Let’s take the same money off you – not once, not twice, but three times.

by Gareth Morgan on May 24, 2020

Even by Universal Credit (UC) standards that might seem a little bit excessive, but it appears to be happening.

It’s also a real, and urgent, problem for a rapidly increasing number of people.

Once again, it illustrates how the complexity of rules within Universal Credit seems to work against the stated aim of simple, understandable support.

The problem here is the concept within Universal Credit of surplus income.

Universal Credit is calculated on a monthly basis, called an assessment period (AP), which differs from person to person, based on their original date of claim. Any earnings paid, or other income received, during that AP is used to calculate the following month’s payment of benefit.

Because earnings received within each AP may be different, for many reasons including different numbers of paydays within the AP, this can lead to months when higher earnings taken into account lead to lower or no Universal Credit, or low earnings taken into account lead to a higher award.

The DWP were worried that some people might take advantage of this method of assessment. If somebody arranged to get a lot of earnings within one month, instead of being spread evenly over a period, then, although they might get no UC in that month, they could get more UC in the months when they had no earnings. It could be easy to arrange that, by collusion with employers or by arranging the way in which self-employed earnings were received.

In order to avoid this, the surplus earnings rules were introduced. Where somebody loses entitlement to Universal Credit because their earnings are too high in one month, some of the extra can be taken into account if UC is reclaimed during the following six months. There is a buffer amount of surplus earnings to avoid small surpluses having to be taken into account.

These rules were due to start in 2016 with a buffer, or de-minimis, level of £300 a month.

They actually came into force in 2018 but the £300 a month was ‘temporarily’ replaced by a figure of £2500 a month, for a year. That £2500 has been reintroduced each year since then.

It’s easy to understand why that’s been done, when you look at how likely it could be that relatively low paid people might find themselves hit by the surplus earnings rules just because they have five paydays in one AP instead of four.

A number of commentators have pointed out the difficulties and impracticality of these rules since they were proposed. The Social Security Advice Committee (SSAC), which advises the government on benefits matters, have been very clear in their criticism and wrote again to the DWP last week about their concerns, https://www.gov.uk/government/publications/universal-credit-surplus-earnings .

The higher buffer amount has meant that there has been little impact, to date, of the surplus income rules, but for some people that is now changing.

Many self-employed people, whose incomes have crashed or vanished, because of the virus’ effects, have claimed Universal Credit. Many have also applied for the Self-Employed Income Support Scheme (SEISS) which has begun to pay out to them during the last week. The amounts of grant can be up to £7,500 to help meet the impact of the virus over the last three months.

Universal Credit will take this money into account as earnings in the AP in which it is received. That can be well in excess of the £2,500 buffer figure and trigger the surplus earnings rules.

The rules

It is worthwhile, at this point, having a look at the rules to see how they work.

That’s surprisingly difficult.

The first stop to find any legislative rules is the government’s own website at http://www.legislation.gov.uk/

Although this struggles to keep up to date with changes in the law and regulations, it’s generally pretty reliable, for the work that it has done. That’s not the case here, unfortunately.

The surplus earnings rules are found in the Universal Credit Regulations 2013, regulation 54A. Go to (on 23/5/2020) that reference at http://www.legislation.gov.uk/uksi/2013/376/regulation/54A

And you’ll see it in full … or almost.

There’s an important rule in sub-section 6 which is shown as

(6) In this regulation—

“total earned income” is the earned income of the claimant or, if the claimant is a member of a couple, the couple’s combined earned income, but does not include any amount a claimant would be treated as having by virtue of regulation 62 (the minimum income floor);

“the nil UC threshold” is the amount of total earned income above which there would be no entitlement to universal credit, expressed by the following formula—

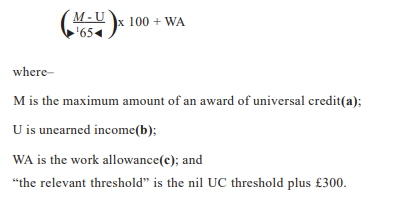

where—

M is the maximum amount of an award of universal credit;

U is unearned income;

WA is the work allowance; and

“the relevant threshold” is the nil UC threshold plus £300.]

The formula in the regulation is missing, which makes working out the surplus earnings figure a bit difficult. Nor is it in the PDF download of the current version of the regulations.

We therefore have to dig a little bit further. Fortunately, the website also has PDF files of the revised regulations at different dates. Here there are two complete revised versions of the regulations, for 30/11/2018 and 31/3/2019, both of which cover the period after the introduction of this rule.

