Retirement – where is thy sting?

by Gareth Morgan on July 27, 2020

PensionBee are a company which “combines and transfers your old pensions into a brand new online plan, managed by some of the world’s largest money managers.” It doesn’t offer advice but points to where that can be found. It emphasises that it offers a simple online service.

It has a lot of useful information on its website which is great (although I’d point out that its pension calculator assumes that everyone will receive the full New State Pension, even those who are of old basic pension age, or who don’t have a full contribution record. It also has a drawdown calculator which points users to a YouTube video on the risks, which is not viewable as it’s private).

What I’m writing about here is not meant to be critical of them, in fact I’d praise them for trying to provide people with information. Providing more accessible information is to be welcomed. I’m just spurred by them into, again, looking at the failings of the pensions industry.

It’s just published a research report, aimed I suspect at professionals, which is “highlighting the barriers and challenges faced by those making plans to access, and at the point of accessing, their defined contribution pension”

Defined contribution, or DC, pensions are those where the contributions end up as a ‘pot’. A sum of savings which can be used in a number of alternative ways to provide income or lump-sums in retirement. These are typically private pension schemes or, increasingly, occupational schemes where employers make some of the contributions. The amount in the pot depends upon how much is contributed and how well the savings have grown while invested. They differ from Defined Benefit (DB) schemes, which guarantee, typically, a proportion of final salaries and aren’t dependent on how much was contributed or how those contributions performed. The DB schemes have proved very costly for employers and are fast disappearing.

The report,

Drawdown Doldrums:

Barriers and challenges faced by people accessing their defined contribution pensions

Dominic Lindley

PensionBee

July 2020

can be downloaded at https://www.pensionbee.com/resources/drawdown-doldrums-report-2020.pdf, It’s lengthy so I’ve included some relevant extracts, together with my comments, to save downloading the whole document.

Some Comments on the report

This report looks in detail at the way in which defined contribution pensions are being used or are planned to be used.

I am not competent to comment on much of the content of the report, which seems entirely competent and useful, but want to make some points about important omissions.

I will make one comment about the wording, however. It uses the prevalent description of pension savings, which is common in the industry, – wealth. It may be a great marketing term but there are few words more likely to say to low-income people that a document or scheme is not intended for them. Not a lot of minimum wage workers will see references to wealth in retirement as having much relevance to their circumstances.

This report omits another relevant area to many low-income people. It is 94 pages long and, in all the text, there is not one mention of means tested or disability state benefits.

Not one word!

In my opinion, that’s an unforgivable omission.

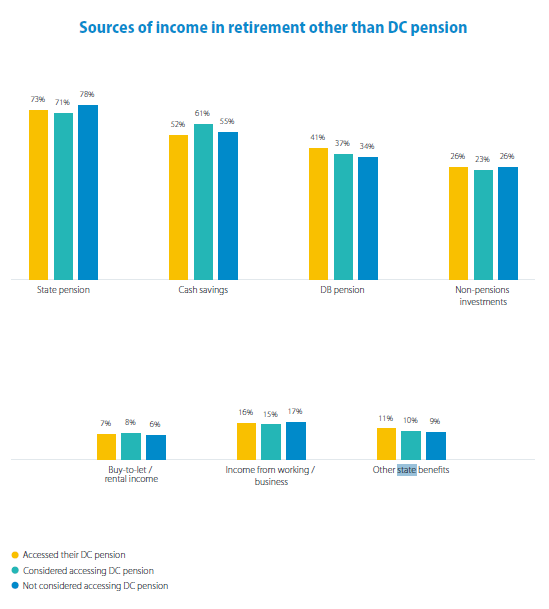

There is one mention of state benefits in the report, in a chart[1] reproduced here as figure 1.

