Shared ownership and Universal Credit – Problems ahead

by Gareth Morgan on September 27, 2013

(including ‘teaching me not to make assumptions – a lesson in fallibility’)

“Shared ownership is an antidote to many of the problems in today’s housing market.

It is a long-standing, affordable and sustainable option – and an ideal way of helping

people realise their home ownership dreams.

People can buy an initial share of between 25% and 75% in their home, using a deposit

and mortgage, then pay a reduced rent to a housing association on the remainder.

It is primarily aimed at first-time buyers, who can afford to sustain home ownership

but are unable to afford a suitable home on the open market. It has successfully helped

almost 200,000 households into home ownership.”

“Shared owners are typically aspirational, working households on

low-to-middle incomes, who are unable to buy a suitable home on the open market

without assistance”, Shared ownership – meeting aspiration, National Housing Federation, 2013

Shared ownership is recognised, and encouraged, as a route to home-ownership especially for younger, lower-earning families.

The important point is, that it is exactly that – a route to ownership. Even though there is a capital sum paid by the occupant, usually by way of a mortgage, they aren’t acquiring any interest in the home at that point. They’re getting an assured tenancy with a lower rent because of the money they’ve paid up-front. Until they ‘staircase’ themselves to full ownership, by paying the rest of the value in, they remain tenants.

Even worse, if they fail to pay their rent the landlord can take possession of the house and there’s normally no legal right to get the capital paid back (see the case of Richardson v Midland Heart Limited 2007).

Fortunately that’s rare

The repossession rate for shared owners in 2008/09 was 0.38%, compared to repossession rates in 2009 of 0.46% for Buy-to-Let owners and 0.42% for all home owners (1)

but it will happen if occupants don’t pay their rent or mortgage.

Over 44% of shared ownership buyers in 2008/09 had incomes below £25,000 and nearly a quarter had incomes below £20,000. Only 13% had an income of £40,000 or more (1)

As would be expected, many shared-owners get support towards their housing costs from the benefits system. In the current system help with the rental element of their payments comes from Housing Benefit (HB) and those working less than 16 hours a week, or not working at all, can get help from Job Seekers Allowance (JSA) or other means-tested benefits with their mortgage interest element as well. This means that those on low-pay, in part-time work in particular, are, to an extent, protected from the risk of repossession.

This will not be the case for many with Universal Credit (UC).

While the rental part of payments will be supported by UC the situation is very different for mortgage help. UC will not help people with mortgages at all if they have *any* earnings. This can be offset by the way in which the amount of earnings disregarded for UC is worked out.

For most families with mortgages the amount of their net earnings that will be disregarded, not used in the UC assessment, will be substantially higher than the amount disregarded by those paying rent. A single parent paying rent will have £60.69 of their earnings ignored for the UC assessment while one with a mortgage will have £169.34 a week disregarded. For a single parent, earning enough to make use of all the extra £108.65 disregard, that means that their UC will be £70.62 a week higher than their rent paying equivalent, ignoring housing costs.

In comparison to the current schemes’ mortgage interest support, people with no or low mortgages and higher earnings may gain from the change. Those with lower earnings, who can’t make use of the full, higher, disregard or with larger mortgages, may be worse off.

Shared owners get the worst of the change.

They will not get any help with their mortgage interest.

They will not get the higher earnings disregard.

The higher earnings disregard is given to those who have no housing costs in their UC assessment, people with earnings with only mortgages will have no housing costs, as they can get no help, but that’s not true for shared owners. Because they have a rent to pay, low though it sometimes is, they have housing costs and so will only get the lowest amount of their earnings ignored.

What will this actually mean?

How much rent is paid? The amount of rent that a shared-owner pays depends on the value of the property and the share that you buy. As a rough guide, for each £1000 of property you rent, the charge would be about £1 per week. So, for example, if you bought the property at £120,000 on a 50% share, the amount you would rent would be 50% at a value of £60,000. The rent would therefore be around £60 per week., Paradigm Housing

A £60,000 mortgage qualifies for Support with Mortgage Interest (SMI) in both the current benefits system and UC at 3.63% or £41.88 a week.

That’s £41.88 a week that won’t go into the UC assessment if there are any earnings but does go into the JSA calculation.

(This is where it gets embarrassing) Given that, and without doing any sums I assumed that shared-owners would find themselves hit badly by the change to SMI and the UC disregard rules; and I’ve been saying that publicly too. In writing this piece I thought I’d better produce some hard figures so I fired up the Future Benefits Model (FFBM), plugged in some figures and pulled the lever …. and found out I was wrong.

… or at least partially wrong.

They will be worse off, in terms of disposable income than people in the same circumstances, paying the same mortgage but not paying rent would be (after allowing for the rental support). A single parent earning £10,000 a year with a mortgage of £60,000 would get £124.20 a week Universal Credit. Add £1 a week rent to that and the UC falls to £54.58.

