Identifying the needs shortfall for older people

by Gareth Morgan on May 13, 2019

This note was originally intended to be a consideration of the effects of the mixed-age couple rules which are to be introduced into the benefit system on May 15, 2019. During drafting, it became very clear that the same sort of considerations apply to many other situations, including those people with higher incomes, especially around the changes of circumstance that are common around retirement and ageing.

Mixed-age couples are those where one member is under state pension age and the other is over it. The regulations also cover cases of mixed-age polygamous marriages. Mixed-age couples will be treated in different ways when claiming benefits after May 15 or when their relationship changes after that date.

Mixed-age couples with a partner under State Pension age already in receipt of Pension Credit or pension-age Housing Benefit when the new rules come into force will not be affected as long as they remain entitled to either benefit. Those receiving pension age rules housing benefit will also continue to be able to claim Pension Credit.

People in a mixed-age relationship before May 15th will be able to claim Pension Credit or pension-rules Housing Benefit until May 14 and will be able to remain on those benefits after those dates, unless a relevant change of circumstance occurs.

Once the new rules are in force, mixed-age couples claiming benefits will be dependent upon Universal Credit until the youngest person reaches pension age.

This will have a particularly severe impact on couples where there is a considerable age difference between the two people. They will spend much longer on the lower working age rates, if they are dependent upon means tested benefits. Benefit rates for older people can be over twice the rate of those paid to people of working age.

The couple rate of the working age benefit is much lower than even the single rate of the older person’s benefit – £114.81 a week for a couple getting Universal Credit compared to £167.25 for a single person receiving Guarantee Pension Credit, from April 2019. For couples getting Pension Credit, the difference is bigger, £255.25 a week is more than double the Universal Credit rate.

The difference in basic benefit, without housing support or additional needs, for couples claiming before or after the date of change will be £140.44 a week – £7327.96 a year,

Two can live as cheaply as one, as the old saying goes. That would be good news from May 15th. This government has decided that two can live much more cheaply than one.

A single person, over state pension age, and claiming Pension Credit, will qualify for £167.25 a week in benefits. That’s for day to day living costs without housing help.

If he, or she, forms a relationship with another, younger, him, or her, you might expect there to be some increase in their living costs as there are now two people involved.

The new rules don’t work like that. Because they move onto Universal Credit, they get the Universal Credit rate for a couple.

That’s £114.81 a week.

So the government’s new rules decide that a single older person needs £52.44 a week more money, every week, to meet their needs, than the same single older person when they’re also supporting another younger person.

Retirement

It is likely that an older partner may retire before the other person reaches pension age. That’s a natural consequence of being older.

The benefit consequences aren’t quite so natural.

The older person is likely to have some pension savings. The consequences of an older partner wanting, or needing, to make use of their pension savings, at the same time as the age of the younger partner makes them subject to the rules and rates of working age benefits, may be particularly severe.

Many people have small pension pots and this means that they may well be entitled to means-tested benefits even after taking income or capital from their savings pot. For many of them the amount of income or an annuity that they could take would not be enough to end their entitlement to Pension Credit but will stop their entitlement to Universal Credit.

Not taking their pension may not be an option for those without other resources; untaken pensions have no effect on those below pension age but will count for older partners. Notional income from untaken pension savings, is not calculated using the Deemed or Tariff income rules but use a complex calculation based on the Government Actuaries Department’s notional annuity’s tables and the current 15-year gilt rate.

I have looked at some of the many issues around notional pensions in a post at https://benefitsinthefuture.com/notional-income-from-pensions-too-notional-for-some-advisers/ .

Capital and savings

Other types of capital matter in a couple of different ways in benefits. Neither Universal Credit nor Pension Credit actually care about income received from capital, whether that’s interest on savings, dividends from shares or even rent from property. Instead they have notional interest rules, at a very high notional level of interest.

The imaginary income is used as part of the means test for the benefits. The way it’s calculated is much more severe in Universal Credit than in Pension Credit.

In Universal Credit, if the claimant has capital in above £6000 notional ‘tariff income’ is calculated on any amount over that.

Every £250.00 of excess capital will generate £1.00 per week of tariff income. Any fractional amounts of £250.00 will also generate income of £1.00.

For Pension Credit the starting point is £10,000 and the rules assume £1 for each £500 of excess income

The difference is substantial; a person with £15,999 in an ISA would have a notional income of £12 a week under Pension Credit rules but £40 a week under the Universal Credit rules.

Capital Cut-Off in Universal Credit and Pension Credit

Capital below £6000 is ignored for Universal Credit but if it’s over £16,000 then benefit will not be paid.

There is no capital cut-off in Pension Credit. With high levels of capital the notional income rule will, in due course, stop Pension Credit as part of the usual means test but it is not uncommon to see people with very high levels of saving still being entitled to the benefit.