And the formula is indeed in both of those:

Surplus Earnings Formula

The superscript 1 besides the ‘65’ refers to the sidenote which says “Value in reg. 54A(6) substituted by reg. 2(3) of S.I. 2017/348 as from 11.4.18.”

Sadly, despite the sidenote, they haven’t actually substituted the value. It should be ‘63’, reflecting the change in the taper, by which Universal Credit takes account of net earnings, which took place in 2018. Neither of the PDF consolidated versions have the correct value in the formula.

The £300 in the relevant threshold figure has been increased by the Secretary of State, for this year again, to £2500.

Having persisted in finding the correct rule, we can now have a look at an example of how this works.

The example calculation

I’ve taken a fictitious example with figures intended to demonstrate the process, so it’s not an example of a real UC case.

I’ve assumed a single parent with a maximum UC entitlement of £1000 a month, including help with rent. They have lost all earnings from their self-employed business because of the virus effect. They have £5000 in savings. They claimed Universal Credit in early April and received £1000 for the month of May.

Last week they received £6000 in SEISS, paid into the bank. That will be taken into account as earnings for the next AP and they lose entitlement to UC for that month. They may also have a surplus income which will be taken into account, when they reclaim UC in the next month. (There is a new special provision for SEISS recipients, where reclaiming is automatic).

The first step is to decide whether the SEISS figure affects the UC entitlement. It is treated as self-employed earnings so, even though there is a tax and national insurance liability, those will not be taken into account until actually paid. 63% of that figure is taken into account by the UC taper and the resultant £3,780 stops entitlement for that month.

When they reclaim in the following month, there has to be an assessment as to whether there is any surplus income to take into account.

This requires a number of calculations, referring to the formula above – but correcting it.

The formula calculates the ‘Nil UC threshold’. This is the amount of earnings that would stop entitlement to Universal Credit completely, given the UC maximum amount.

Breaking it down by sections, the first element is,

M -U.

This is the maximum amount of Universal Credit minus any unearned income. There is no unearned income in this case, yet, so that value becomes,

£1,000.

That is then divided by 63, in order to determine the tapered value that would be taken into account. This gives,

15.873.

This is the value of the calculation within the brackets. This is then multiplied by 100 to give the earnings figure which would have been reduced to £1000 by the taper. That amount is

£1,587.30.

Any work allowance is then added to that, as it would have been disregarded in the UC calculation. In this case that is the lower work allowance of £292, giving a ‘Nil UC threshold’ of,

£1,879.30.

To this, to arrive at ‘the relevant threshold ‘, we add the de minimis amount of £2500 which gives us,

£4,379.30.

The relevant threshold figure is deducted from the £6000 earnings to leave a surplus figure of

£1,620.70.

to be used in the next assessment period when UC is reclaimed.

The Reclaim

The surplus income figure of £1620.70 is taken into account, together with any other earnings or income in the UC calculation in the next assessment period. In our simple example, there is no other income or earnings, so this becomes the total figure used.

As it is earnings, firstly a work allowance, if there is one is applied. In this case the lower work allowance of £292 is deducted, leaving,

£1328.70.

The 63% taper is applied to that, producing a figure of,

£837.08

which is taken into account in assessing entitlement. When that is deducted from the maximum UC of £1000, the claimant is entitled to Universal Credit of,

£162.92.

In this case, there is entitlement in the first assessment period and there is no surplus to carry forward into the next. This will not always be the case and there may be one or more months of zero entitlement to benefit.

Looking at this process, it can be understood why the SSAC “had serious doubts about the potential for the surplus earnings policy to operate effectively”. Lord Freud, the welfare minister, said in 2011, when setting out the aims for Universal Credit, “the point (of Universal Credit) has got to be simple. It has to be easy to understand that it is worth working”.

During the duration of the Covid-19 outbreak, Ferret have made a number of its Reckoners free for general use. These are normally supplied as part of its benefits calculation packages. They can be accessed at https://www.ferret.co.uk/reckoners/free/ .

