Universal Credit and patterns of earning

by Gareth Morgan on October 12, 2018

Universal Credit is a simpler benefit than the complicated six benefits that it replaces; says the government. It is understood more easily because it matches the way in which most people in work get paid – monthly. Of course not everyone who is actually in work does get paid monthly, so those people who are paid weekly, or fortnightly, or four weekly, get Universal Credit paid on a different schedule to their actual earnings.

Universal Credit will be paid monthly, 12 times a year, and normally on the same day of the month. Notice the word “normally”; more on that later.

If you’re paid weekly then you would expect to have 52 paydays in the year; sometimes there will be 53 depending upon which day of the week you are paid and how many of those there are in the year.

Spread evenly, that would mean 4⅓ paydays per period for a 52 payday year and, if spread evenly, 4⅓ weeks’ pay in each period.

Universal Credit doesn’t believe in averaging, unlike most of the previous, slowly phasing out, ‘legacy’ benefits; instead it only counts income received during the ‘Assessment Period’ – the month (normally) ending seven days before Universal Credit makes its payment.

The consequence of that is that, in some assessment periods, people paid every week will have five paydays taken into account when assessing their entitlement to Universal Credit.

The DWP do make this clear on their website, if you dig a little.

If you’re paid weekly

If you’re paid weekly by your employer, you will get either 4 or 5 payments of earnings within a Universal Credit assessment period. Depending on the amount you get paid this may affect your Universal Credit.

When you have 5 weekly earnings payments within an assessment period, your income may be too high to qualify for Universal Credit in that month.

If this happens you will be notified that your income is too high and you will no longer get Universal Credit.

You can re-apply the following month as you should only get 4 wage payments in your assessment period then.

You will need to be prepared for a month when you get 5 wage payments in one assessment period and budget for a potential change in your monthly Universal Credit payments.

There’s even a pretty graphic to make it clearer.

They explain what happens if you’re paid fortnightly,

If you’re paid every 2 weeks

If you’re paid every 2 weeks by your employer, at certain points throughout the year you will get 3 payments of earnings within a Universal Credit assessment period

or 4 weekly

If you’re paid every 4 weeks

If you’re paid every 4 weeks by your employer, you will get one payment of earnings for each Universal Credit assessment period for most of the year. You will usually get 2 payments of earnings within a Universal Credit assessment period once a year.

Even if you’re paid the same amount of money on every payday, you will find that you get different amounts of Universal Credit sometimes, if you’re being paid weekly, fortnightly or 4 weekly.

Worse; you may very well find that you’re not getting any Universal Credit at all. To be fair, the DWP point this out again,

Depending on the amount you get paid this may affect your Universal Credit.

When you have 5 weekly earnings payments [or 3 fortnightly, or 2 4-weekly] within an assessment period, your income may be too high to qualify for Universal Credit in that month.

If this happens you will be notified that your income is too high and you will no longer get Universal Credit.

You can re-apply the following month as you should only get 4 [or 2 fortnightly, or 1 4-weekly] wage payments in your assessment period then.

So, not only may you find yourself without any benefit in that month but you have to reapply for Universal Credit in the following month. As long as you haven’t left it more than six months before re-claiming, you won’t have to go through the full Universal Credit claim process again,

You will need to claim Universal Credit online again. When you log in, the claim will show your circumstances on the date you last got Universal Credit.

You just need to confirm that the details in your account are correct to claim again.

and, you will continue to keep the same monthly assessment period as you had in the previous claim. If you are in the older ‘live service’ type of Universal Credit and don’t have an online account then the re-claim should happen automatically.

How likely is it that your Universal Credit will stop in one of these months, rather than just being reduced? It depends upon your earnings and the amount of Universal Credit that you receive, but the answer is quite likely, and more so if you’re paid two weekly or four weekly.

If you’re paid weekly, then you will find yourself with an extra week’s earnings, or 25% more, used in the Universal Credit calculation. If your Universal Credit is less than one week’s net earnings then it’s likely that it will be stopped.

If you’re paid fortnightly, then you will find yourself with an extra fortnight’s pay, or 50% more, used in the assessment. If your Universal Credit is less than a fortnight’s net earnings, then it’s likely that it will be stopped.

If you’re paid 4-weekly, then you will find yourself with an extra four weeks’ pay, or 100% more, used in the calculation. If you Universal Credit is less than your four weeks net pay, then it is likely that it will be stopped.

But wait – this is Universal Credit, it can’t be that simple.

