal on people, especially the self-employed, with irregular employment or earnings can be even more baffling than the effect it can have on those in regular circumstances.

Recognising and responding to such variances quickly will be particularly important over the next months as the coronavirus impacts continue.

One very important advantage that would come if the principle of future estimation, and subsequent reconciliation were accepted would be that the five-week wait would no longer be required. Estimations of earnings and income, including Statutory Sick Pay, New Style ESA and other support could be used as the basis for immediate assessment and rapid payment of Universal Credit.

Conclusion

Universal Credit is struggling. It struggles to meet the needs of those it supports who, rightly, are often baffled by the amounts they receive, even after they have succeeded in claiming and waited for their payment. The DWP is struggling with administration and systems. Those who provide support and advice to claimants are struggling with insufficient resources and poor access to officials.

The current crisis can only make things much worse, and support system will inevitably have to change to meet the needs of the time. My suggestion undoubtedly has flaws and difficulties but I do not think that they will be unsurmountable or difficult to solve. I believe that it is possible that this change to assessment methods could be made quickly, and relatively easily.

Many thanks to those who commented on the earlier draft of this, especially Ian Holloway of Cintra who generously provides payroll expertise.

Gareth Morgan

March 24th 2020

[1] https://www.gov.uk/running-payroll/reporting-to-hmrc

[2] https://www.judiciary.uk/wp-content/uploads/2019/01/johnson-and-others-judgment-final.pdf

Comments

How would this work for people on 0 hours contracts? People in these situation might not have income accurately reflected by their previous payslips.

Lets say G is due to be paid on a Friday (for 4 weeks work) and their UC is calculated a day before on Thursday. How can we know how much money that (random) pay cheque would be if the employer only has to report the day after the UC is calculated?

It looks to me that this could drive these people into debt in the same way the previous tax credits were sometime know to.

Other than that it looks good, but very hard to calculate. Last I checked UC was actually calculated manually by DWP civil servants rather than by computer.

Please consider this as constructive criticism. I greatly appreciate the work you have put into this.

I myself have come up with a different solution and put it forward to the Secretary of State copying in the select committee. However my solution has a different set of cases where it fails.

I would be interested to discuss this topic with you if you have time.

Thanks for this Huw. I’m always happy to discuss this.

To answer your question; firstly the situation under the current rules is worth considering. I’m assuming this a regular 4 weekly earnings cycle. It will depend upon whether this is a first claim or a repeat claim.

If this is a first claim then the UC will be assessed as if there are no earnings, leading to a high initial payment, 5 weeks after the claim, because the calculation will not take any earnings into account. The next assessment will include these earnings and may also include the earnings for the next 4 week period ( there may be 2 4-weekly periods of earnings within an assessment period, typically once each year). If there are 2 payments used then there will be a reduced UC payment, or commonly there may be no entitlement. If there is only one payment then the UC amount will be much lower than in the previous month.

If this an ongoing claim, then there will have been a previous earnings figure which will have been the basis of the UC payment in question.

UC is a means-tested benefit and will therefore reflect changes in income with changes in benefit, that is the way that it’s meant to work. UC’s changes happen to lag changes in earnings by a month which can make budgeting difficult but, in the absence of a Universal Basic Income, this relationship between varying earnings and varying benefits is inescapable.

My criticism of the current system began with the effect that it has on people whose earnings are not variable but who end up with varying benefits because of the way that pay cycles and benefit cycles interact.

How my proposal would work in the same situation is again dependant on whether it’s an ongoing or initial claim.

If this is a first claim then the UC will be assessed on expected earnings. That estimation is most easily based on the claimant providing their expected earnings during the period. If there are better bases for estimation, such as the employer, then those could be used but there is a practical trade-off between simplicity and precision. That will mean, in this example, a lower UC payment in the first AP and a higher payment in the second; given the same circumstances. The reconciliation in the second period would take account of the difference between the estimated and actual earnings but would normally be small. If the estimation was way out, because of unrealistic expectations, or even fraud, then the difference night be larger but it would be less than the effect caused by a zero earnings figure.

If this an ongoing claim, then there will have been a previous earnings figure and that could be used to estimate the next earnings periods figures, adjusted where circumstances are known to have changed. The same reconciliation process would be used.

I’ve limited myself to proposing a process which keeps the existing AP lengths and dates, and uses only the existing data that RTI holds. That makes these changes feasible, inexpensive and relatively easy to introduce. If I hadn’t constrained myself in those ways then I might have suggested something rather different.

The result is, in essence, a system which replaces large blocks of earnings dropped in to the assessment at irregular intervals with a proportioned amount of earnings related to each assessment period which smooths out the irregularities, allows the elimination of oddities like the surplus earnings rules and makes the end of the 5 week wait possible. Using the estimated earnings period means that the assessment periods payment can be made at the beginning not the end of the month. This payment in advance gets rid of the costly need for legacy benefit run-ons and for advances, which, in the long run will probably be cheaper than the current system, while improving the claimant experience.

Has your evidence been published?

Thank you for your reply Gareth.

I understand that your proposal would be a drastic improvement. I would support it being implemented ‘as is’ for that reason alone.

What I do think is that it faces an issue that an individual who suddenly get’s a well paid job or a drastic increase in earnings will actually have a debt outstanding to DWP. I don’t doubt that DWP could recover that money, but it might leave the individual in hardship depending on how quickly it could be recovered.

For example if someone was receiving £800 /month UC and they got a (self employed) job that earned £1270 in the last few days of the period:

Under the current system they would receive £800 in one period and then £0 in the next.

Under your system they would receive £800 in one period, but that money would then need to be recovered in the next assessment period. It’s not disastrous but if the worker continues to earn then they have an £800 debt to DWP.

I have not published my suggestion as such as I don’t have a suitable platform. but I made a copy of the letter here.

https://www.facebook.com/huw.the.gnome.evans/posts/2986784864881421

My suggestion was to extend the assessment period without changing the monthly payments. So every 31 days you take a 92 day snapshot of the client’s earnings and apply a lower taper of 21%. (with other adjustments for work allowance etc.)

I would prefer your solution if it could be implemented. I’m honestly not sure whether implementing it is practical or not though. This would depend on the coding in the UC computer system itself. My solution is ‘cruder’ (ie likely easier to implement) but has the advantage that no reconciliation is required.

[…] Irregular UC and regular pay – A solution that also ends the 5 week wait? – Benefits in the Future (blog post). Irregular UC and regular pay – A solution that also ends the 5 week wait? – Benefits in the Futu… […]