Notional income from pensions – too notional for some advisers?

by Gareth Morgan on May 13, 2019

The means testing rules for state benefits have, until now, always ignored pension savings until pension age has been reached. That means that people claiming working age benefits do not see them reduced because of any pension savings, unless they choose to take income or capital from them earlier. Once pension age was reached, and entitlement to pension age benefits began, then untaken pension savings were included in the assessment.

That has now changed, because of the rules about mixed age couples coming into force in May 2019.

Mixed-age couples are those where one member is under state pension age and the other is over it. The regulations also cover cases of mixed-age polygamous marriages. Mixed-age couples will be treated in different ways when claiming benefits after May 15 or when their relationship changes after that date.

Not only will mixed-age couples have much lower levels of state benefits in their assessments but any untaken pension savings of the older partner will be taken into account as notional income. Similar rules apply to deferred state pension.

Notional income is a widely ignored, or misunderstood, part of the benefits system. In its broad application it is designed to ensure that no one can receive extra benefits by choosing not to take income or capital that they are entitled to. It differs from tariff or deemed income from capital in the possession of the claimant which is a way to assess, albeit at a very high level, the income that could be generated from it.[i]

Notional pension income is the commonest application of these rules and has a specific method of assessment. The notional income attributable to pension savings is calculated using the Government Actuaries Department tables for annuities. These tables assess the income per £1000 of pension savings using the saver’s age and the 15 year gilt rate published in the Financial Times.

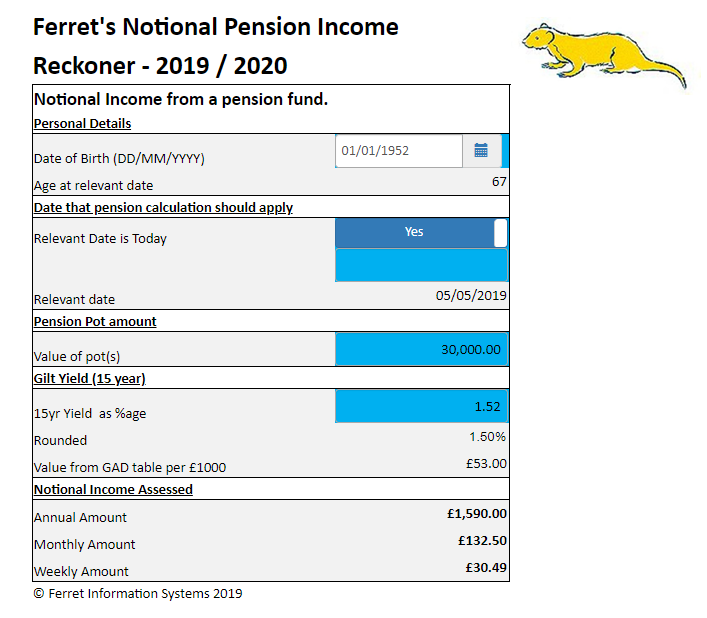

Figure 1, below, shows the notional income for a 67-year-old with pension savings of £30,000, the gilt yield at the relevant date, and the resultant notional income.

| Figure 1 |

If the saver continues to leave the pot untouched then, for benefit purposes, he or she will be considered to have income over £132.50 a month which will be taken into account in the calculation of Pension Credit or, for mixed-age couples, for Universal Credit.

There’s a little more complexity where the saver chooses to draw regular income from the savings. Figure 2, below, shows the income that is taken into account (Here in green in an extract from a table produced by Ferret’s pensionForward system).

Figure 2

The table shows that notional income is applied, in full, until the income being withdrawn is greater than the notional income calculated. Once the real income being taken exceeds the notional income figure, for the value of the savings, the real income is used in the benefit calculation. Note however, that the value of notional income begins to fall once that point is reached. This is because the value of the pension savings is also falling as income is being withdrawn. The notional income calculated therefore also falls.

