Weekly rent and Universal Credit – Don’t panic!

by Gareth Morgan on January 2, 2019

Coming up to the New Year, there have been a flurry of comments about how Universal Credit works for people who pay their rent weekly. Most of this concern has come from social landlords who will have 53 rent days in their next rent year.

The National Housing Federation [NHF], in a technical note (53-week rent years, rent reduction and Universal Credit – 20 December 2018), say:

“For a housing association with weekly rents due on Mondays, whose rental year starts on the first Monday in April, there will be 53 gales of rent during the financial year.”

A ‘Gale’ is a periodical payment of rent. While this may seem an arbitrary choice of year – there are 52 Mondays in both the calendar year 2019 and in the financial year 2019 to 2020 – it seems to be attracting some attention.

Crudely, there appears to be a belief that tenants will be paying 53 weeks rent but only receiving 52 weeks in benefit.

Give us back our eleven days!

To side-track a little, the year used to start, under the Julian calendar, on Lady Day, March 25th, that being 9 months before Christmas Day and so believed to be the day of Jesus’s conception. So March the 24th would be in, e.g.1400 and March the 25th in 1401. That why some dates in history books are shown with two different year numbers attached to them, one for the year number starting in January and one for the year beginning in March.

When Britain adopted the Gregorian calendar in 1752, in order to get the seasons back in step and to align with other countries, the calendar jumped from Wednesday 2nd September 1752 to Thursday 14th September at midnight. At the same time the year changed to start on 1st January each year. In order to keep the same number of tax days in that year the tax year moved forward 11 days to end on the 5th April. The next tax, or financial, year then started on the 6th April; which it still does. Many areas continued to use the old calendar, for festivals especially, for a long time. In the Gwaun Valley in West Wales, they still do.

The NHF are wrong, by the way, to say that there will be 53 rent days during the financial year, they should have said ‘in the housing association’s rent year’.

Figure 1 Hogarth’s Election Entertainment – the placard on the floor calls for the return of the 11 days

For generations, there has been no better illustration of the collective idiocy of the crowd than the story of the English calendar riots of 1752. At the trial of Henry Hunt and others for treason in 1820, James Scarlett, the prosecuting counsel, had this to say:

The ridiculous folly of a mob had been exemplified in a most humorous manner by that eminent painter, Mr. Hogarth. It was found necessary many years ago, in order to prevent a confusion in the reckoning of time, to knock eleven days out of the calendar, and it was supposed by ignorant persons that the legislature had actually deprived them of eleven days of their existence. This ridiculous idea was finely exposed in Mr. Hogarth’s picture, where the mob were painted throwing up their hats, and crying out “Give us back our eleven days”.

Poole, Robert (1995) “Give us our eleven days!: calendar reform in eighteenth century England.

While I don’t expect to see a repetition of the riots in Bristol in 1752, it is sad to see that there are still misunderstandings about the effect of the, admittedly complex, way in which Universal Credit deals with weekly rents. Many of the problems stem from the unfortunate decision in designing Universal Credit to rigidly apply rules based on months to its assessment. The blithe assumption that everybody has stable incomes and outgoings in monthly cycles has caused more complexity and difficulty than probably any other part of the Universal Credit assessment. I’ve looked elsewhere in my blog at the very real problems caused by different earnings cycles to claimants (here) and the consequential problems for landlords and others (here)

The situation with weekly rents is a little different.

While there may be undoubted budgeting problems, because there are more rent days than usual in a Universal Credit period, there is no conspiracy to steal large amounts of rent from tenants or landlords.

There is, though, a small shortfall in the normal calculation where rent weeks are concerned. Universal Credit determines the amount of rent that it uses each month by dividing the annual amount by 12. Where rent is payable in weekly cycles, it arrives at the annual amount by multiplying the amount paid for each weekly cycle. That means:

For weekly rent, it multiplies the amount by 52

For two-weekly rent, it multiplies the amount by 26

For four-weekly rent, it multiplies the amount by 13

Multiplying a week’s rent by 52 generates an annual coverage of 364 days. The same is true for two-weekly and four-weekly rents. This means that when converted into months, over the course of a year, one day’s rental support is lost. With a leap year, the effect is to lose two days rent.

Months, or Universal Credit assessment periods, will normally not coincide with the dates for the financial year, in the same way that months don’t coincide with the weekly cycles of pay or anything else. That’s why people on weekly pay will normally have some Universal Credit periods with four paydays and some with five paydays.

