Mortgage interest changes – finally on their way

by Gareth Morgan on August 20, 2015

I wrote some time ago, over 3 ½ years in fact, about the consultation and call for evidence that had been published by the government announcing their policy intentions for support for mortgage interest in means tested benefits – http://blog.cix.co.uk/gmorgan/2012/01/06/mortgage-interest-support-consultation/.

The Summer Budget 2015 has now produced the date of introduction of the proposal – April 2018 – and more detail of the implementation.

There have been a number of changes to the proposals as originally suggested. The core elements remain; there will be a second charge on the property and the loan will carry interest and service charge. There will not though be a two-year period where the current mortgage interest scheme operates, loans will be made for up to £200,000 of mortgages and existing recipients will be transferred onto the loan system.

The waiting period for help with mortgage interest will be extended, again, to 39 weeks.

Gone is the suggestion, which would have been difficult to administer, that liability would cease to increase once the property went into negative equity. Instead, repayment will be limited to the amount of remaining equity in the home and any additional balance would be written off when the account is settled.

The absence of a two-year period which would have been loan free may introduce new complexities for those people with irregular work patterns. Loan repayment will be expected not just on the sale of property, or the death of the owner, but when the claimant enters work.

Universal Credit has a ‘zero earnings policy’ where no help with mortgage interest is available if there are any earnings at all. Loans will therefore be available only when there are no earnings at all. Irregular earning patterns, which for current benefits will normally mean over 16 hours a week’s work before it happened stops, are much more likely for Universal Credit claimants.

Before loans are made, financial advice will have to be received by the claimant. This is described as ‘industry-standard advice’ although this is described only as ‘explaining the consequences of taking a loan’. This advice will be made by ‘a non‐governmental organisation which will also be responsible, on behalf of the Secretary of State, for registering charges on claimants’ properties and for the recovery of the debt’. Whether this will be an entirely new organisation or whether an existing organisation expected to take on these functions is unclear. There does seem to be some potential conflict within these different roles.

The Effects

All of the following examples are concerned solely with mortgage interest. They assume that no capital repayment takes place. Shortfalls in interest support are added to the capital amount owing while higher amounts of support than interest due, reduce the capital outstanding.

I have used the current support for mortgage interest (SMI) rate of 3.12%, in place since July 2015, for modelling the current scheme effects. For the loan scheme I have taken the Office of Budget Responsibility (OBR) forecast for Gilt rates to 2020 and continued the last rate into the future.

Interest and charges have been added using the 2% rate applied in the examples in the 2011 call for evidence.

In these examples, for ease of calculation, I’ve used a case with £100,000 value and £50,000 mortgage, giving starting equity of £50,000.

