Greggs £300 – Bonus or Booby Prize?

by Gareth Morgan on January 11, 2020

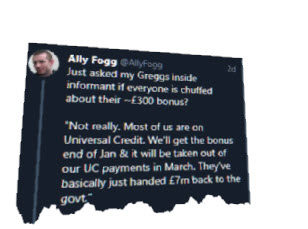

Greggs, the well-known bakers, have been in the news this week because they are giving their staff a bonus because of good financial results. It’s always good seeing employers rewarding staff, and Greggs already have a generous profit-sharing scheme.

They’ve basically just handed £7m back to the govt.

I have two questions about this. The first, widely shared as can be seen from a number of comments to the tweet above, is ‘how much will people actually get in their pocket?‘.

This is the same question, in many ways, as my post a few days ago about the increase in the National Living Wage; https://benefitsinthefuture.com/national-living-wage-cui-bono/ . It’s the problem of what is called Marginal Deduction Rate, or perhaps more accurately, the effective marginal tax rate. That is the amount of money taken away from the extra earnings or bonus by such things as tax, National Insurance (NI), reduction in state benefits, reduction in local benefits, and the loss of other means-tested entitlements, such as free prescriptions because of low income.

This can be a very complex calculation. It also depends a great deal upon individual circumstances. There are some relatively straightforward parts of such a calculation; for example, a 20% deduction for income tax where somebody’s earnings are above the personal allowance level and a similar assessment for NI. It gets more complicated when looking at Universal Credit which depends not only upon what’s left after tax and NI but upon the personal details which are used to assess the benefit, where some people will have different amounts of earnings that are disregarded, so that the extra may have more, or less, effect. Some people may find that the extra leaves them with less benefit, while others may find that they lose their entitlement altogether, and might have done so with even a smaller increase. The causal chain continues with local benefits, such as Council Tax Reduction, dependent upon the Universal Credit result and low income or ‘passported‘ entitlements following on again.

Universal Credit, in particular, is affected by this kind of bonus payment, because it uses when the payment is made in its calculation and doesn’t spread the impact over a year. That magnifies the problem for many people.

Unlike my figures for the National Living Wage note, where I was looking at the government’s assumptions for people in full-time work, Greggs staff may have a wide range of hours of work and pay scales. Some of them may have earnings above the tax or NI thresholds, while others may not. Some may be claiming Universal Credit, while others may not, etc. etc. The value of the bonus to different people will be worth different amounts.

What I have tried to do, is to break down the effects of tax, NI and benefits in a way which might offer some illustrations of the results.

First, what happens to people whose existing overall earnings, averaged over a year, will be above or below the tax and NI thresholds. I’m using the 2019/2020 figures throughout.

| Earnings below the tax and national insurance thresholds. Less than £165.55 a week, (£8,632 a year). | Earnings between the tax and national insurance thresholds. More than £165.55 a week, (£8,632 a year) but less than £239.07 a week (£12,500 a year) | Earnings above both thresholds. More than £239.07 a week (£12,500 a year) | |

| No deduction | NI deducted at 12% | NI deducted at 12% and tax deducted at 20%. | |

| Bonus | £300 | £300 | £300 |

| After deduction | £300 | £264 | £204 |

I am, of course, ignoring the more complicated, but very real, cases where the bonus takes people’s earnings above threshold values, so there is a part deduction, and where people are taxed at different rates for various reasons. I’m also not taking any account of pension contributions here.

If people are not receiving, or entitled to, any benefits then that will be the end result for those people. That often applies to people with higher earnings, or partners with higher earnings. Many Greggs staff, as pointed out in the tweet above, will be claiming benefits and increasingly that benefit will be Universal Credit. That introduces another stage and another serious problem.

As pointed out earlier, Universal Credit, unlike the legacy Working Tax Credit it’s replacing, looks at earnings, including bonuses, when they are paid and not averaged over a year. That means that the bonus paid this month reduces the Universal Credit paid next month.