The same problem causes the five rent days in a month occasionally (typically 4 a year) with a weekly based rent. This has been recognised as a budgeting problem since the start of Universal Credit.

This isn’t connected to the 53 rent days issue. That can be summarised by the NHF, when they say:

“In a 53 week year tenants with weekly (or fortnightly or four-weekly) tenancies will receive a week’s less Universal Credit than their annual rent charge.”

I shall be kind, and assume that when they say “a week’s less Universal Credit” they actually mean a week’s less rental element which forms part of their Universal Credit.

They’re still wrong!

It does seem that they are guilty of believing that the “legislature had actually deprived them of” a week’s rent.

It hasn’t.

Next year will start on a Tuesday, 1 January and end on another Tuesday, 31 December. That means 52 weeks and one day (it is not a leap year). However, the financial year 2019 to 2020 which starts on Saturday, 6 April and finishes on Sunday, 5 April 2020 has 52 weeks and two days (as 2020 is a leap year). Neither of these maps onto the time period that they’re concerned with.

A week’s rent, from Monday to Sunday, will not necessarily fit within any other period. If the calendar year ends on Wednesday, then four days of the rent paid will fall into the following year. Similarly, some of the rent paid in the last rent week of the previous year may have fallen into the current year. The same will be true for the 12 month period of Universal Credit, which will in any event be different from person to person, based on their initial date of claim.

Trying to shoehorn their choice of time period into an entirely different time period will always lead to tears.

Having 53 rent days doesn’t mean paying more over the course of the year; it just means, that is the effect of the day of the week selected for paying rent. If you pay rent on a Friday and that happens to be 1st of January or 31st of December, you’re still paying rent for a week but there may happen to be more rent days in a calendar year for one year rather than the other. If you converted everything to a daily basis; rent and Universal Credit, then over a year it should sort itself out (apart from the one or two days that Universal Credit forgets).

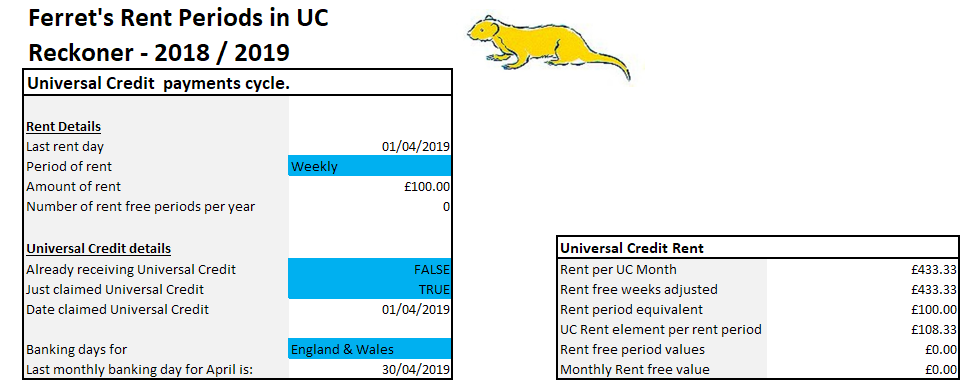

We’ve produced another Ferret Reckoner that allows this to be worked out.

Figure 2 Ferret’s Rent Periods’ Reckoner

Using a 52 week rent cycle, and a rent of £100 a week, this helps to clarify some of the relationship between the different rent and benefits periods.

In this example it shows that, in each Universal Credit monthly period, rental support is assessed on the basis of £433.33 each month. If there are four rent days in the Universal Credit month, then £108.33 is paid for each of them. In four rent day months therefore, the benefit is based on £33.33 more than is actually paid by the tenant.