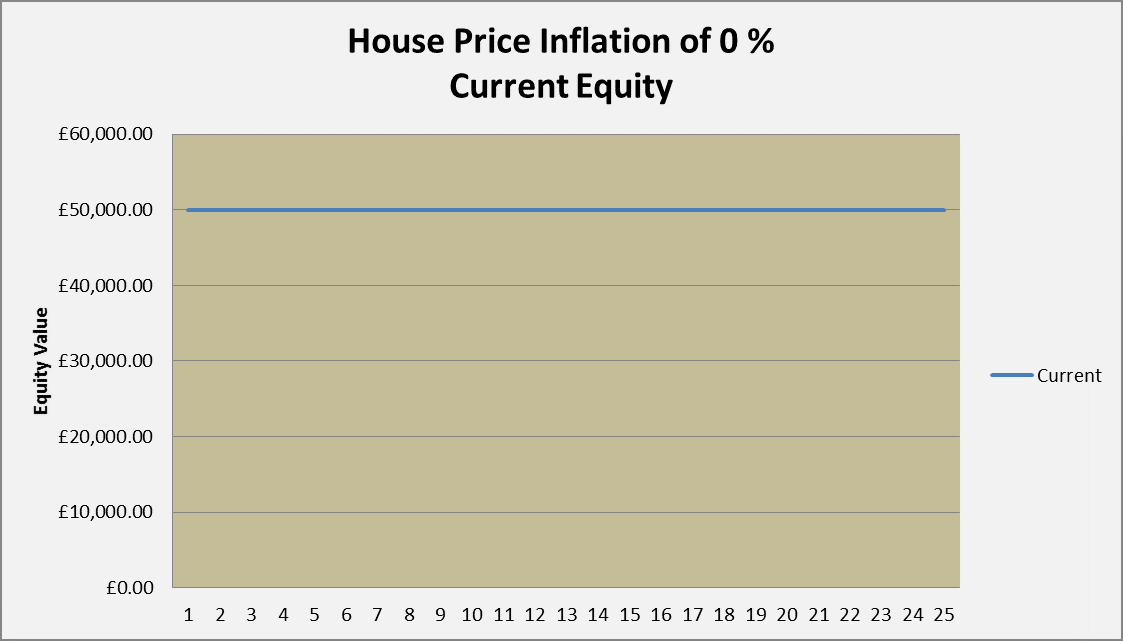

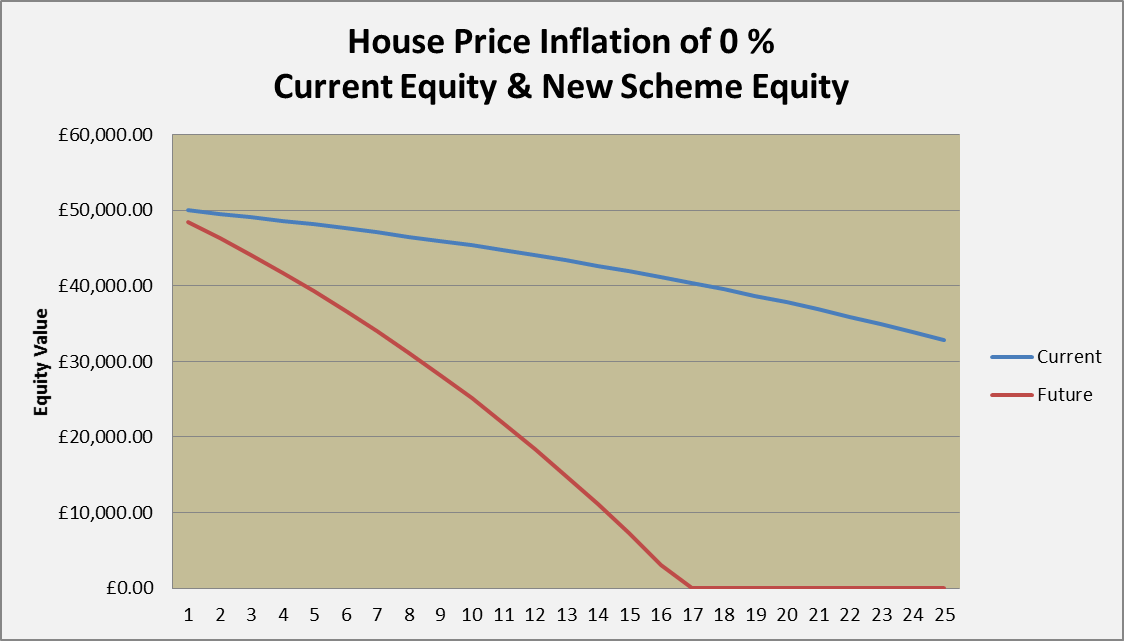

To start with the simplest case; a mortgage interest rate of 3.12%, the same as the SMI rate, and zero assumed house price inflation (HPI).

Figure 1 shows that under the current SMI scheme, equity is unchanged across the duration of the claim, as the interest due on the mortgage matches the support received.