It’s not, for many people. People with children or who are disabled. If you’re in one of those groups then some of the money you earn each month isn’t taken into account when calculating your Universal Credit in that month. It’s called a Work Allowance and it’s the equivalent of what are the Earnings Disregards in legacy benefits. Although the value of it, and who can get it, has been cut severely, it’s still worth having.

It’s applied at two rates; one for people who get help with their housing costs within Universal Credit and a higher allowance for those who don’t. The first group get a monthly work allowance of £198 and those without housing costs get an allowance of £409, at 2018/2019 rates. Because this is earnings that would otherwise have the Universal Credit 63% taper applied to it, the real value of the allowance is different. The actual values, after the taper is taken into account, are £124.74 and £257.67. People in these groups get this amount extra, every month, compared to someone earning the same amount but without children or disabilities.

Every month.

If you have one payday in the Universal Credit payment period then you get one work allowance applied. If you have five paydays in the Universal Credit payment period then you get one work allowance applied.

Those with an extra payday in the month, whether that’s weekly, fortnightly or four weekly, won’t get an extra work allowance. All of the extra net pay will be taken into account, increasing the amount by which Universal Credit is reduced and making it more likely to stop entirely.

The pattern of these extra payment periods depends upon the date of claim and the date of payment. This table shows the 2 year pattern of paydays, in a calendar month period of Universal Credit, for paydays on Fridays over the 2 years following the date of writing. This is produced by Ferret’s Pay Period Reckoner (there’s a link to it later on).

Pay Table |

Universal Credit Period | Pay days weekly | Fortnightly | 4 weekly | Monthly |

| From | To | ||||

| 02/09/2018 | 01/10/2018 | 4 | 2 | 1 | 1 |

| 02/10/2018 | 01/11/2018 | 4 | 2 | 1 | 1 |

| 02/11/2018 | 01/12/2018 | 5 | 2 | 1 | 1 |

| 02/12/2018 | 01/01/2019 | 4 | 2 | 1 | 1 |

| 02/01/2019 | 01/02/2019 | 5 | 3 | 2 | 1 |

| 02/02/2019 | 01/03/2019 | 4 | 2 | 1 | 1 |

| 02/03/2019 | 01/04/2019 | 4 | 2 | 1 | 1 |

| 02/04/2019 | 01/05/2019 | 4 | 2 | 1 | 1 |

| 02/05/2019 | 01/06/2019 | 5 | 2 | 1 | 1 |

| 02/06/2019 | 01/07/2019 | 4 | 2 | 1 | 1 |

| 02/07/2019 | 01/08/2019 | 4 | 2 | 1 | 1 |

| 02/08/2019 | 01/09/2019 | 5 | 3 | 1 | 1 |

| 02/09/2019 | 01/10/2019 | 4 | 2 | 1 | 1 |

| 02/10/2019 | 01/11/2019 | 5 | 2 | 1 | 1 |

| 02/11/2019 | 01/12/2019 | 4 | 2 | 1 | 1 |

| 02/12/2019 | 01/01/2020 | 4 | 2 | 1 | 1 |

| 02/01/2020 | 01/02/2020 | 5 | 3 | 2 | 1 |

| 02/02/2020 | 01/03/2020 | 4 | 2 | 1 | 1 |

| 02/03/2020 | 01/04/2020 | 4 | 2 | 1 | 1 |

| 02/04/2020 | 01/05/2020 | 5 | 2 | 1 | 1 |

| 02/05/2020 | 01/06/2020 | 4 | 2 | 1 | 1 |

| 02/06/2020 | 01/07/2020 | 4 | 2 | 1 | 1 |

| 02/07/2020 | 01/08/2020 | 5 | 3 | 1 | 1 |

| 02/08/2020 | 01/09/2020 | 4 | 2 | 1 | 1 |

Still, at least if you are paid monthly, Universal Credit will fit in with your pattern of earnings and there’ll just be one payday taken into account each month.

Unless…. there isn’t.

Remember Universal Credit is simple, and so are the rules.

(2) Each assessment period begins on the same day of each month except as follows–

(a) if the first date of entitlement falls on the 31st day of a month, each assessment period begins on the last day of the month; and

(b) if the first date of entitlement falls on the 29th or 30th day of a month, each assessment period begins on the 29th or 30th day of the month (as above) except in February when it begins on the 27th day or, in a leap year, the 28th

The Universal Credit Regulations 2013 Regulation 21(2)For people paid on a weekly based cycle, this has little overall effect, other than occasionally changing which assessment period has an extra payment date taken into account.