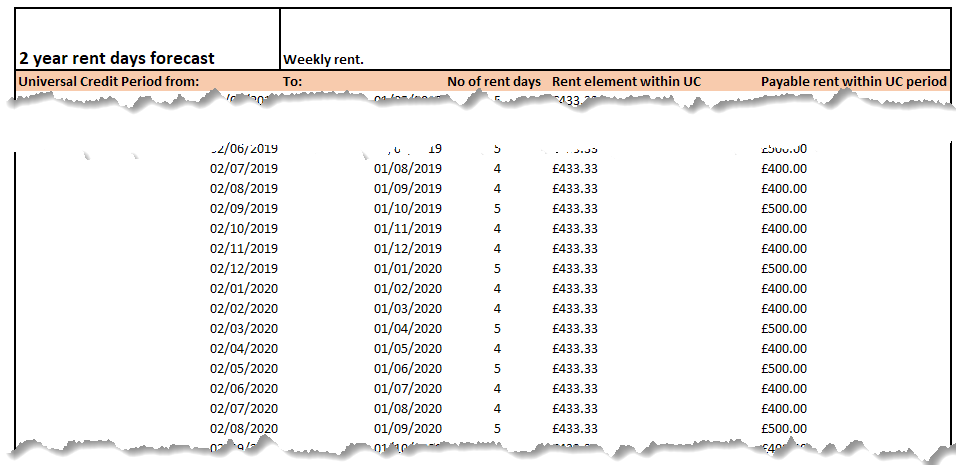

If we look at the relationship over time, generated by the Reckoner, the long-term situation can be seen clearly.

Figure 3 Rent and Universal Credit over time

In months when there are four rent-days then a little more benefit may be paid to the tenant than the tenant is responsible for paying to the landlord. In months when there are five rent-days then less is paid in Universal Credit than the landlord is due. The extra in the, more common, four rent-day months can be expected, through budgeting, to be available to pay the additional rent in the, less frequent, five rent-day months.

This is a budgeting problem, and often a very real one, but it is not a problem caused by the, arbitrary, count of 53 rent days in a particular 12 month period.

(There is a separate, and extremely complex, relationship between weekly rent cycles and weekly pay cycles with the Universal Credit monthly calculation. This will have those advisers determined to do thorough calculations, tearing their hair out.)

When the NHF say, in their briefing:

“Part 3 of the Universal Credit 2013 regulations state that to convert a weekly rent figure to monthly figure DWP should multiply by 52 and divide by 12. In a financial year that has 53 weeks a tenant whose rent is charged weekly will not receive enough rent to cover the whole year – he or she will be 1 week short”

They are right – and completely wrong.

Yes, that’s how the weekly rent is converted to monthly.

No, he or she won’t be “1 week short”.

53 Rent-days is not the same as 53 weeks rent in the year! Please look at a calendar!

Rent-free periods

The briefing also points out, without coming to any conclusions:

“Tenants with rent free weeks will also be affected. The regulations were amended in 2014 to specify that the calculation for cases with rent-free weeks will be 52 minus the number of rent free weeks. This will apply even in years where there are 53 rent weeks.”

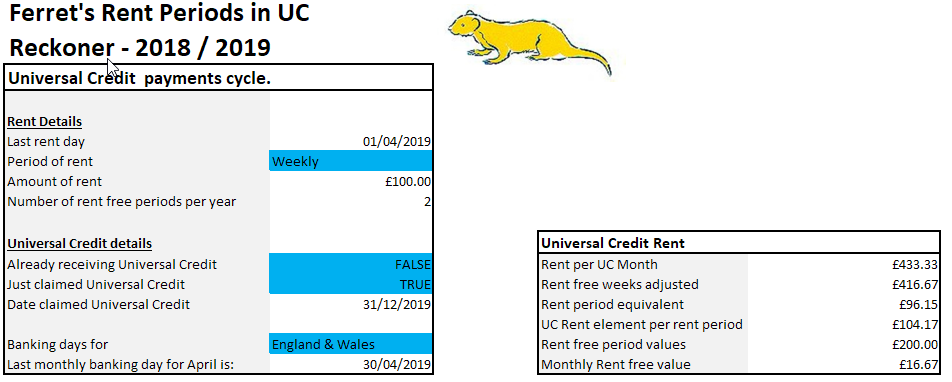

The effect of rent free weeks on support is, again, largely an issue of budgeting. Using the same example as above in figures 2 and 3, with 2 rent free weeks in the year, the results can be seen, using Ferret’s Reckoner.

Figure 4 Two rent free weeks included

Rent free weeks are averaged out throughout the year and have the effect of reducing the weekly rent taken into account. In this example the effective weekly rent is reduced to £96.15 and there is a reduction in the Universal Credit monthly element of £16.67. In a four rent-day month, the Universal Credit rental element is still higher than the amount due to the landlord.