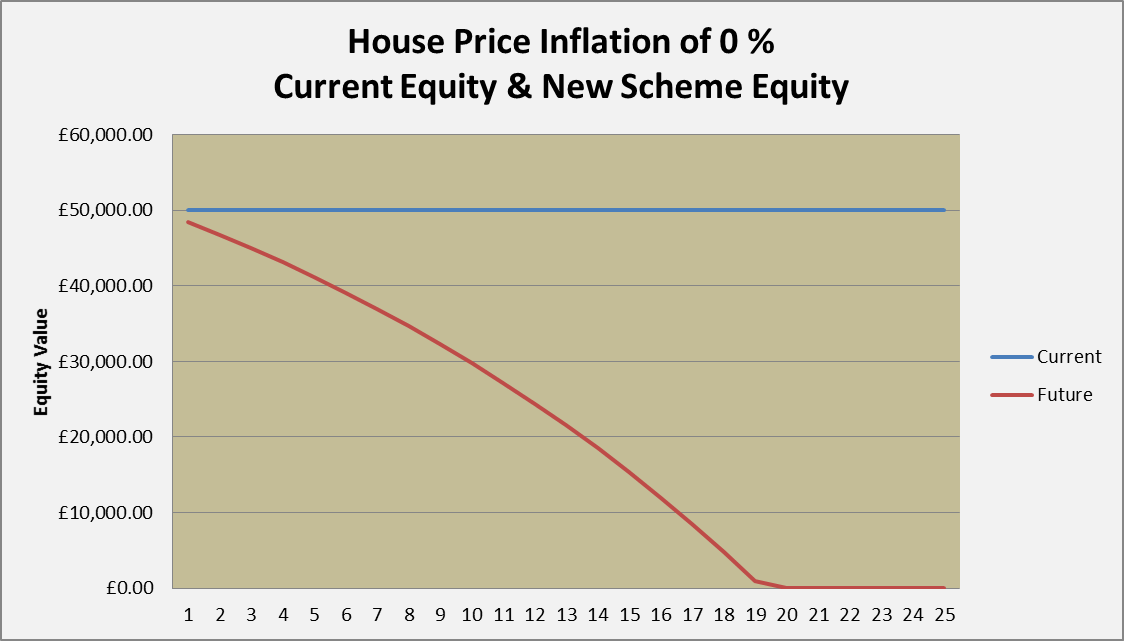

Figure 2 shows the situation under the new proposals.

The loan, together with the interest and administrative charges, will use up all equity in the property after about 20 years.