But for one group of people this can have extremely serious results. Those people in the large group who are paid monthly, on the last banking or working day of the month. According to the Chartered Institute of Payroll Professionals[1], “The last working day of the month continues to be the most popular pay day for monthly payrolls at 38.6%”. There are also problems for the 24% paid on the 25th of each month and for the 20.5% paid on the 28th, caused by weekends and, in particular, bank holidays such as Christmas and the New Year, especially if they fall on a weekend and the days following are then the bank holidays. Add to that the effects of the different bank holidays in the different parts of the UK and, it is possible, the results may be unclear to some people.

We should recognise that it is likely that a disproportionately large number of benefit claims are made towards the end of a month, as that is likely to be when people leave jobs, receive final pay or contracts come to an end.

There is also a lack of certainty, amongst some employers, about the dates of payment which should be submitted to HMRC when actual pay is made earlier than the due date because of bank holidays. HMRC’s guidance says “the date you paid them, not the date you run your payroll. Use the normal payday if it falls on a non-banking day”. HMRC are expected to clarify their guidance on this shortly as many employers, it is believed, do not follow this. Good Friday can cause particular problems if it falls at the end of the tax year and a different payment date, in a different tax year, is used.

The most extreme results are seen by those who are paid on the last banking day of the month and whose Universal Credit assessment period starts on the 30th of 31st of the month.

Take the example of a single person, working 35 hours at the National Living Wage of £7.83 an hour and paying £150 a week in rent.

Her net earnings will be £1089.27 and her normal entitlement to Universal Credit will be £281.57 a month. She is paid on the last banking day of the month and she claimed Universal Credit with an assessment period which starts on the 30th of each month.

Looking at her situation from October 2018 forwards, we see, using Ferret’s Pay Period Reckoner, that the variations above apply to her and the effects on her Universal Credit entitlement.

As may be expected, because of the way in which the number of paydays in each month is assessed, there are some months with two paydays and some months with none. In this example, in the months with two paydays there is no entitlement to Universal Credit because of the much higher earnings figure used. In the months where no payday falls within the assessment period, the Universal Credit figure increases very substantially because there is no earned income in the calculation. There is, of course, no work allowance in a month when there is no pay and only one in a month when there are two pay days, adding a further loss.

The work allowance issue does not arise in this example as there is no disability and there are no dependent children or young people. It might be thought therefore that, although there are clear budgeting problems, the situation would broadly even out over the course of a year or even be better for her because of the high rate of Universal Credit in months where she is treated as having no earnings.

Unfortunately, it may not work like that.

After each of the periods when she has no entitlement to Universal Credit, she will have to re-claim the benefit. Not only does that mean having to go through the, admittedly simplified, reclaim process but it brings her into a new set of rules.

The Universal Credit (Surpluses and Self-employed Losses) (Digital Service) Amendment Regulations 2015 (as amended by S.I. 2015/ 1754, S.I. 2016/ 215, S.I. 2017/ 197 & S.I. 2018/ 65. )

These regulations, which came into force in April 2018, provide that pay earned when there is no entitlement to Universal Credit, because the pay is too high, can be taken into account for a later Universal Credit claim, if Universal Credit had been in payment at all during the six months before the new claim. The description for this is:

Where a UC award ends due to excess income, these amendments allow for past earnings (employment, self-employment or a combination of both) to be taken into account on a further claim to UC within 6 months of the previous award. …. These changes ensure that those claimants with fluctuating earnings patterns, which may bring them in and out of entitlement to UC, are not unduly penalised or unfairly rewarded over those claimants who receive the same amount but are paid monthly and retain UC entitlement throughout.

The examples in the DWP guidance document for staff, use large bonus figures to demonstrate the workings of the rules but any earnings are caught by the regulations.

The regulations came into force in April 2018 but with a buffer of £2500 in each period which has meant that they have had no noticeable effect for many people. This buffer is due to fall to £300 in April 2019, although there are powers for the Secretary of State to extend the larger disregard.

- EDIT. This disregard has now been extended by the Autumn 2018 Budget to April 2020

The reduction in the disregarded figure will mean that the rules can apply to many more people.

In particular, they may apply to people whose entitlement to Universal Credit ceases because of extra paydays in a particular Universal Credit period, such as this example.