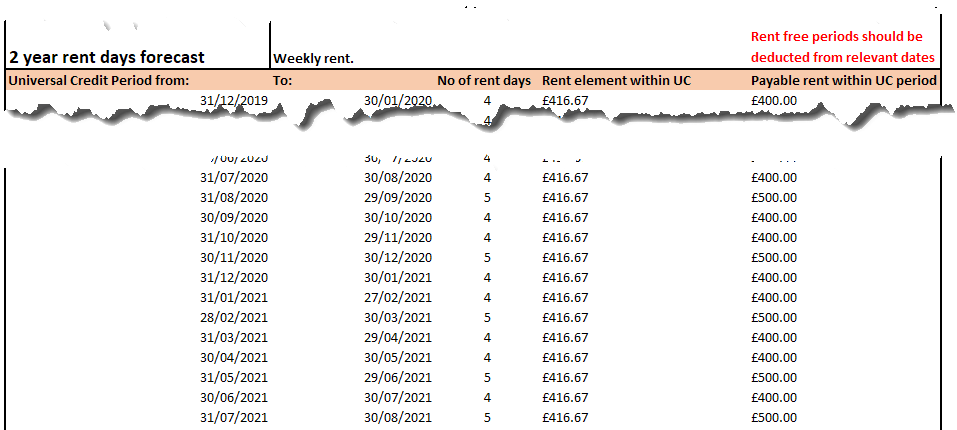

Looking, in figure 5, over periods of time, using the Reckoner, the benefit looks lower than in the table in figure 3, without rent free weeks.

Figure 5 Over time with rent free weeks

The difference, of course, is that within the year, at some point, there will be two rent-days when no rent is payable but Universal Credit will still be including the same amount of rental element.

In conclusion; it is possible that the discontinuity between the different time periods used for rent, Universal Credit and landlord’s years may cause some accounting difficulties.

That is not the same as accusing the DWP of stealing a week’s rent from claimants.

In this case, perhaps unusually, they are innocent, although it might take a Hogarth to persuade everybody.

Gareth Morgan

January 2019

Ferret Information Systems

To try the Reckoner, go to

http://www.ferret.co.uk/reckoners/demo/RentPeriods/rentperiods.html

Comments

The DWP said let’s create a less complex system of benefits and here it is in universal credit. Well they have failed spectacularly, the mess with rent payments is mirrored by the problem with people being paid 2 or 4 weekly and their UC claim being closed as they received too much money in one assessment period. Then the self employed being told they must have earned the minimum wage rate.

The other part I don’t understand is if you take a high paid temp job and have to reclaim UC the dwp counts your previous earnings as if you still have them, by doing that they reduce the amount you can be awarded. What a mess but thanks for the blog, I will re read it and try to understand how it affects my clients.

Thanks Sarah. The previous couple of recent posts in the blog look in some detail at the problems of weekly pay periods. There’s some stuff about self-employment further back too.

I agree with you that the NHF have described the probem badly. However, there is certainly a valid concern with UC.

A landlord who received HB direct and now receives the housing element of UC direct (via an APA), will be worse off each month by an amount which adds up to a week’s rent after approx. 5 to 6 years, unless they go chasing the tenant for it.

This will of course also happen if the housing element is paid to a claimant, but who then transfers the amount of the housing element straight to the landlord.

If the claimant does pay the shortfall, then s/he will be the one shortchanged by the above amount.

Under HB, those who paid rent weekly were covered in full, and those who paid monthly actually gained slightly, and were able to pocket an amount of benefit totalling a week’s rent after 5 to 6 years.

The answer for UC is to calculate the monthly housing element by dividing the weekly rent by 7, multiplying by 365.25 (let’s not worry about century years for now!), and dividing by 12.

Yes Charles. As I said in the post, there will be a 1, or in leap years 2, days shortfall in rent for anyone whose rent is based on a weekly cycle. But that has nothing to do with the number of rent weeks in the year. Shifting rent in UC to a daily basis is a relatively simple solution that would solve that problem. There are many other problems associated with money, in or out, over different periods, that a daily rate could solve but it would fundamentally alter the character of and administration of UC (No bad thing).

But would this be such a fundamental change? Everything would still be done on a monthly basis, just instead of calculating WR*52/12 it’ll be WR/7*365.25/12.

There is already one calculation for which UC seems to use this more accurate calculation: the LHA rates used for UC are calculated from the weekly figures using WR/7*365/12. See here: https://www.gov.uk/government/publications/local-housing-allowance-lha-rates-applicable-from-april-2018-to-march-2019

(This calculation is done by the VOA, not DWP, but we see it can be done!)

Rent is fine, as I said but moving, for example, earnings to reflect the real period it’s paid for would mean breaking the link with HMRC’s RTI system which is, at base, annually focused and finding new ways to collect the data.