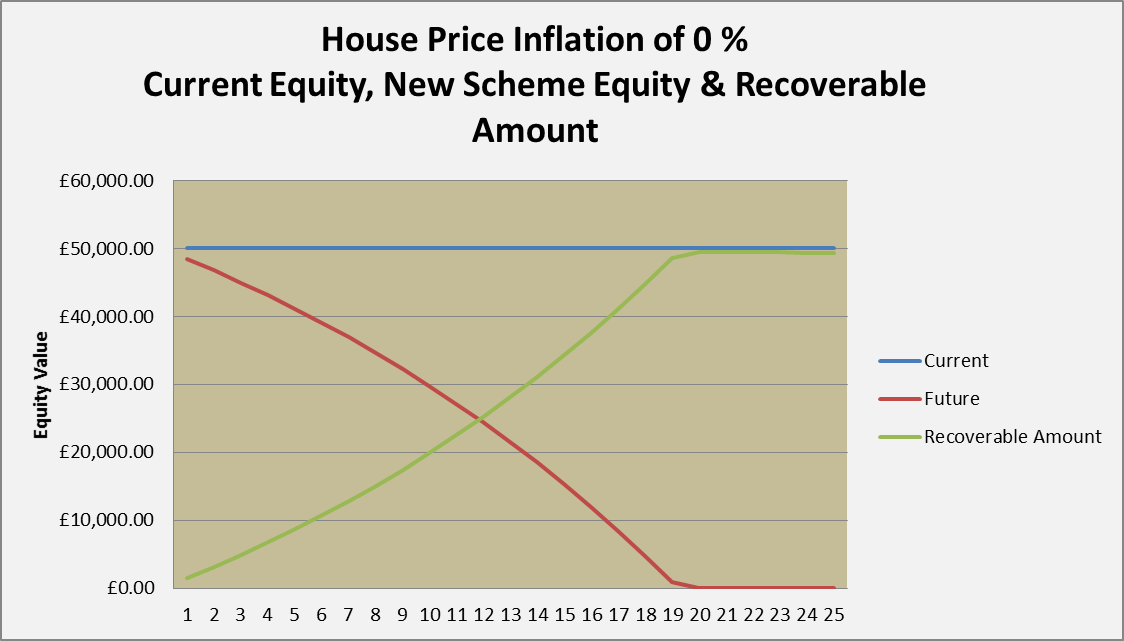

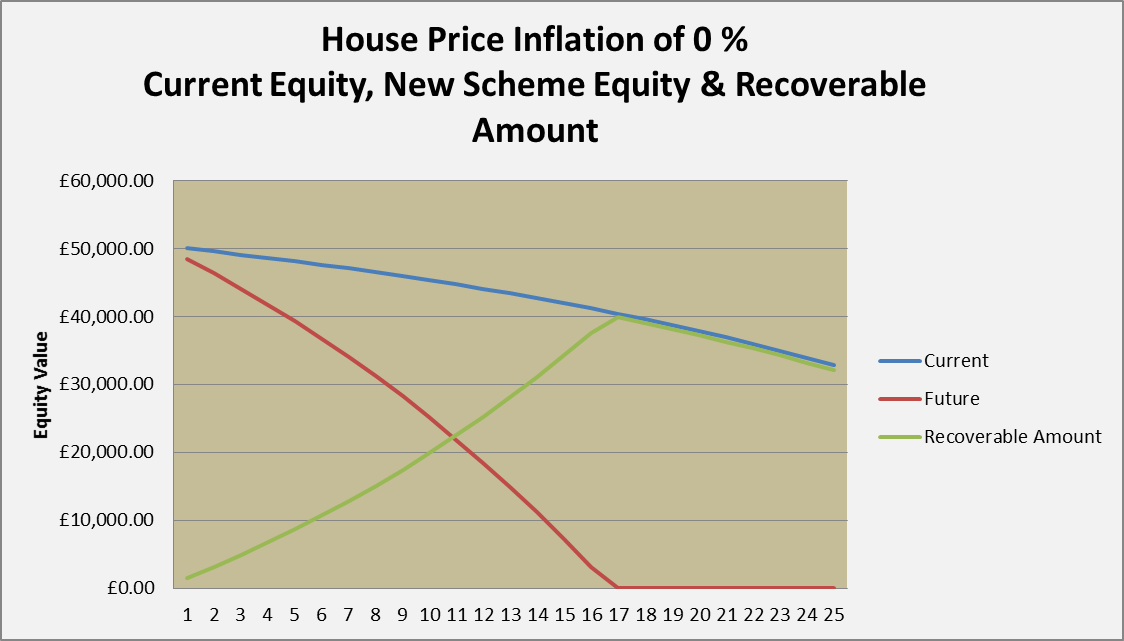

The repayment due is shown in figure 3.

The joy of compound interest is shown by the fact that after 10 years and amount of just less than £20,000 would be due while after 20 years the whole £50,000 will be due.

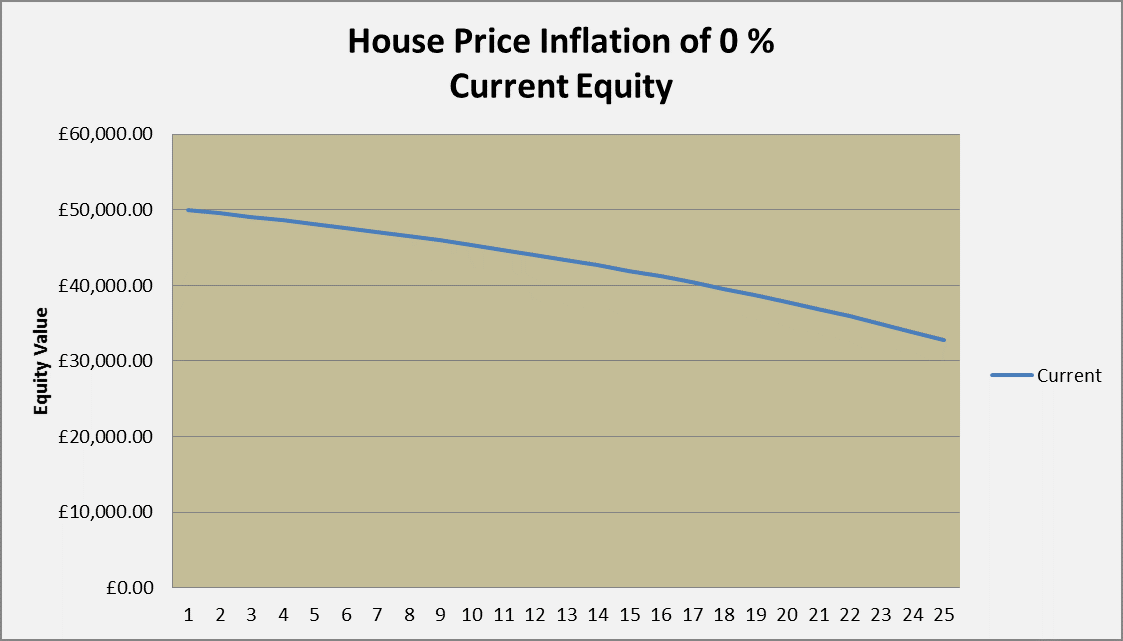

Where the actual mortgage interest due is greater than the SMI rate, the normal approach under the current scheme is to add the shortfall to the mortgage amount owed. Figure 4 shows the effect that this has, with a real interest rate of 4%.

The real equity is reducing slowly; by year 20 it has fallen to £37,824.

Under the new scheme, shown in figure 5, things are different.

All equity has gone by 17 years but, presumably, the continuing interest shortfall will move the borrower further into negative equity.

Figure 6 shows that the amount repayable peaks and then reduces after 17 years as the first charge amount owed on the mortgage increases. There is no net gain for the borrower from this as there is no equity for them remaining in the property.

If there is house price inflation, which seems to be the assumption behind the justification for this policy, then the situation becomes more complex.