For pension providers this can make things difficult. The rules specify that there is a duty on the pension provider to reassess the value of savings and to inform the DWP of the changes. [ii]

- after every drawdown of capital

- after every drawdown of income which exceeds the applicable notional income amount or

- upon the claimant’s request.

The consequences of the revaluation not being carried out are clear. The benefits assessment will be using a notional income or capital figure which is too high, meaning that the benefit paid is lower than it should be.

While this task may seem onerous, it is amenable to automation. The alternative may be the saver sending a request after every withdrawal, which could result in even more effort and complex processes.

For claimants this cumbersome process, in whatever way it operates, will prove to be slow and likely to leave them with a lower income than they should be receiving.

For those making irregular drawdowns from their savings, which will be treated as capital rather than income, things are equally complex.

I looked in some detail at the effect of taking capital from pension savings on means tested benefits in a posting of January 2018 (https://benefitsinthefuture.com/income-certainty-and-low-pension-savings/). In it, I pointed out what seems counterintuitive in some ways. Taking money from pension savings as capital can increase the amount of benefits payable.

This is because some capital is ignored for benefit purposes. For working age benefits the first £6000 has no effect on benefits while the pension age benefits the sum ignored is £10,000. Taking, for example, £10,000 from a pensioner’s savings pot (if claiming Pension Credit) will, if there is no other capital, leave the amount of means tested benefits calculated and changed but to reduce the amount of pension savings. That, in turn, reduces the amount of notional income attributed to the pension savings and that reduction in income will increase the amount of benefit entitlement.

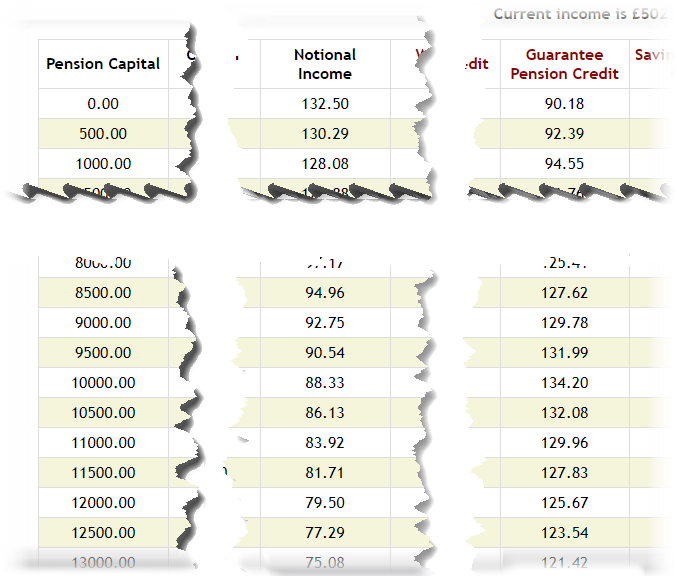

A 67-year-old with £30,000 of pension savings will have a notional income of £132.50 a month. Figure 3 shows that as capital is withdrawn, in the extract from the table generated by Ferret’s pensionForward system, the notional income falls and the Pension Credit entitlement increases.

Figure 3

if the pensioner was to take £10,000 from their pension savings, the maximum that can be disregarded in the benefit calculation, then, as figure 4 shows, notional income would fall to £88.33 and their Pension Credit entitlement rise to £134.20 a month.

Figure 4

Figure 4 shows that once the £10,000 limit is breached, although the notional income continues to fall the amount of capital held over £10,000 is assessed as generating a tariff or deemed income, at the rate of £1 a week for every £500, or part, above the capital limit (for every £250, or part, over £6000 for working age benefits, including Universal Credit) . This tariff income increases greater than the reduction of notional income, so benefit begins to fall.