Yes, I see. Thanks.

Written answer by DWP Minister Justin Tomlinson MP to Written question 195091 appears to contradict you….

“Universal Credit is paid on a monthly cycle to reflect the fact that the vast majority of people receive their wages monthly. Many social landlords still expect their tenants to pay rent on a weekly basis, a practice based upon a time when both wages and benefits were paid weekly. The effect of this is that, roughly every six years, there will be 53 payment days in a twelve-month period with the result that, over the cycle, the average social sector tenant will receive approximately 35p a week less towards their rent. A key principle of Universal Credit is that it simplifies the benefit system for working age claimants and re-assessing housing costs to reflect the number of rent payments in any particular year would be complicated and lead to confusion.”

If a L/L were to treat the 53rd week as free the 2014 change to UC regs requiring the rent calc to reflect the number of RFW’s would mean for UC it would be 51 weeks which would have an undesirable effect would it not ?

No. The important issue is the number of weeks in the year not rent-days. If the tenant has one*week* in the year when rent is not paid, then the rent is averaged over 51 weeks. If you choose to give them an extra week rent-free by not collecting rent in, and for, that week, then that’s the effect. Most of that rent would, presumably, be used in the next accounting year anyway.

I get that when its a 52 week year with one of them free but if its a 53 week year with one free the UC regs assume two are free – If there were 52 free weeks in a 53 rent year then the UC regs would say there were no rent weeks at all and no housing costs would be payable regardless of which week in the year was actually chargeable (lets assume its in July). That has to be a week lost surely ?

Must add that this is a really useful analysis – thank you Gareth

Every year, calendar, accounting or financial has only 52 weeks, plus 1 day or 2 days if a leap year. It may have 53 occurrences of a particular day of the week. That’s why there may be 53 rent days, for example. That’s unconnected with the way the DWP work out monthly rent. If there are two rent free weeks in a 52 rent-day accounting period, that means that 50 payments of rent are made – covering 350 days. At £100 a week the landlord gets £5,000 to cover 52 weeks of occupation. £96.15 a week. The UC calculation takes the weekly rent and multiplies it by 50 giving it the same result. They then divide it by 12 to give a housing element of £416.66 in each period.

If your 52 weeks rent free in a 53 *rent days* year happened then the calculation would just be £100 * 1 / 12

In your 53 rent day year, with no free weeks, the tenant is paying 371 days rent. It’s just that 6 days are going into a different accounting period.

My theoretical 52 free weeks in a 53 week year doesn’t deliver the result you have Gareth because as you quote in the body above:

“Tenants with rent free weeks will also be affected. The regulations were amended in 2014 to specify that the calculation for cases with rent-free weeks will be 52 minus the number of rent free weeks. This will apply even in years where there are 53 rent weeks”

The regs actually force a situation where the calculation will be 52-52=0 so the weekly rent calculation will be £100 * 0/12. Regardless of the fact that there is a week that falls wholly within the accounting year and the rent year.

You’re still thinking about rent-days equalling rent weeks. That isn’t the case There can *never* be 53 rent weeks in a 12 month universal period. The most you can manage is 52 and 2/7ths (in a leap year). The UC calculation does mean that the tenant loses 1 days rent support (or 2 days in a leap year) although the landlord will still, presumably, expect the rent to be paid to them.

Be interested to know you thoughts on this Gareth. Is my maths right? I have been thinking hard about RFPs and I think Julian is right that there is a problem for weekly tenants. As with the related issues discussed in your article, it isn’t really anything to do with landlords’ accounting practices, in particular if the landlord has the odd 53-week rent year it doesn’t follow that the UC claimant loses out in that year … but I have become convinced that weekly tenants with rent free weeks do lose a week’s UC every so often.

Whatever 12-month period UC looks at for the purpose of Schedule 4 .7(3A), every now and again there will be 53 rent payments in it – this happens whenever the first rent day falls on the first or second day of the UC 12 month period, or even the third day if the period includes a long February. But the total amount of rent used in the UC calculation for that year will be based on 52-RFP. The claimant has to pay Rx(53-RFP) but UC only takes into account Rx(52-RFP). I don’t see how that lost week is recouped in the following year – it remains invisible to the UC assessment forever.

Now this only happens every few years, so it’s not a whole week’s rent lost every year. Compared with people who pay weekly rent without RFPs, who lose a small amount of UC every year because of the inaccurate x52/12 pcm conversion, I suppose you could say everyone breaks even: all UC claimants are cheated out of roughly the same amount of money, whether it’s a day or two every year a whole week every few years. But if the pcm conversion issue were fixed for people without RFPs, there would still be a lost week now and again for RFP cases.