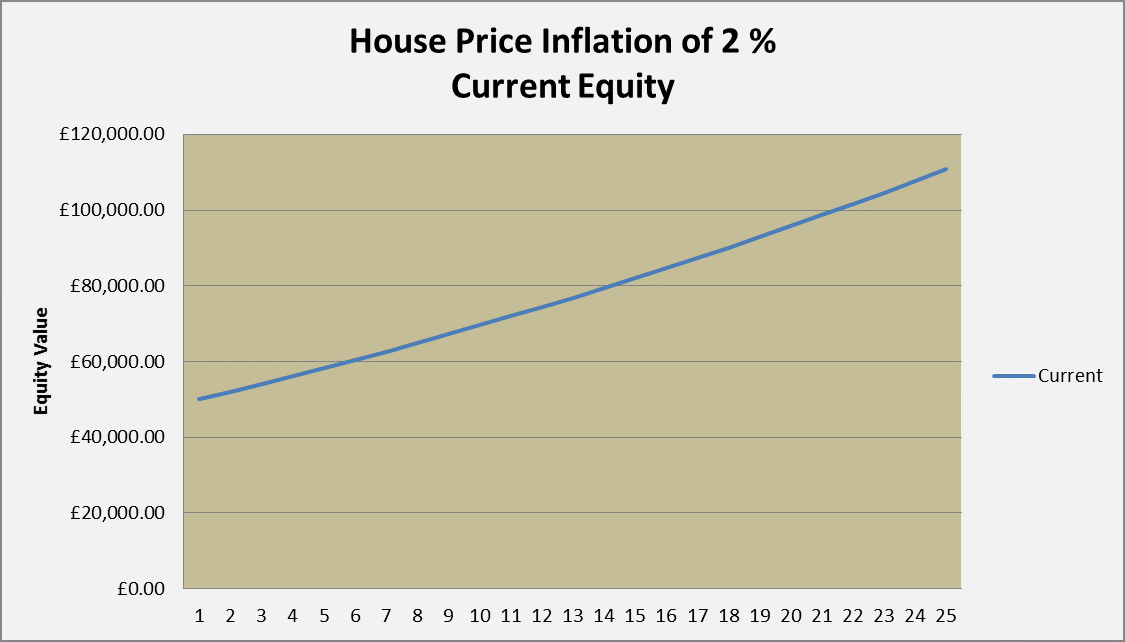

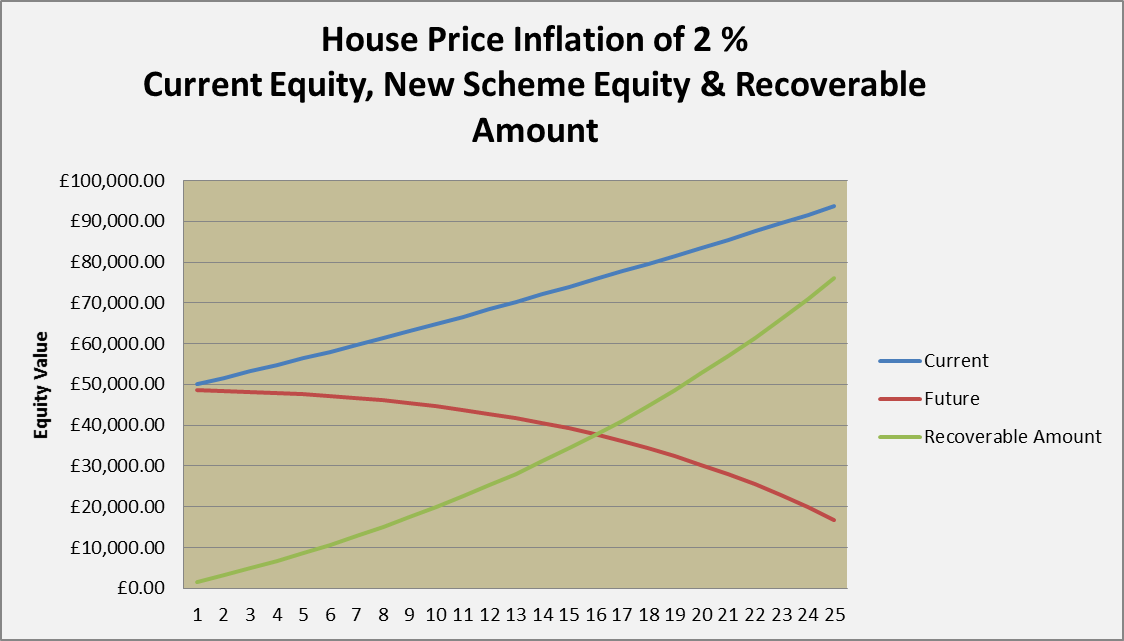

Assuming 2% HPI and a mortgage rate which matches SMI then the situation under the current support scheme is shown in figure 7.