That means, for example, an older partner retiring with a small pension pot, which might be better taken as a lump sum under Pension Credit, will be disadvantaged substantially when on Universal Credit.

Planning for the future

If we consider a man who is three years older than his non-working partner and who retires at exactly his state pension age, some of the practical issues can be seen.

As his earnings stop, his income is likely to drop substantially even if he is able to take an occupational pension at that time. This makes it likely that benefits may be claimed and, now, that will have to be UC. After three years (or slightly more as pension age will have increased) Pension Credit entitlement will start as the partner reaches pension age.

There will be a common cycle, where income drops on stopping work and moving on to Universal Credit (or not being entitled to any help) followed by, after a period, an increase in income when the couple qualify for Pension Credit. Understanding this situation, and the amounts involved, will be vital for budgeting and in particular for creditors who will need to consider what options are available to cover the period with less income.

Non-benefit cases

The same considerations, broadly, may apply to those whose income is, or capital, take them out of the benefits area. At around the time of retirement, it is likely that there will be changes in earnings, pension income, mortgages, capital and needs. Many of these changes will occur over a lengthy period, with consequent changes in the pattern of income and outgoings.

Quantifying these differences, for benefits and non-benefits cases, need not be difficult. Ferret have produced a calculator which does this, including the complex changes in pension ages and benefit entitlement over the changes in circumstance. This calculator can enable any shortfall in resources, over specific periods of time, to be assessed.

Meeting the shortfall

The financial services industry may be able to help in a number of ways. For those with equity in their homes an equity release drawdown facility could help meet the shortfall with confidence about the final costs thanks to the better understanding of the requirements.

Pensioners, again using drawdown from their savings, would be able to plan more accurately for the future situation. For those with insufficient savings; if the assessment were to be carried out early enough then it may be possible to introduce sufficient savings to meet the future need.

Examples.

These examples are falsely precise. We have kept the figures detailed, for comparative purposes, but the apparent exactness should not imply that level of precision could, or should, be used in real situations. This kind of assessment can offer broad guidance but no more than that.

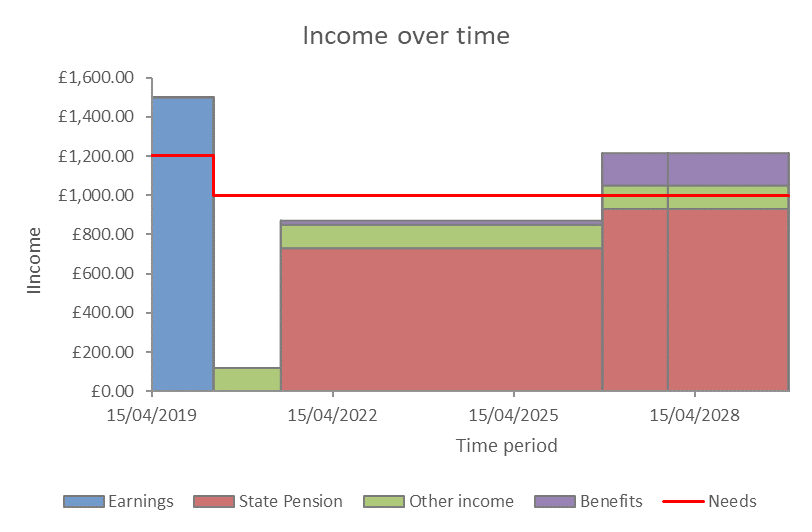

A couple, one aged 63 the planning to retire in a year from a job paying £18,000 a year and one aged 58 not working. Homeowners with no mortgage, in good health and with savings of £20,000. The retiree will receive a full new state pension when reaching the age of 66, while the partner will receive a small state pension, thanks to low previous contributions. They estimate their income needs at the moment as £1200 a month.

They have a Council Tax liability of £1250 a year. The Council Tax Reduction scheme has not yet introduced a rule change for mixed-age couples but they are affected if in receipt of working age benefits, because of the new rules. For consistency in modelling the calculations here, in all examples, assume that mixed-age couple rules apply to this benefit also.

On retirement, earnings stop and a small occupational pension of £120 a month comes into payment. There is no entitlement to working age means tested benefits as their capital exceeds £16,000 limit. Because of savings to work expenses their needs figure is estimated to drop to £1000 a month

They estimate that by 2021, when the oldest person reaches state pension age, their capital will have reduced by £10,000. The oldest person’s new state pension comes into payment at £730.60 a month.

| Figure 1 |

The next predictable change is when the partner reaches state pension age in 2026. At that point they receive £200 a month state pension. Both members of the couple are now over state pension age and now qualify for Pension Credit and Council Tax Reduction which is payable at £163.98 a month (at April 2019 rates).