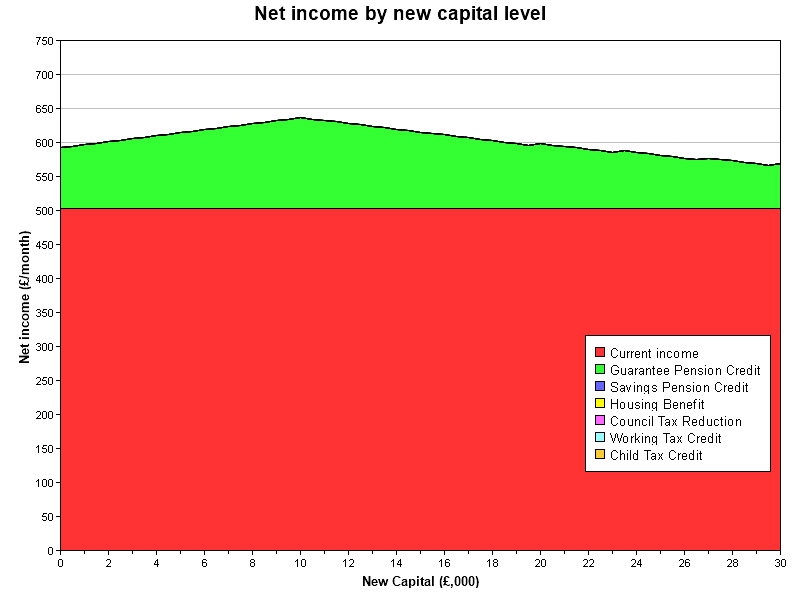

Figure 5, from Ferret’s pensionForward system, shows this effect graphically, where it can be seen that benefit increases as capital is withdrawn until the £10,000 limit is reached when it begins to fall once again

| Figure 5 |

For many people, it will be beneficial to reduce their pension savings in this way rather than taking regular income. A lump sum, gradually reduced, and topped up occasionally and irregularly will impact benefit levels less in many cases.[iii]

BUT… In the case of capital reduction, or regular income drawdown, the benefit increase from the reduction in pension savings will depend upon the DWP valuation of their savings being updated. If that revaluation is not carried out, carried out late or, in the case of regular drawdown, aggregated from a number of withdrawals then the benefit payment may be incorrect, to the disadvantage of the claimant.

The notional income rate will change at each birthday, increasing as the saver gets older and life expectancy reduces. This has the effect of reducing benefit as the notional income increases. There is not, however, a duty to reassess this value on the birthday but the new rate should be used on the next revaluation.

It is also important to remember that the pension savings will normally be invested rather than kept as cash. That means that the value will increase, therefore increasing the notional income as well.

Taking capital or income?

These tables, necessarily simplistic, attempt to compare withdrawing pension savings as regular income or as irregular drawdowns, treated as capital.

the tables assume a single claimant aged 70 with pension savings of £30,000 and no other capital. The income withdrawal rate is £200 a month. The 15-year gilt rate is assumed to be 1.5% and so the GAD rate per £1000 is £59. The tables assume an annual increase in value of retained capital of 4%, assessed monthly.

| Actual Income withdrawn | Capital remaining | Notional income at starting capital | Real notional income | |