The interest on the mortgage has been met by SMI, but the increase in the value of the house all accrues to the claimant. The original £50,000 equity reaches £110,843 in the 25th year. The capital outstanding remains at £50,000 and, in this example, there has been no shortfall in mortgage interest.

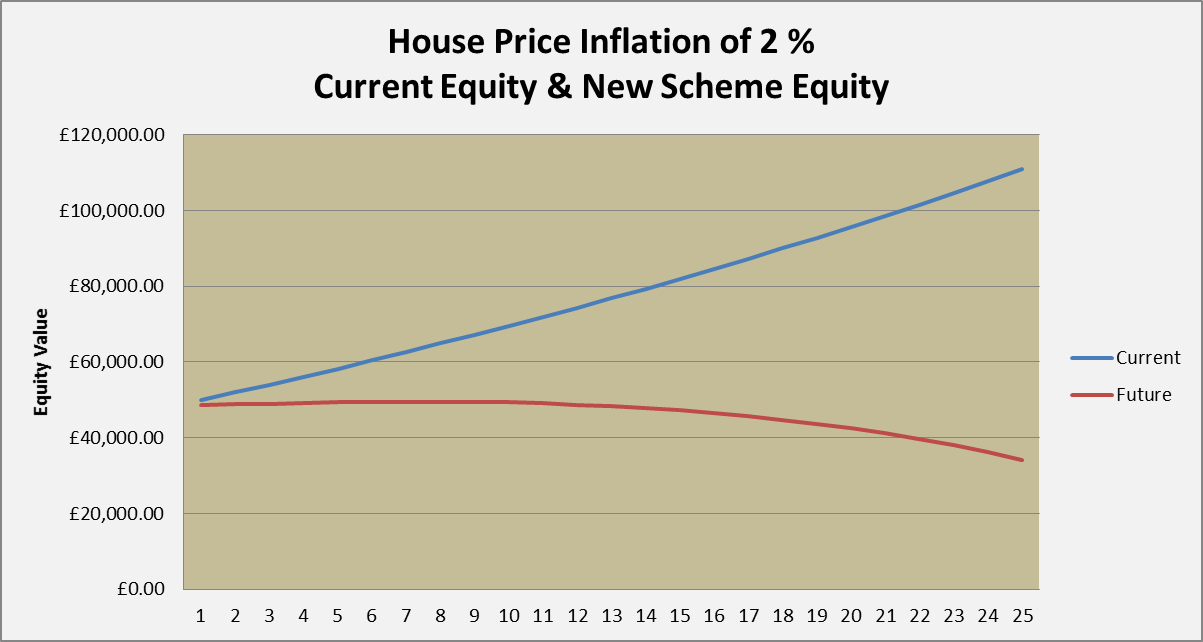

Applying the rules of the new scheme, as shown in figure 8, changes the situation dramatically.

In this example, the increase in the value of the house is not reflected in the equity possessed by the claimant. Their equity falls as in previous examples, although much more slowly.

The repayment of the loan makes most use of the increasing running of the home is shown in figure 9.

The OBR, in their July 2014 working paper No.6 – Forecasting house prices forecast that “assuming consumer price inflation in line with the Bank of England’s 2 per cent target implies 5.3 per cent a year nominal house price growth in steady state”.