Figure 1 shows the points at which their changes of circumstance occurs. As can be seen, there is a lengthy measurable period where income is less than needs, which comes to an end when benefits entitlement begins. The table below shows the relevant figures together with the shortfall or surplus, month by month.

| Start Date | Date of change 1 | Date of change 2 | Date of change 3 | Ongoing | |

| 15/04/2019 | 24/04/2020 | 05/06/2021 | 04/10/2026 | 04/11/2027 | |

| Earnings | £1,500.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| State Pension | £0.00 | £0.00 | £730.60 | £930.60 | £930.60 |

| Other income | £0.00 | £120.00 | £120.00 | £120.00 | £120.00 |

| Benefits | £0.00 | £0.00 | £20.22 | £163.98 | £163.98 |

| Needs | £1,200.00 | £1,000.00 | £1,000.00 | £1,000.00 | £1,000.00 |

| Net | £300.00 | -£880.00 | -£129.18 | £214.58 | £214.58 |

Table 1

Taking the periods of shortfall, only, and using the length of time for which they apply, it is easy to quantify the amount by which income falls below needs.

| From | 24/04/20 to 05/06/21 | 05/06/21 to 04/10/26 |

| Monthly | -£880.00 | -£129.18 |

| Shortfall over Period | -£11,738.15 | -£8,259.03 |

Table 2

From this, it can be seen that for the six years from 2020, this couple have needs which exceed their income by just over £20,000.

On current figures, by 2027 they would have an excess income of over £200 a month which would, in theory, allow repayment of a loan to be made. It may be more practicable, for them, to secure any loan using their housing equity.

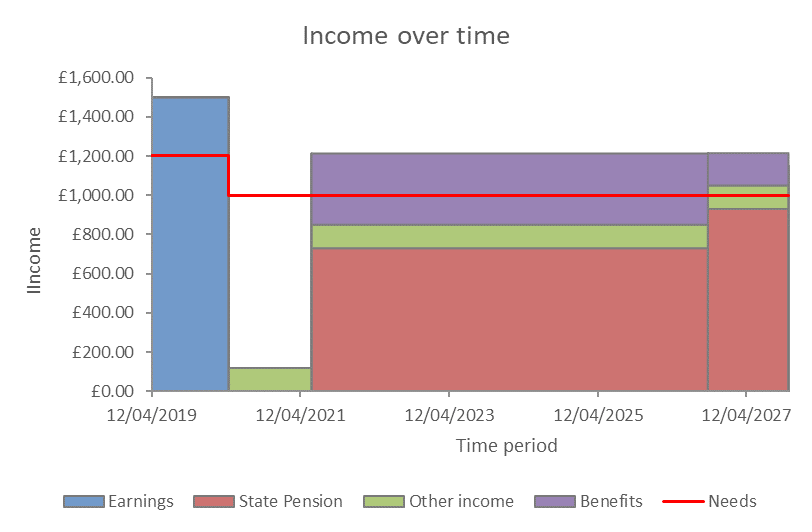

What’s changed?

Simply, the rules. Until the introduction of the mixed-age couples changes in May 2019, entitlement to Pension Credit for a couple depended on the age of the older person. In this example, shown in figure 2, they would have become entitled to benefit in 2021 and their income would have been topped up by Pension Credit and Council Tax Reduction. There would still have been a shortfall between stopping work and reaching State pension age but it would have been considerably less overall and the certainty of future benefit entitlement would have been more reassuring.

| Figure 2 |

| Start Date | Date of change 1 | Date of change 2 | Date of change 3 | Ongoing | |

| 15/04/2019 | 24/04/2020 | 05/06/2021 | 04/10/2026 | 04/10/2029 | |

| Earnings | £1,500.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| State Pension | £0.00 | £0.00 | £730.60 | £930.60 | £930.60 |

| Other income | £0.00 | £120.00 | £120.00 | £120.00 | £120.00 |

| Benefits | £0.00 | £0.00 | £362.15 | £163.98 | £163.98 |

| Needs | £1,200.00 | £1,000.00 | £1,000.00 | £1,000.00 | £1,000.00 |

| Net | £300.00 | -£880.00 | £212.75 | £214.58 | £214.58 |

Table 3

| From | 24/04/20 to 05/06/21 |

| Monthly | -£880.00 |

| Shortfall over Period | -£11,738.15 |

Table 4

In this example, there would always have been a shortfall, although one which would have been considerably less in value and for a much shorter period of time under the old rules.