Am I right?

I think that you’re still thinking in weeks rather than days. Assume a 2 rent free weeks year. The tenant *pays* rent for 51 x 7 days = 357. They get 2 x 7 days free = 14, so they’re covered for 371 days = 52 weeks + 6days. That 6 days equals a week minus the 1 day lost by the 52 week calculation.

Still not convinced. I now intend to compare rent liability v UC over a period of several years beginning on Monday 1 January and ending on Sunday 31 December where rent is paid weekly and there is an RFP. I am convinced that a week goes missing when there are 53 rent payments in the UC year.

Will get back to you when I’m done!

OK, so the spreadsheet is done. Period from Monday 1 January 2018 to Sunday 31 December 2028. Weekly Monday-Sunday tenancy; landlord’s rent year runs from first Monday in April; final week of rent year is a rent free week; rent due in advance on Monday. UC AP runs from 1st of month; Sched 4.7(3A) period runs from 1 January.

In most years there are 52 tenancy Mondays, with rent due on 51 of them. But in 2018 and 2024 there are 53 tenancy Mondays, with rent due on 52 of them. UC pays 51 weeks’ rent every year in 12 equal instalments because Sched 4.7(3A) says the formula is always R x (52-RFP) / 12. If the rent is £100 every time it is due, and £0 in the RFP, there is £56,300 of rent due for the 11 year period but only £56,100 of UC is payable. On two occasions, a week of rent has not been taken into account in the UC calculation.

Also of note is that the 53-gale UC years do not coincide with the landlord’s 53-week rent years. This not a 53 week rent year problem.

Peter, your sums are right but the reason isn’t. I can send you my spreadsheet that compares rent free periods with whole year liability. I’ve done a 20 year period comparing 52 week rent years and 50 week rent years and the results are:

No rent free weeks

UC Rent per month £433.33

UC Rent per week £99.66

Total rent days 1044

Average rent days over 20 years 52.2

52 week periods 20

Rent in those periods £104,000

Additional 4 weeks £400

UC Rent over 20 years £104,000.00

Rent free weeks

UC Rent per month £416.67

UC Rent per week £95.82

Total rent days 1004

Average rent days over 20 years 50.2

50 week periods 20

Rent in those periods £100,000

Additional 4 weeks, if all paid £400

UC Rent over 20 years £100,000.00

You’ll see the same shortfall every time. That’s made up from accumulating the extra 1 or 2 days each year that UC doesn’t cover, which accumulates at about 1 week every 5 years. It doesn’t matter whether it’s a rent-free basis or not. The only difference would be if there’s a rent free period falling in the last 4 weeks of the 20 years, when the difference falls; but that’s caused by an arbitrary choice of period.

Looking at the occurrences of rent days in UC periods over 20 years, you get the following which should be pretty standard but vary, within assessment periods, by rent and claim dates.

4 rent-days – 156 5 rent days – 84 Total rent days – 240

And I’ll send you mine! We obviously aren’t using the same method for RFW cases, my method pays exactly the right amount most years but falls short by one week in a 53 “gale” UC year. This contrasts with weekly tenants who don’t have RFWs, where the shortfall accumulates gradually because of the conversion method. That’s the key to it: the way I read the regs for RFW cases, the ×52/12 conversion issue doesn’t arise but instead there is this sporadic lost week problem. You have my email address, let’s share spreadsheets!

One further point to add, doubling down on Julian’s “reductio ad absurdum” scenario. Assuming the landlord wants to collect a certain amount of rent in its rent year, the fewer weeks that rent is concentrated in the greater the UC loss in absolute terms when the UC year contains 53 days that are normally rent days (including the RFP obviously)

I think that I’ve worked out the problem, from the perspective of the social landlords. Their rent years aren’t years!

They work, in the main, to a fixed first Monday in April year start. So their years are always an exact number of weeks. Normally that will be 52 but sometimes it will be 53. In other words their years will be either 364 days or 371 days so losing 1 day in a calendar year(add 1 for leap years) or gaining 6 (or 5). With that confusing basis it’s easy to see that they can think they’ve lost a week’s rent when they haven’t.

Apart from social LLs don’t gain any days in a 53 rent week year due to the calculation used by the DWP.

Hence the ‘lost’ week of rent