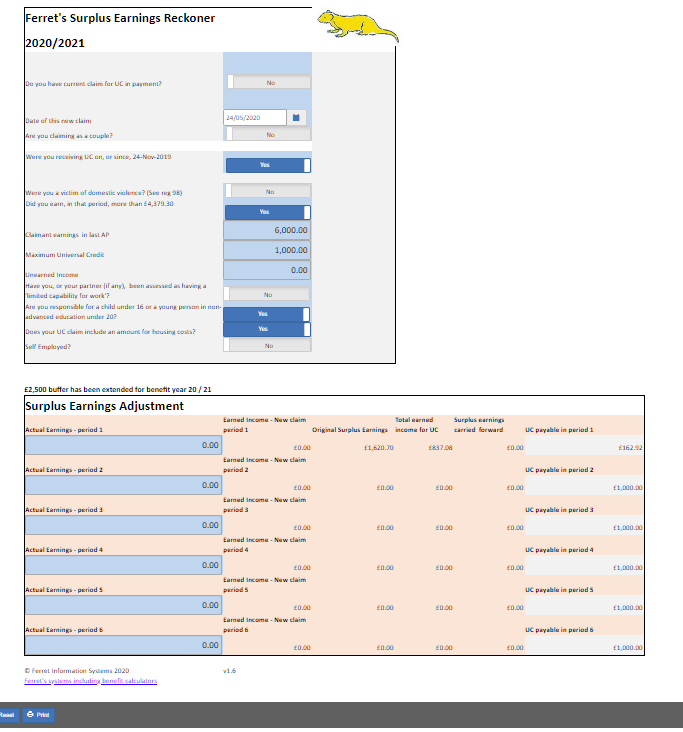

The screenshot below shows the calculation in the example above. We hope that using this Reckoner can make it make it easier to understand this situation.

Surplus Earnings 2020

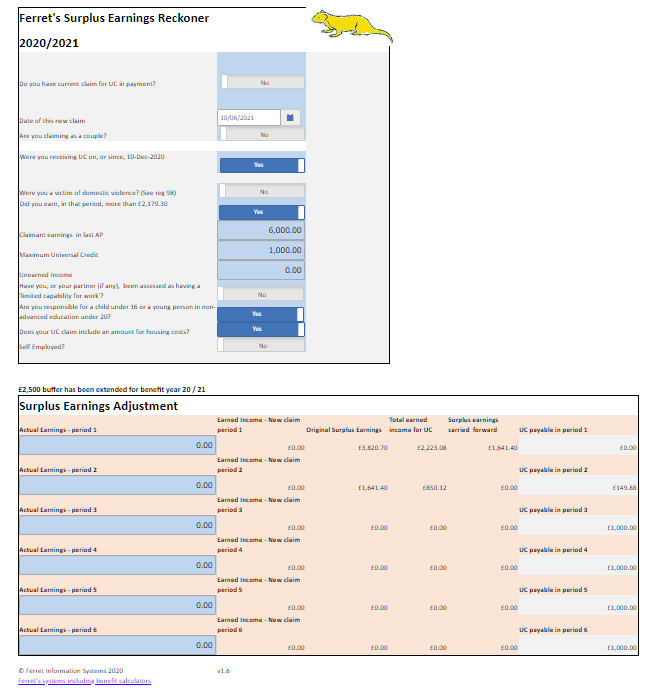

The Reckoner assumes that the extended £2500 de minimis figure will reduce to the £300 in the legislation in April 2021. The second screenshot, below, shows the result if the de minimis figure has been returned to £300. The relevant threshold becomes £2,179.30, leaving a much higher amount of £3,820.70 surplus income to be taken into account.

Surplus Earnings 2021

It shows that there would be no UC in the first month at all and a very much lower entitlement in the second month. I suspect that this explains why the de minimis figure has been kept at £2,500. It is not solely that more people would be affected by the lower threshold but that they would be affected for a longer period.

People who have higher earnings may be expected to spend, at least some of, the increase. Earning more may mean that people think that some of the economies they have had to make while on benefit may no longer be necessary. That might seem to be entirely reasonable to most people.

But not to the designers of Universal Credit. Their view seems to be that people should not spend their increased earnings but, rather, save them in case they go back onto UC within the next six months. Universal Credit has a mantra that work always pays; the surplus income rules might be thought to make it pay for the government.

These rules have been designed to solve the problem of the schemes own creation. If UC did not count everything received in an AP as income for that AP, then the necessity for these rules would largely disappear. (As an aside, my proposals for a day rate method of assessing income https://benefitsinthefuture.com/irregular-uc-and-regular-pay-a-solution-that-also-ends-the-5-week-wait/ , while focusing on the irregularities created by the system of assessing income would also remove most of the need for the surplus income rules, including collusion with employers.)

Double (Triple?) counting

Means tested benefits have always had a problem with income because they have to decide what to do with it when it’s not spent. Traditionally earnings, in particular, have had one set of rules applying to them, after they’ve been paid, which just doesn’t exist in UC. Those rules have, crudely, said that income remains income, and subject to the rules applying to it, for the period of time for which it is paid and, only after that, will it become capital and subject to the rules applying to capital.