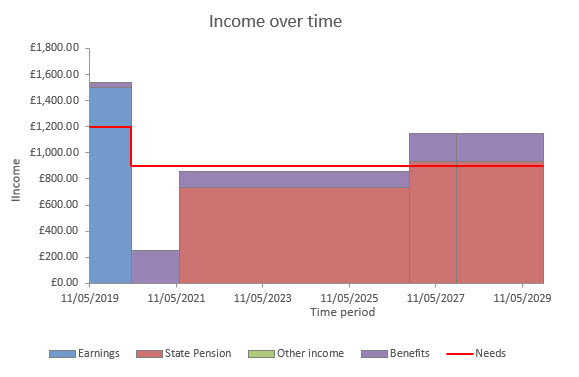

The next example looks at the case of a couple who are renting, with the same age structure and income but paying rent, although for comparison we have retained the same needs figure.

New rules

| Figure 3 |

| Start Date | Date of change 1 | Date of change 2 | Date of change 3 | Date of change 4 | Ongoing | |

| 09/05/2019 | 24/04/2020 | 05/06/2021 | 04/10/2026 | 04/11/2027 | 04/11/2029 | |

| Earnings | £1,500.00 | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| State Pension | £0.00 | £0.00 | £730.60 | £930.60 | £930.60 | £930.60 |

| Other income | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| Benefits | £38.86 | £252.44 | £128.84 | £215.27 | £215.27 | £215.27 |

| Needs | £1,200.00 | £900.00 | £900.00 | £900.00 | £900.00 | £900.00 |

| Net | £338.86 | -£647.56 | -£40.56 | £245.87 | £245.87 | £245.87 |

Table 5

| Start Date | 09/05/2019 |

| Final Date | 04/11/2029 |

| Overall Surplus | Monthly |

| £1,753.29 | £13.93 |

Table 6

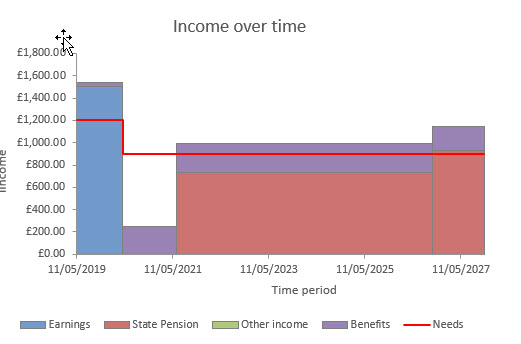

Old Rules

| Figure 4 |

| Start Date | Date of change 1 | Date of change 2 | Date of change 3 | Date of change 4 | Ongoing | |

| 09/05/2019 | 24/04/2020 | 05/06/2021 | 04/10/2026 | 04/11/2027 | 04/11/2032 | |

| Earnings | £1,500.00 | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| State Pension | £0.00 | £0.00 | £730.60 | £930.60 | £930.60 | £930.60 |

| Other income | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

| Benefits | £38.86 | £252.44 | £261.27 | £215.27 | £215.27 | £215.27 |

| Needs | £1,200.00 | £900.00 | £900.00 | £900.00 | £900.00 | £900.00 |

| Net | £338.86 | -£647.56 | £91.87 | £245.87 | £245.87 | £245.87 |

Table 7

| Start Date | 09/05/2019 |

| Final Date | 04/11/2032 |

| Overall Surplus | Monthly |

| £19,073.44 | £117.81 |

Table 8

The effect of the new rules will make a large number of people in mixed-age couples worse off. The effect is not limited to the period until the younger partner reaches pension age. There is a considerable effect past that point for many people.

Advice needs

as emphasised in the introduction, the figures in the examples should not imply that the assessment of needs over a number of years can be exact. Necessarily, the estimates of need and future resources will be just that, estimates. The aim of these estimates is to identify the likelihood periods of income shortfall or surplus and the approximate levels of income associated with them.

That does not mean that these assessments have no value. Many advisers have operated, many still do, on a snapshot basis. Looking only at today’s circumstances and not considering a longer-term view of the client’s situation. It is now possible, as this note shows, to identify at the least, probable periods of need and of the broad resources needed to meet them.

For some people it may be feasible to make use of financial products, including loans, extending mortgages or equity release. Some of these will not require repayment while others may be manageable when resources increase in the future.

There will be some people however whose only resource may be their pension savings. There are many dangers involved in using savings intended for long-term support to meet shorter term needs. There are many and complex issues around the use of pension savings, a number of my blog postings consider these, in particular the recent https://benefitsinthefuture.com/notional-income-from-pensions-too-notional-for-some-advisers/. In short, spending money now, means that there will be less to spend in the future. For some people, this will mean an increase in their benefit entitlement in the longer term (assuming the continued existence of the benefits system). This is not, presumably, what the mixed-age rules were meant to achieve. For others, it will mean a reduction in the quality of life over the longer term; again not what this government says its policies are intended to achieve.

Whatever the situation, we should recognise that advisers have a duty to help their clients to look ahead and to recognise the long-term position that they are in. Financial advisers have long done this for the better off; now it’s the turn of those in greater need.

Gareth Morgan

Ferret Information Systems

May 2019

Leave a Reply