| £30,000.00 | £147.50 | £147.50 | ||

| Month 1 | £200.00 | £29,899.33 | £147.50 | £147.01 |

| Month 2 | £200.00 | £29,798.33 | £147.50 | £146.51 |

| Month 3 | £200.00 | £29,696.99 | £147.50 | £146.01 |

| Month 4 | £200.00 | £29,595.32 | £147.50 | £145.51 |

| Month 5 | £200.00 | £29,493.30 | £147.50 | £145.01 |

| Month 6 | £200.00 | £29,390.94 | £147.50 | £144.51 |

| Month 7 | £200.00 | £29,288.25 | £147.50 | £144.00 |

| Month 8 | £200.00 | £29,185.21 | £147.50 | £143.49 |

| Month 9 | £200.00 | £29,081.83 | £147.50 | £142.99 |

| Month 10 | £200.00 | £28,978.10 | £147.50 | £142.48 |

| Month 11 | £200.00 | £28,874.03 | £147.50 | £141.96 |

| Month 12 | £200.00 | £28,769.61 | £147.50 | £141.45 |

| Month 13 | £200.00 | £28,664.84 | £147.50 | £140.94 |

| Month 14 | £200.00 | £28,559.72 | £147.50 | £140.42 |

| Month 15 | £200.00 | £28,454.25 | £147.50 | £139.90 |

| Month 16 | £200.00 | £28,348.43 | £147.50 | £139.38 |

| Month 17 | £200.00 | £28,242.26 | £147.50 | £138.86 |

| Month 18 | £200.00 | £28,135.74 | £147.50 | £138.33 |

| Month 19 | £200.00 | £28,028.85 | £147.50 | £137.81 |

| Month 20 | £200.00 | £27,921.62 | £147.50 | £137.28 |

| Month 21 | £200.00 | £27,814.02 | £147.50 | £136.75 |

| Month 22 | £200.00 | £27,706.07 | £147.50 | £136.22 |

| Month 23 | £200.00 | £27,597.76 | £147.50 | £135.69 |

| Month 24 | £200.00 | £27,489.08 | £147.50 | £135.15 |

| £3,540.00 | £3,387.65 |

Table 1

If the claimant was to take £10,000 as capital but not take any regular income, table 2 below, shows the result.

| Capital taken | Capital remaining | Notional income at value | Difference in notional income | |

| £30,000.00 | £147.50 | |||

| Month 1 | £10,000.00 | £20,066.67 | £98.66 | £48.34 |

| Month 2 | £20,133.56 | £98.99 | £47.52 | |

| Month 3 | £20,200.67 | £99.32 | £46.69 | |

| Month 4 | £20,268.00 | £99.65 | £45.86 | |

| Month 5 | £20,335.56 | £99.98 | £45.03 | |

| Month 6 | £20,403.35 | £100.32 | £44.19 | |

| Month 7 | £20,471.36 | £100.65 | £43.35 | |

| Month 8 | £20,539.60 | £100.99 | £42.51 | |

| Month 9 | £20,608.06 | £101.32 | £41.66 | |

| Month 10 | £20,676.76 | £101.66 | £40.81 | |

| Month 11 | £20,745.68 | £102.00 | £39.96 | |

| Month 12 | £20,814.83 | £102.34 | £39.11 | |

| Month 13 | £20,884.21 | £102.68 | £38.25 | |

| Month 14 | £20,953.83 | £103.02 | £37.40 | |

| Month 15 | £21,023.67 | £103.37 | £36.53 | |

| Month 16 | £21,093.75 | £103.71 | £35.67 | |

| Month 17 | £21,164.07 | £104.06 | £34.80 | |

| Month 18 | £21,234.61 | £104.40 | £33.93 | |

| Month 19 | £21,305.39 | £104.75 | £33.06 | |

| Month 20 | £21,376.41 | £105.10 | £32.18 | |

| Month 21 | £21,447.67 | £105.45 | £31.30 | |

| Month 22 | £21,519.16 | £105.80 | £30.42 | |

| Month 23 | £21,590.89 | £106.16 | £29.53 | |

| Month 24 | £21,662.86 | £106.51 | £28.65 | |

| £2,460.89 | £926.76 |

Table 2

On the basis of this table, using what should be the real value of notional income following a reduction in capital and in regular drawings, the benefit entitlement following capital withdrawal would be calculated on a substantially lower notional income over the period. However capital growth, from the continued investment of the untaken pensions would also be lower. Although the £10,000 withdrawn could be placed in an income generating product to offset this, no responsible adviser would suggest withdrawing money from pension savings to invest elsewhere, simply for that effect.

Additionally, a revaluation following an age change, in this case from 70 to 71, would mean that the GAD value per thousand pounds would increase from £59 per year to £62 per year, altering the notional income assessment.