Universal Credit, unlike other legacy benefits such as Job Seekers Allowance, does allow people to keep some of the extra earnings, including bonuses, that they get. It lets them keep 37% of the extra. The government claws back the other 63%. That gives the following result.

| Earnings below the tax and national insurance thresholds. | Earnings between the tax and national insurance thresholds. | Earnings above both thresholds. | |

| Bonus | £300 | £300 | £300 |

| After deduction | £300 | £264 | £204 |

| Universal Credit Reduction | £189 | £166.32 | £128.52

|

| Worker | £111 | £97.68 | £75,48 |

The reduction figures apply to those people who don’t have any disregarded earnings for Universal Credit, called Work Allowances, or whose earnings are already higher than those allowances. If people’s earnings are below those work allowance figures, and they have children or disabilities, then some of the net bonus will also be disregarded.

It’s striking though that roughly two-thirds to three-quarters of the bonus, for those people on income support, is being taken by the government.

Whatever the amounts that are taken into account, they will affect the Universal Credit the following month. They will be added to the existing earnings to recalculate entitlement. Universal Credit already has problems with the way it assesses monthly earnings figures. People paid weekly, as is common with low paid or part-time employment, will find that sometimes five paydays taken into account and sometimes four, with very serious effects ( see https://benefitsinthefuture.com/universal-credit-and-patterns-of-earning/ ).

Universal Credit is not a high-paying benefit; benefit caps, rent caps, limits on the number of children supported, sanctions as well as the freeze on the level of benefits for the last four years have driven down the real level of support. That means that often it does not take a big increase in earnings to stop entitlement altogether.

If that happens then people must claim the benefit again in the following month, using a shortened process. If they don’t, or aren’t able to for some reason, then their benefit won’t restart.

If they’re also claiming Council Tax Reduction then that will be reduced as well and, because for most local authorities it’s linked to Universal Credit, if Universal Credit stops then Council Tax Reduction can be thrown into confusion. It’s not possible to illustrate the effects of the bonus as there are different rules across the country.

Greggs generosity to their employees might seem, in practice, to be generosity to the government. Not only is the bulk of this bonus money likely to end up in the pockets of central or local government but Greggs will be paying an additional 13.8%, or £41.40 by way of extra Employers National Insurance contributions, although there will be a corporation tax offset to take into account.

So, to my second question, is there a better way to reward employees?

While a bonus is probably administratively simpler, because it doesn’t require much individual consideration, there are other alternatives that might be more welcome, once the real value of the bonus is taken into account. Additional holiday entitlement or pension contributions spring to mind. A bonus sacrifice into their workplace pension would save most National Insurance, for example. Pension contributions are disregarded completely from Universal Credit.

While the bonus clearly isn’t a booby prize, it’s still depressing that a government which talks non-stop about work incentives and encouraging people to work longer and earn more, still insists on grabbing as much as they can of any increase that people get.

Comments

Excellent analysis as ever Gareth. As you say, all depends on individual circumstances. But there will surely be some who have all UC wiped out & have to reclaim, others who lose free prescriptions temporarily (high risk of not realising this & being fined I’d have thought), some who temporarily escape benefit cap, the CTR consequences as you say – & these different effects will also overlap. From this point of view, tax credits with their disregard from one tax year to the next look like a better vehicle, but as we know have their own problems…

[…] Greggs £300 – Bonus or Booby Prize? Gareth Morgan’s blog: Greggs generosity to their employees might seem, in practice, to be generosity to the government. Not only is the bulk of this bonus money likely to end up in the pockets of central or local government. […]

[…] calculated that under current tax and benefit rules, a worker earning less than the tax and NI thresholds of […]

This is an excellent summary of how news of an exciting bonus is to be paid by an employer for an employee’s hard work is soon shot to peices. My boss recently very generously awarded me a bonus of £1500. After tax, NI etc this reduced this to approx £1000. Once UC are finished I will have received approx £600 of my very sizeable bonus. Yes I am sure some people are thinking “quit complaining its still an extra £600”, but its very demoralising as a single full time working mum who works her butt off, to have said hard work rewarded and only for that to be torn apart by the government.