Even within those, apparently common-sense rules, the legacy benefits still faced complexities about the treatment of capital and income and how they are shared. Although not directly relevant, I cannot resist sharing my favourite quote from a commissioner’s decision in a social security appeal

“The principle as thus understood has been described as extraordinary, and draconian: …; though the second epithet may be thought a little unfair to Draco, whose harsh code of 621 BC was at least coherent). It is said to be for administrative convenience, to save the authorities the trouble of inquiring into the actual beneficial interests in jointly held or pooled assets, which may be difficult to discern. Reliance is placed on the very wide empowering legislation, which does indeed allow regulations to prescribe that for the purposes of assessing income or capital resources black must be treated as white and vice versa, and people as possessing what they do not, or not possessing what they do.”

CIS 7097/95

The situation with the surplus income rules is not directly a question of whether or not people possess something; it’s rather worse than that.

In Universal Credit, income is income for the AP in which it is received. At the end of that period, if not spent it becomes capital. The surplus income rules would appear to more than encourage the retention of as much as that income as possible, in case it needs to be used in a future claim.

Even though that ‘surplus income‘ is presumably intended to meet people’s needs during those periods when it reduces entitlement to UC.

But…

It is also counted as capital and taken into account, as that, in the UC calculation.

This is not accidental; the DWP in a memorandum to the SSAC in 2014 about these rules said

The surplus earnings policy does not affect the way capital limits or tariff income rules apply. Where a person has a large amount of surplus earnings so that they build up a substantial amount of capital that is still available to them when they make a new claim for UC, this will be taken into account in the usual way i.e. in line with Part 6 of the 2013 Regulations.

Capital affects Universal Credit in two different ways. If a claimant has more than £16,000 of capital, then there is no entitlement to UC. If they have less than that sum but more than £6000, then for each £250, or part, over £6000 there is a notional income taken into account that is the equivalent of £1 a week.

For the surplus income situation that seems to give some different outcomes.

- The total capital is less then £6,000 – no effect

- The total capital is over £16,000 – no UC, and if it persists at this level for more than 6 months then no surplus earnings consequences when it drops below £16,000

- The difficult one is when the total capital is between the two figures.

The notional, tariff, income and capital between £6000 and £16,000 is between £1 and £40 a week, or £4.33 and £173.20 in an assessment period. In Universal Credit, that is listed as one of the types of income making up unearned income.

Going back to the surplus income formula, which determines “the nil UC threshold”, you will remember that it includes:

M – U; where M is the maximum UC and U is unearned income which includes the tariff income from capital.

Any tariff income therefore reduces the threshold figure, and increasing the surplus income taken into account.

In our earlier example, the claimant already had £5000 in savings, which has no effect on the UC entitlement. If they had kept £5000 of their £6000 SEISS award, because they understood that it might be taken into account as surplus income, giving a total of £10,000 then it would generate a notional income of £69.33 a month, in a normal UC assessment.

That has to be included in the surplus earnings assessment as other income.

That changes the M-U from £1000 to £930.67.

Skipping the rest of the steps (please do work through, if you want, or try the reckoner) that gives the result that the Universal Credit payable falls from £162.92 to £93.59 in the first reclaimed AP. This shows that the full tariff income figure has been deducted from the Universal Credit payable.

If there was no surplus income calculation because the threshold was not reached, then the normal tariff income figure would be applied anyway.

Conclusion

The surplus earnings policy was originally a clumsy attempt to fix a problem that shouldn’t have existed. In the current circumstances, particularly of the SEISS payments, it is likely to create hardship and penalties among a group of people who cannot be expected to understand its justification or application.

To add to that by taking the same money into account as surplus earnings, as other income within the surplus earnings assessment or as tariff income is completely unreasonable.

In legacy benefits, there are rules which diminish notional income and capital over time. The introduction of similar rules within the surplus earnings assessment deserves consideration.

If the government really intend to reduce the de minimis figure to £300 in future, then, I’m afraid, they deserve the administrative, financial, and social chaos that must ensue.

Gareth Morgan

May 2020

Comments

Hi, Hope you are well? one thought, the SEISS Payment is taxable etc, but won’t be assessed for both until the end of this tax year, so the full payment will be counted now by UC, but not after tax etc has been deducted, seems daft as at odds with normal earnings calc .rules.? So earnings capital and surplus earnings rules are being done on the wrong Higher amount. Of course it won’t be

recalc after tax calculation has been done. I’d not only be confused, but livid!