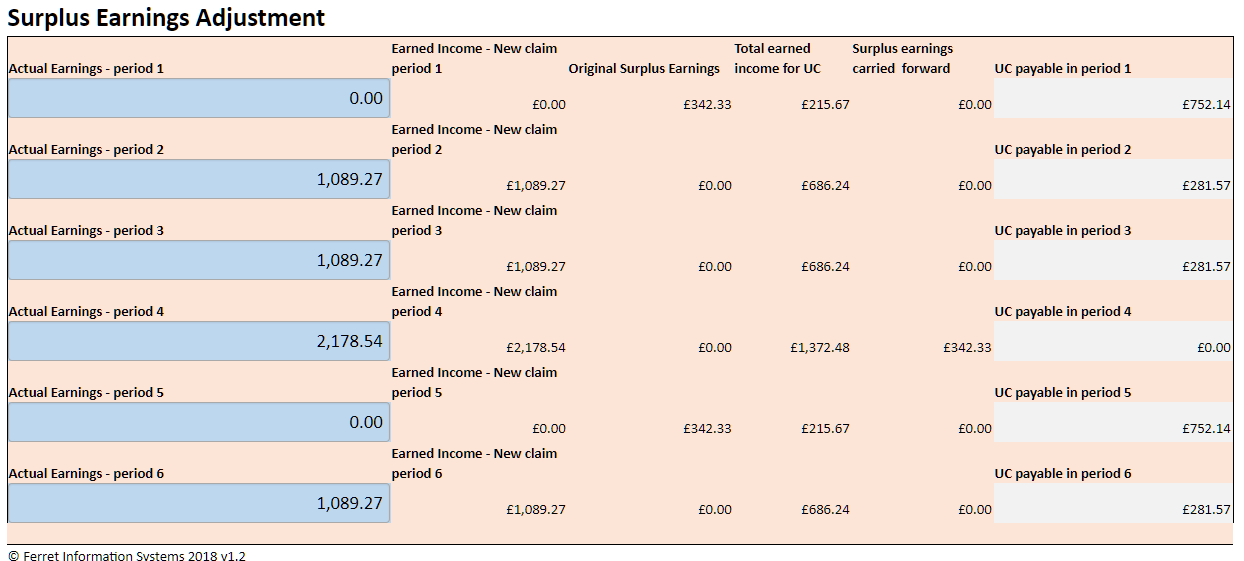

If we use the current figures for earnings and Universal Credit entitlement but apply the £300 buffer figure from April 2019 it is possible to show the effect on this person. The double earnings figure, which stops entitlement to Universal Credit in those months, will be used in a surplus earnings assessment when Universal Credit is claimed again.

The effect of taking into account the higher earnings during the double pay period, against the zero earnings paid in the following Universal Credit assessment period, is to count some of the higher earnings against the new entitlement. The result is shown in the assessment from Ferret’s Surplus Earnings Reckoner below.

The number of assessment periods between the two payday and zero payday months has been reduced in order to show the effect when those occur. The high UC figure in zero pay months is reduced by the excess income in the two payday months, although the buffer may be seen as providing some additional benefit.

Of course it’s not that simple, there are further potential complexities that need to be considered.