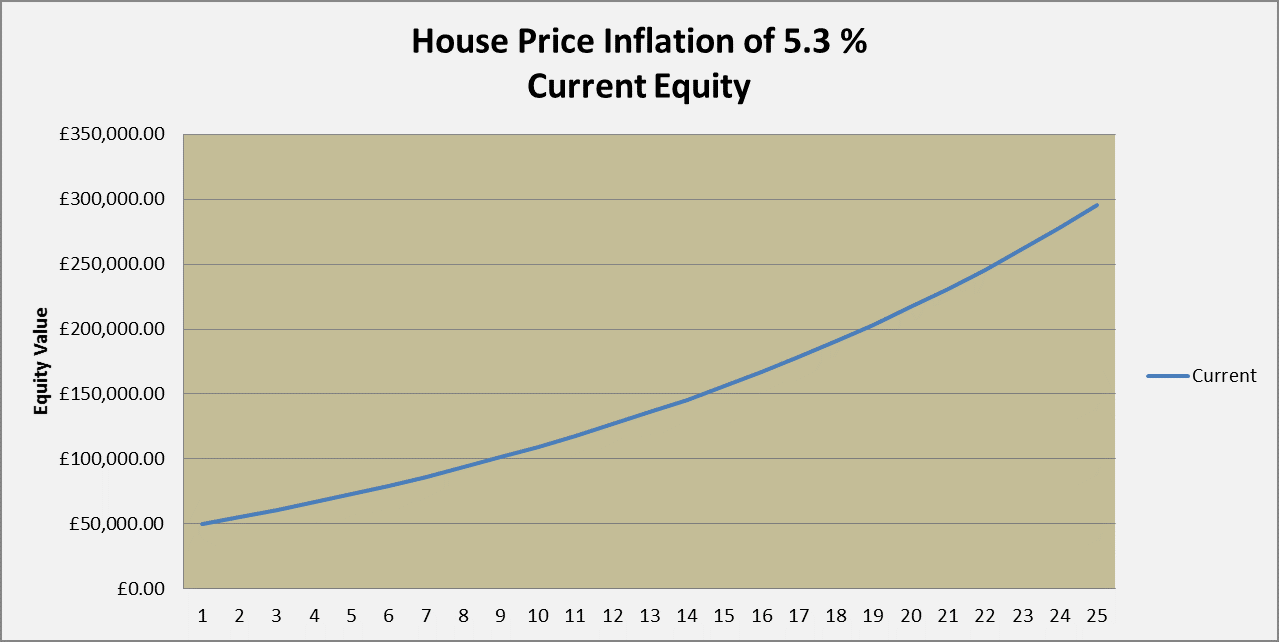

That house price growth produces a substantial change in house values, and thus equity after the fixed mortgage amount is deducted.

Continuing the current SMI support scheme with this level of HPI and a mortgage rate at the same level as SMI would produce the result shown in figure 10. There is a substantial increase in equity for the claimant, even after the effects of inflation at the OBR assumed rate of 2%.

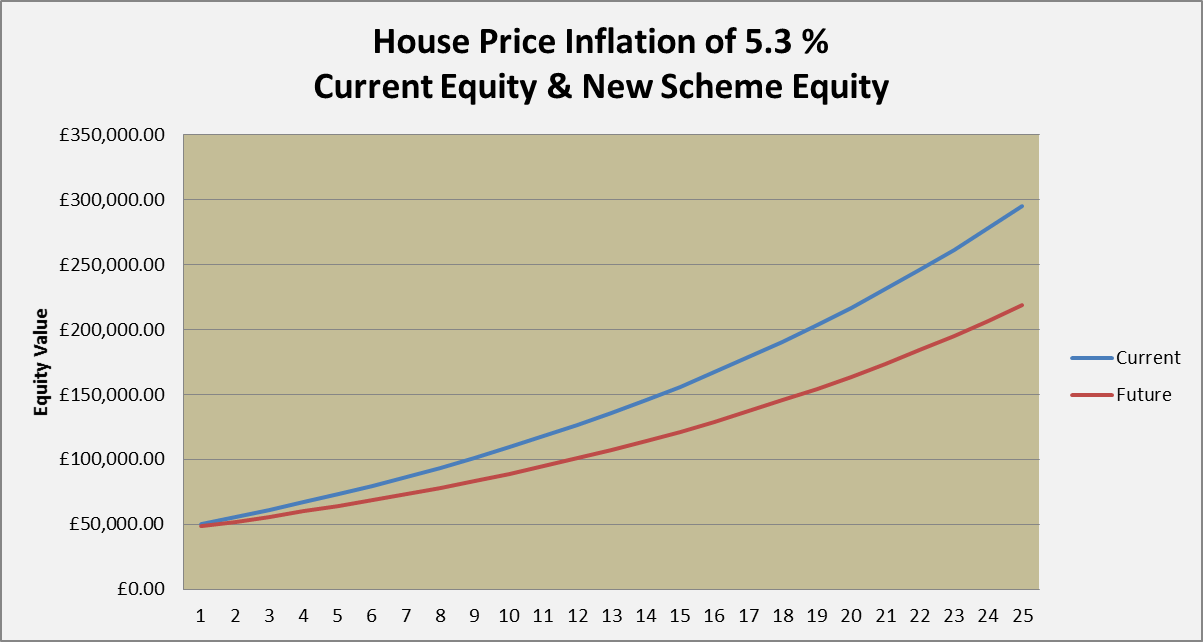

Figure 11 shows the effect of the new loan proposals. With this level of house price inflation, a substantial amount of equity would remain even after repayment of the loan and other charges.