Conclusion

Few advisers, whether financial or welfare rights, seem to adequately consider the value and impact of notional income from pension savings. Although sometimes complex mathematically, the effect on individual and family incomes and benefits can be substantial, and there are tools available to carry out the calculations.

In particular, ensuring that prompt revaluations are taken into account following withdrawals of income or capital will be vital to ensure that correct benefits are paid.

The new rules for mixed-age couples make it likely that they will be more severely affected by the notional pension rules than those in other situations.

This note has shown that there are, in many cases, options and choices for those with pension savings. It is incumbent on advisers to understand those, and the consequences, and to make sure that their clients do as well.

Gareth Morgan

Ferret Information Systems

May 2019

[i] Universal Credit Regulations 2013

Notional unearned income

74.—(1) If unearned income would be available to a person upon the making of an application for it, the person is to be treated as having that unearned income.

…

(3) A person who has reached the qualifying age for state pension credit is to be treated as possessing the amount of any retirement pension income for which no application has been made and to which the person might expect to be entitled if a claim were made.

(4) The circumstances in which a person is to be treated as possessing retirement pension income for the purposes of universal credit are the same as the circumstances set out in regulation 18 of the State Pension Credit Regulations 2002 in which a person is treated as receiving retirement pension income for the purposes of state pension credit.

[ii] Decision Makers Guide Chapter 28

28628 For the purposes of notional income for claimants, or their partners as appropriate, who have reached the qualifying age for SPC (see DMG 28631), the claimant’s pension pot is required to be re-valued

after every drawdown of capital

after every drawdown of income which exceeds the applicable notional income amount (see DMG 28632) or

upon the claimant’s request.

Example

John is in receipt of SPC. He has a pension pot of £40,000 which he doesn’t wish to access at the moment but might do at a later stage. The DM calculates that as an annuity income, this would produce £2,000 per annum or £38.46 per week. This is based on 100% of the rate of annuity that the fund would generate (see DMG 28631). The figure of £38.46 is taken into account as notional income. John then decides to draw down £8,000 as capital, leaving £32,000 in his pension pot. The decision maker reassesses the notional income figure based on 100% of the rate of annuity that the remaining amount in the fund would generate.

Information and evidence

28629 Pension fund holders must provide the DM with information about

the rate of annuity available from the pension fund and

the amount of income that would be available if the funds were held in a scheme that produces an income.

This information is usually provided by the provider on form PPR1 and is based on tables prepared by the Government Actuary’s Department (GAD)1. The rate of annuity is 100% of the rate of the annuity that could be generated by the fund. DMs must consider evidence from pension fund holders when deciding the amount of notional income2. Do not make a decision until the pension fund holder has been given sufficient time to provide evidence.

1 SS (C&P) Regs, reg 7(6); 2 JSA Regs, reg 105(4) & 105(5); IS (Gen) Regs, regs 42(2B) & 42(2C)

[iii] Unearned income calculated monthly

73.—(1) A person’s unearned income is to be calculated as a monthly amount.

(2) Where the period in respect of which a payment of income is made is not a month, an amount is to be calculated as the monthly equivalent, so for example–

(a) weekly payments are multiplied by 52 and divided by 12;

(b) four weekly payments are multiplied by 13 and divided 12;

(c) three monthly payments are multiplied by 4 and divided by 12; and

(d) annual payments are divided by 12.

…

(3) Where the amount of a person’s unearned income fluctuates, the monthly

equivalent is to be calculated–

(a) where there is an identifiable cycle, over the duration of one such cycle; or

(b) where there is no identifiable cycle, over three months or such other period as may, in the particular case, enable the monthly equivalent of the person’s income to be determined more accurately.

Comments

Hi ,thanks for this information.It is a great help to me as i have a small pension and i am a low wage earner.I am due to retire in approx six years time.

With reference to the GAD table at the top of this page.

In the box Notional income assessed, is TAX deducted from the amount(s) ?

I ask because i am trying to understand what my situation will be regarding my own pension pot.

Thank you.