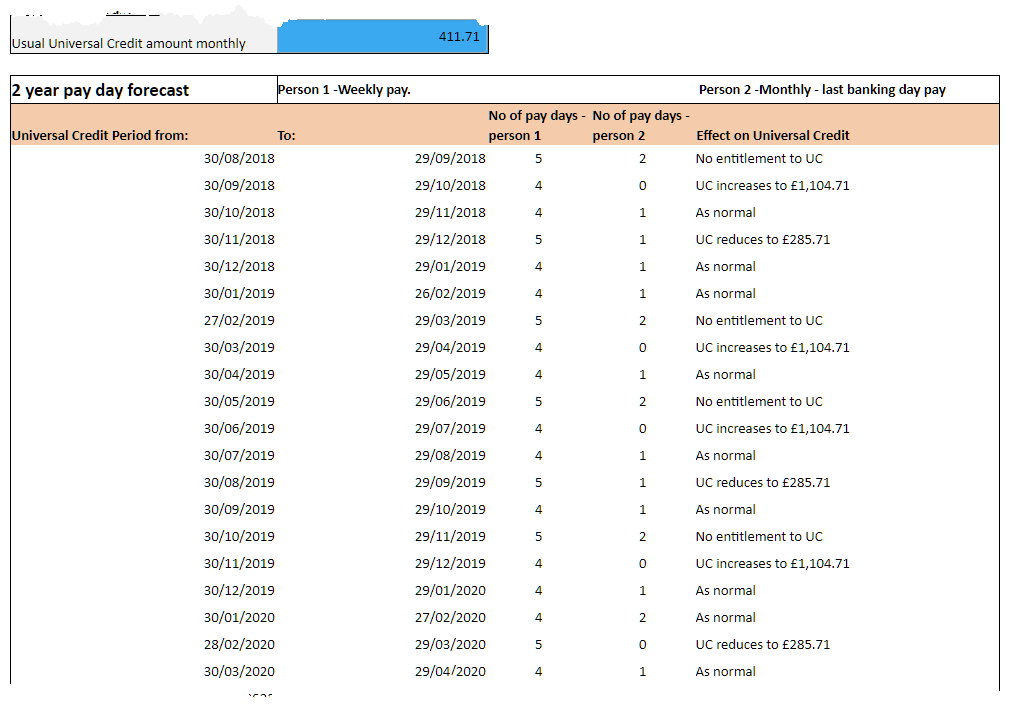

Couples

The situation of couples where both are earning and paid on different days in the month, or on different pay cycles, introduces further complexities. The output from Ferret’s Pay Period Reckoner, below, shows the mix of paydays in Universal Credit periods for a couple where one is weekly paid and the other paid on the last day of the month. It is clear, from the effect that this has, how difficult budgeting will be for this household.

The benefit cap

There are maximum amounts of benefit which can be paid. The government has said that this is to ensure that people who are not working do not receive more than people working on average pay. The cap does not recognise that many people on average pay also receive benefits, because their needs are higher. Although this capping does not apply when people receive pay at more than 16 hours a week at National Living Wage levels, the effect of the pay cycle can mean that people may find their benefit capped in months when they are treated as having low, or no, earnings and consequently higher Universal Credit.

Passporting

Receipt of Universal Credit means that a number of other, particularly health related, services, such as prescriptions, are free. This means that the loss of benefit, because of the notionally higher income in an assessment period, can also lead to the loss of these.

Free school meals

There is an entitlement to free schools where people receiving Universal Credit have less than £7,400 in earnings. Oddly, local authorities have been told to ignore the normal monthly basis for everything Universal Credit and, instead, to average earnings over the previous 3 assessment periods. These again could have varying numbers of paydays in them but potentially out of step with Universal Credit payments.

Pension contributions

If she is contributing to a pension then 100% of those contributions are disregarded in the Universal Credit calculation. This means that the same amount of income is not taken into account in the calculation and the effect of this is that for every £100 a month paid into a pension scheme the Universal Credit entitlement increases by £63. If she pays £100 in a month when she is treated as having no earnings, she won’t get any extra benefit as it is an offset against earnings in the period. If she makes £100 contribution on each payday, for example as an automatic deduction, then she may still gain no benefit if her total earnings in that period stop entitlement to Universal Credit.

Timing of claim?

It is possible all to be a winner, or a loser, based simply upon the date that Universal Credit is claimed. A high earner who claims the benefit on a date which means that there will be no paydays in the assessment period will be able to qualify for universal credit for at least that month; and potentially for any following month with a zero pay day period, although subsequent months may be subject to the surplus earnings rules.

More concerning will be the case of somebody whose claim is made when there are two paydays in that month (or where there are extra paydays in one of the weekly cycles). They may find themselves with no entitlement to universal credit in that period and, unless aware or advised, may not realise that this is not their usual entitlement situation.

But… apparently, they don’t need advice. As ministers have said from the beginning,

We are making it a much simpler system

Gareth Morgan

Ferret Information Systems

October 2018

If you’d like to try out the Reckoners that were used here then, for a short time, you can find them at:

Ferret’s Pay Periods Reckoner

http://www.ferret.co.uk/reckoners/demo/PayPeriods/payperiods.html

Ferret’s Surplus Earnings Reckoner

http://www.ferret.co.uk/reckoners/demo/surplus/surplus.htm

These are not for use with clients and no reliance should be placed on them as they are still in development.

[1] CIPP Payslip Statistics Comparison 2008 – 2016, Helen Hargreaves, CIPP

Comments

What form or calculator did you use to work out the 5 week months. I’m trying to find one online as we get UC every 25th and we get paid weekly its horrid!

We have a (free for the pandemic duration) reckoner included with many others at https://www.ferret.co.uk/reckoners/free/ . These normally come with our chargeable benefit and financial services calculators, but we’ve made them public for the time being. It should give you a two year forecast of dates and number of payments,