The same single parent with no mortgage but paying £60 a week rent gets £113.58 UC. Our shared owner, adding £41.88 a week mortgage interest to their outgoings will get £113.58 in UC.

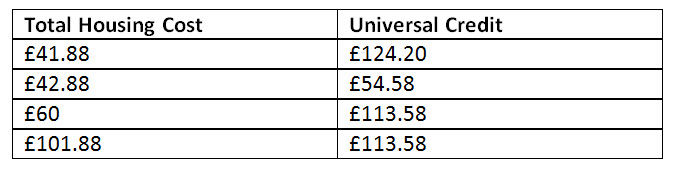

Let’s put that into a table, so that we can show how simple it is. I’ve arranged it in increasing amounts of housing cost.

This is a splendid example of the simplicity of the new benefits system and a demonstration of the way in which people will be able to work out their own entitlement without the need for any troublesome benefits advisors.

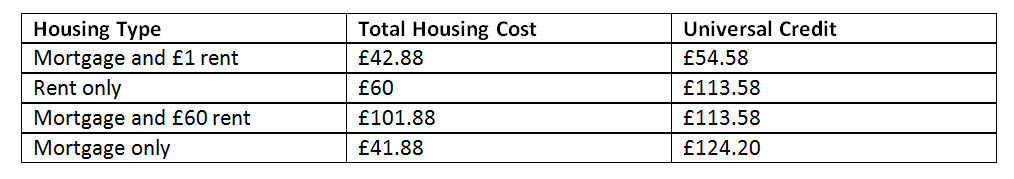

I’ll rearrange the table by increasing levels of Universal Credit and note the housing type.

The winner here is the mortgage only claimant because the value of the extra disregarded income is greater than the mortgage interest they pay. If their mortgage interest had been more than £70.62 they would start to lose out and if their net earnings fell below £169.34 (£8,805 per annum) they would lose some of the benefit of the higher disregard.

In this example, the shared owner loses out by comparison with both the renter and the owner. The figures for other cases will vary greatly because of the combination of factors including, rent, mortgage, earnings and family composition. It is, however, a fair example and demonstrates the broad situation for shared-owners.

The very real practical issue here is how do we assess affordability for shared ownership in future? Remember that the comparison with current schemes has focussed on part-time workers but the earnings disregard complexities will also apply to those working full-time on Universal Credit.

Shared ownership will still be affordable for those getting help from the benefits system

*BUT*

- Current owners will face a very real problem if they staircase down because of the earnings disregard changes.

- landlords and potential shared-owners will need to understand the mortgage interest issue.

- There are interesting detailed points that need to be considered , see the later mention of non-dependants for example.

Back to embarrassment, so where did I go wrong with my Cassandra impression?

I assumed that shared-owners would be worse off than under the current system.

This group of shared owners, the part-time workers who lose mortgage interest support they currently get, won’t be, in the main.

The reason for this, to be fair to Universal Credit, is that part-time workers are also the group who gain most generally from the new system. They don’t have any current entitlement to Working Tax Credit and they have much lower earnings disregards in current means tested benefits than even the lower of the UC disregards.

Try as hard as I could, and I did, I couldn’t generate in the generality of cases any substantial drop in entitlement under UC and a good number of examples would have gained a reasonable amount of overall income were it not for the way in which Universal Credit and Council Tax Support interact (that’s another issue for a future blog – it’s a whopper).

I’m reminded strongly of a phrase once used by a very senior DHSS official (that dates me) when I gave an example of a poverty trap situation to her; “Gareth, they’re not worse off they’re just not as better-off”. It actually fits this case better.

So as my old partner in Ferret, Philip Boyd now a tribunal judge, used to say ‘Mea Culpa, mea maxima culpa’ for any misleading impression I’ve given about the future situation of shared-ownership under Universal Credit.

There are actually some other issues for shared-owners that I’d better bring in here for completeness.

They win a little because there will be no bedroom tax applied to their rental element, regardless of the number of bedrooms they’re using.

Non-dependants though may create some complexity and, perhaps more impact. Under UC the Housing Cost Contribution (HCC) is going to be a flat sum of about £15.70 a week for each non-dependant. There are not going to be any HCCs applied to mortgage support payments. The impact of a HCC may be bigger for shared owners because their rent will be proportionally smaller.

To finish off with another demonstration of how simple the new system is going to be (and to subtly get in an advert for Ferret’s benefit calculators) the HCCs will introduce an interesting better-off calculation.

If the rental element of a shared-owner is low enough that one non-dependant’s HCC, or two HCCs for a couple, would add up to more than the rent, then there would be no housing costs in the Universal Credit amount. That would mean that the earnings disregard would increase to the higher level. Depending on the level of earnings, rental amount, family type etc. that may easily increase UC by more than the HCC applied. What are the penalties for inventing a non-dependant so that the DWP can make a deduction?