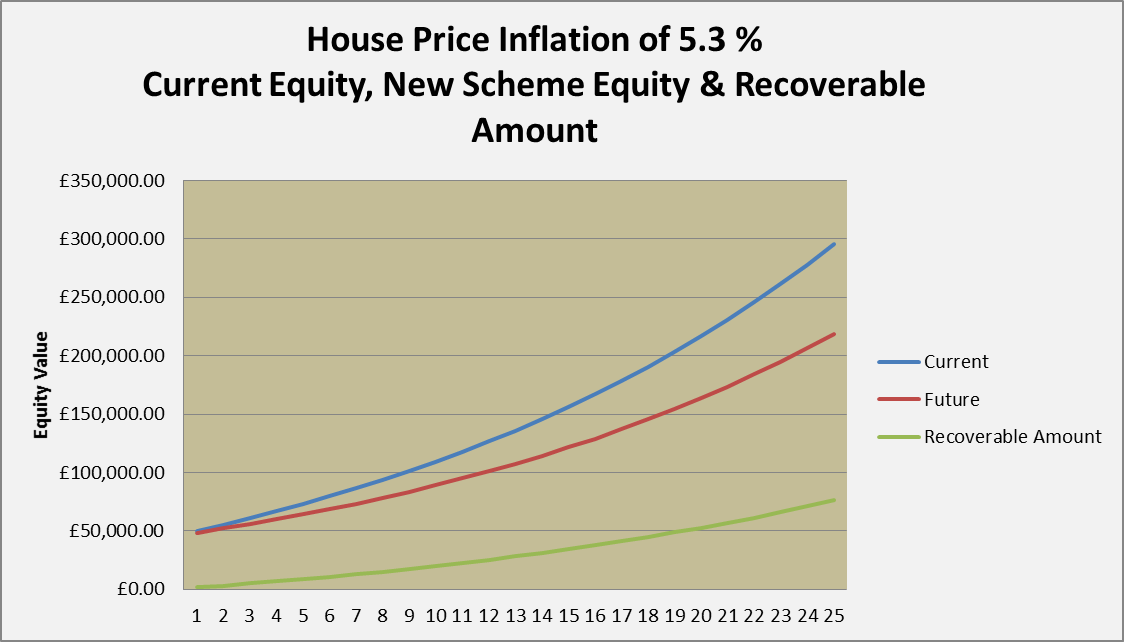

Figure 12 shows the substantial payment, which would be recovered in these circumstances, is almost dwarfed by the increase in house prices.

House price inflation at this level would clearly make the changes much more acceptable.

Conclusions?

Although these are only a small number of very simple examples, some conclusions seem reasonable to draw from them.

The acceptability of the scheme, to claimants and to others who may benefit from the remaining equity after loans and charges are repaid, appears to depend upon substantial and continuing increases in house prices. There is no certainty, as has been seen over the recent period, that this will occur.

If it does not, and HPI is lower than the OBR forecasts, then what?

The reduction in equity, in particular for those likely to remain dependent on benefits for a lengthy period, will be substantial. This will affect both individuals and others in many ways.

Local authorities see their long-term care costs substantially contributed to, by the remaining equity in their homes, of those entering residential care. That contribution may be reduced by this proposal, with consequent effects on local authority budgets.

Individuals, who have seen the equity in their homes as contributing to their retirement funds, care needs or as an inheritance for their heirs, may have to alter their plans.

A homeowner with a mortgage who becomes unemployed in their late 50s may see little opportunity for employment but expect over 20 years more of life. If the example shown in figure 2 is to be expected, any equity in the home would have been lost by this time.

An Equity Release scheme could allow them to make early use of the equity and, if gradually applied, need not affect the net amount of their benefit income. Releasing funds early, in this way, may benefit the financial services industry and reduce government costs in the short term. The additional needs of older claimants and those in need of care may, however, outweigh these effects.

The impact assessment for this measure has not examined this area carefully, but it would be very interesting to see the internal policy briefings which have, presumably, been produced.

Comments

I think it’s usually only older folks on pensions and Income Support that manage to stay in their own home for long periods on SMI – do the planned rules depend on age?

No, the new rules will apply to working age benefits and to Pension Credit. You’re right that most SMI is paid to people over pension age.

For people on working age benefits, Universal Credit in particular, there may well be a real disincentive to work in the proposals. Not only is there no help with mortgages if there are any earnings at all but there will be a, presumably, larger repayment due on return to work the longer support has een received.

At some point that may outweigh any real gains and people will be better off staying out of work.

Until we see the details, we won’t know.

Hi Gareth

With a lower benefit cap this Autumn how does UC work with claimants receiving help with mortgage interest? Is the full amount still paid direct to the mortgage lender, leaving the household with potentially very little for living costs, or is it paid net of any benefit cap deduction (and therefore placing the mortgage shortfall back on the claimant’s shoulders)? Have searched for the answer on this but no luck so far……..

I don’t know, although most people hit by the cap will be tenants with high rents. The highest amount of mortgage interest payable is £120 a week.