Hi Barbara. Self-employed Universal Credit is cash based, so the tax and NI gets taken into account as an expense in the AP in which they’re paid. But, you’re right, in these circumstances, that’s likely (hopefuly) to be later, when earnings have taken the claimant off Universal Credit. It’s another problem caused by the assessment basis.

Excellent post, thank you!

It’s interesting to note the history of the ‘missing’ formula!

When Reg 54A was first made (in SI 2015/345), they completely missed off the denominator. This was corrected by SI 2015/1754.

SI 2017/348 amended this due to the new 63% taper rate.

However, SI 2018/65 completely replaced the whole Reg 54A, and included the correct taper rate from the outset.

The 2018 and 2019 PDFs you mention include the new Reg 54A in its entirety, but strangely use the old formula (along with the footnote, as you describe). This seems extremely odd, as why would they make any change to the new Reg 54A?

Here is what I think happened:

The relevant provision in SI 2017/348 was never repealed. Reg 1 of those Regs provides for the amendment to come into force immediately after the Surplus Regs come into force.

The person consolidating the main UC Regs after the Surplus Regs came into force at first inserted the new version of Reg 54A, as s/he was correctly looking at the consolidated version of SI 2015/345.

S/he then attempted to include the change made by SI 2017/348 and seeing the ’65’ figure already in the new Reg 54A, misread SI 2017/348 as changing it to ’63’! (If you read SI 2017/348 quickly, it is easily possible to make that mistake.)

Thanks Charles, I assume you mean switched 63 back to 65 by thinking that a change was needed.

Yes, precisely.

Sorry, just realised I got my numbers confused in that last paragraph of my first comment!

Hi Gareth

Would it be worth people paying some tax in the AP they get their SEISS – it will probably be due next month anyway – so if they know it’s coming pay it a month early?

It could be. As I’ve said before, the time to make payments out is ideally when they offset income. Although there is some loss carry forward allowance now, that only works forward and can’t offset previous higher income.

prior covid 19 I was self employed 16 hrs weekly my daughter was put into my care 2 years go I have been self employed 5 years followed advice claim universal credit in panic mode not knowing what to do and no advice available I did I have my daughter to support i accepted £500 advance thinking this would be enough for the month not knowing tax credits would stop and everything with it nobody had explained this to me I am new to this I did not know after a phone call with CAB they advised me to get another £500 advance which in total is £80 a month not knowing the final amount I would receive which is around £977 after deductions lock down brought us higher food bills and energy. My Rent is £411 per month I cannot cope till end of month without borrowing come the winter months I will be in a very bad situation its bad now I did get £750 grant because of my low earnings. Thank fully at right time as my fridge freezer was broken I did try get this repaired at a cost of £100 but this was unsuccessful. This was replaced with grant money. i do plan on continuing self employment in September when schools return and maybe i am a bit better from the heart attack i had in January this year and the anxiety of chest pain money worries protecting my daughter are a constantly on my mind. May I point out I searched guidance all the time nothing was available the country was in panic mode. Just the other day i and found that – SEISS (details not available until 30/04/20, not live until 13/05/20

My claim for universal credit was 24/03/20 home schooling no help with school meals till 8th may even though i was getting them due to low income and told to reapply

Then I seen this (From 23 May 2020, a change in the rules means that you can remain entitled to working tax credit during the corona virus pandemic) again all to late but not available and not able to return to this

Simply for following government advice

Thanks for this really useful article – I’m trying to get my head around Universal Credit since applying earlier in the year (I’m a freelancer / self employed)

I’ve only read the article briefly, so may not be making a relevant point, but how I’ve treated my SEISS payments is to record them as income across 3 months of AP

My thinking behind this is although the money was paid into my account in one month / payment it wasn’t just to cover that one month … the first payment was to cover March – May (so I split it across those 3 months as 3 equal lots) and the second payment covered June – August so I split that into 3 payments

This is going to slightly tricky for the next payment as I’ve already submitted my AP for Sept but as the announcement was only made that the SEISS was being extended recently I think I’m going to request that I resubmit my AP for that month … I don’t feel I can be held responsibility for short term budget notifications from the government

Thanks Ben. While it may seem to make sense to distribute the SEISS payment across the period that it seems to relate to, that isn’t how it works. Like all self-employed income, the Universal Credit assessment takes it all into account in the assessment period in which it’s received. It’s just another bit of the ‘all income in’ minus ‘all expenses out’ calculation of earnings for the period. The same will be true for the next tranches, if you qualify for them. If you have outgoings, where you have some control over timing, then you may want to think about making those in the same period as lumps of income such as SEISS. Many people make their pension contributions or interim tax payments in this way.