(1) SHARED OWNERSHIP Facts & Figures, Produced by the Promoting Shared Ownership group of 21 housing associations, September 2010

Comments

Gareth, I don’t think you should have given all those quotes about the benefits of shared ownership without comment.

There are strong arguments that shared ownership is a con. You can pay a high rent on the share that you do not own and yet you get no repairs or any of the other things tenants expect to get. Instead you get high service charges (and any better off calculation has to take account of these- for example it is common for there to be a service charge for management, but this will not be eligible under UC). It is also not clear how the market in shares of houses will develop, particularly in times of downturn of the market. There has be what Tony Newton used to call “substantial anecdotal evidence” that landlords can make life difficult for people who want to sell their shares and that they may insist on vetting potential buyers. I’ve run across one organisation running shared ownership extra care for older people (quite common) who insisted on buying back the share at the price that was paid for it!)

Brain dead again! sorry for calling you Gavin. I really shouldn’t post things on a Saturday night!

Er, Chris, you didn’t call me Gavin.

I think its time I retired

For the sake of accuracy, shared owners do own their properties in the same way as most other property purchasers. They own the share which they purchase and have an assured tenancy for the part not purchased. The share they own is a disposable asset. They are not simply assured tenants.

If shared owners do encounter payment difficulties then unless the rules have changed then they can access help with their rent through the benefit system and standard help with the interest on their mortgages. Arguably therefore they are somewhat better protected than traditional purchasers who can only access help with mortgage interest.

Stephen

I’m afraid that is not so. Shared owners only have an assured tenancy until they own the full 100% share. If they fall into arrears on the rent component, they can have a possession order made against them and be evicted under the Housing Act 1988 grounds and do not have an entitlement to the return of their ‘purchase’ money, let alone any increased equity in the property. This is the lesson of Richardson v Midland Heart. See my post on the case here:

http://nearlylegal.co.uk/blog/2008/09/shared-ownership-midland-heart-with-benefit-of-transcript/

The repossession rates are probably seriously understated too. If there is a mortgage (as there usually is) the mortgagees will pay any arrears when pressed in order to avoid losing their security if the landlord repossesses. And once the arrears to the mortgagee build up as a result they repossess against the tenant under their mortgage, and recover their expenditure. These cases are almost certainly not included in the figures given above.

There is more on my website about this (and other factors) in my recent piece at http://wp.me/p1yFJl-bt

What about those that are fortunate enough to own their own home – no rent/mortgage ? Will they receive nothing in terms of Universal Credit ? thanks in advance.

No housing expenditure means no help from Universal Credit.

Hi,

Can anyone give advice on this?

We currently live in my father in laws house. We don’t claim housing benefits as we only pay 500/month. We are buying the house through shared ownership , but we are buying 10% only and using £20,000 savings that we’ve had for a few years.

We currently receive child tax credits and child benefit for our two year old.

If we buy the house the rent will start at £768, so probably unaffordable unless we got more benefits. If we buy the house my father in law is giving us £10000.

I want to know we could get universal credit? Our savings would be £10000, which is under the £16000 mark. Would they count the £20000 as savings after we’ve brought the 10% share. Would that £20000 be classed as income ? Even though we’ve had it in back for 2 years??

Did a entitledto calculator and it said £137 a week universal credit for us.

Without it we’d really struggle so need advice!!

The £20,000 shouldn’t be counted. If you keep the £10,000 yourselves then the effect would be a notional income of £16 a week.

ok thanks, but would the gift of 10k be classed as income for this year? meaning our income would be $35000. Would that lower the benefits by much?

not sure how it all works and I want to make sure were not making a mistake.

Hi Gareth, do you think spending the 20k on the deposit would be classed as’Deprivation of Capital’?

Hi Gareth, do you think spending the 20k on the deposit would be classed as’Deprivation of Capital’?

Hi I currently claim universal credit, I wish buy a house on shared ownership basis, but have no clue what implications will it have on my current paid amt, one of the major component of my payment is housing rent, I tried calling UC helpline but the agent give me different answers, my question is that shared ownership has 3 elements 1) rent 2)Mortgage 3) Service charge. I do understand from above article that I will get rebate on interest charge on mortgage and on service charge but what about the rent element will I get paid the rent, there are 3 components of my payments in universal credit 1- personal allowance for me and my wife 2- housing 3- child tax credit

If I go for shared ownership will I still get the full amount on personal allowance and child tax credit..I am confused. It seems I will not even get 30% of what I am getting under UC if I go for shared ownership….could I get any contact no to discuss this over phone as I can share my exact details and seek your valuable advice…pls help!

Things have changed a lot since the original posting. In particular, from next month any help with mortgages is becoming a loan; to be repaid with interest.

There are also complex rules about access to loans for properties purchased when already receiving benefits.

I’m afraid that I can’t give advice but you do need to get some. Try a local advice service or Shelter’s housing advice telephone service.