The chart shows about 10% of those studied have income from other state benefits than their state pension. Interestingly, it shows that the largest group receiving other state benefits are those who have already accessed their DC pensions. This would imply that their use of the pension savings that they have, has been insufficient to lift them off state benefits. It also means that there may have been little value in using their pension savings, because, in many cases, the pension savings taken will simply reduce the amount of entitlement to state benefits.[2]

As this group formed a substantial element of the study, the interaction with means tested benefits would certainly have benefited from being looked at in some detail.

The impact of, and on, state benefits of pension usage is, unfortunately, omitted throughout the remainder of the report and I feel that this needs to be pointed out. Neglecting to consider the importance of other state benefits to those in, and approaching, retirement may lead advisers, and providers, to inadvertently mislead their customers or to fail to provide comprehensive and accurate information to people making these very important decisions about the use of their pension savings.

I want, therefore, to comment on some areas of the report where I think this omission could affect the conclusions or recommendations. This should not be taken as criticism of the report’s contents in themselves.

Figure 1

Some areas of the report where consideration of the benefits impact would have been important

… As a result, only half had thought a great deal about how they would manage throughout their retirement.[3]

While this is undoubtedly true, it demonstrates the level of ignorance about the availability and importance of means tested benefits. Pension Credit and Council Tax Reduction are both benefits which are not claimed by a very high proportion of those entitled. The main reason for this is ignorance of the benefits themselves or of potential eligibility. Anyone providing advice or information about income in retirement, should include state benefits in their content.

People are accessing their pension early, leading to them paying too much tax and losing out on potential returns. There were two main reasons for this[4]:

-

-

Accessing pensions had become disconnected from retirement: Accessing pension funds early has become the norm, with two-thirds of pension pots being accessed before the age of 65 and those working were more likely to say that they accessed the money in their pension fund to help them meet day-to-day expenses.

-

Many people do not feel in control of their pension and want to take control of the money by withdrawing it and putting it in a Savings account or other investments: A desire to take control of their pension by taking the money out was the single most popular reason which had prompted people to access their DC pension.

-

There are other dangers in accessing pension savings early. Pension savings, for those under state retirement age, are completely disregarded in the assessment of entitlement to means tested benefits. Once withdrawn, however, any income or capital will be taken into account in the assessment of means tested benefits. Income will reduce the entitlement to means-tested benefits, penny for penny, leaving people with no net increase in income in many cases. Taking capital and putting it into a savings account, or other investment, may disqualify the saver from benefits entirely, if the amount puts capital over £16,000, or reduce benefit entitlement through the tariff income assessment.

Where the reason for withdrawal is to meet day-to-day expenses, the first step, before withdrawing from the pension, should be to make sure that any benefits to which the person is entitled have been claimed.

Retirement income products[5]

People are making choices about retirement income products without considering important factors which might influence their decision: Many people choosing retirement income products are failing to consider important influences on their choices such as the investment risk, their health and tax considerations.

Taking the full 25% tax-free lump sum acts as a strong anchor: The desire to take the entire 25% tax-free lump sum acts as an important anchor for people, even if they do not have a need for it or a plan for what to do with it. For those who just took the 25% lump sum, around a quarter put some of the money into a current or savings account to save for a rainy day and 11% used the largest share of the money they withdrew in this way. 11% used the money to save in a Cash ISA and 7% used the largest share of the money in this way.

As above, the factors mentioned are important but omit the way in which the decisions affect benefits entitlement. These are decisions which cannot be undone later, when, perhaps, the impact on existing or potential benefits has become clear.

Withdrawal amounts[6]

Decisions about how much to withdraw each year and when to review it are complex and pension providers are doing little to help people understand sustainable withdrawal rates or to develop withdrawal strategies:

Considerations about how much to withdraw, when and how are even more vital where state benefits are concerned. There is a complex relationship between the notional income figure, which is assessed on untaken pension savings, once state pension age has been reached, and the reduction, or even sometimes increase, in state benefit entitlement caused by the withdrawal. Very few financial advisers, or providers, seem to understand this or to understand the onerous duties placed on them to reassess and inform the DWP after each withdrawal. There is no mention of the implications of deferral of state or personal pensions.

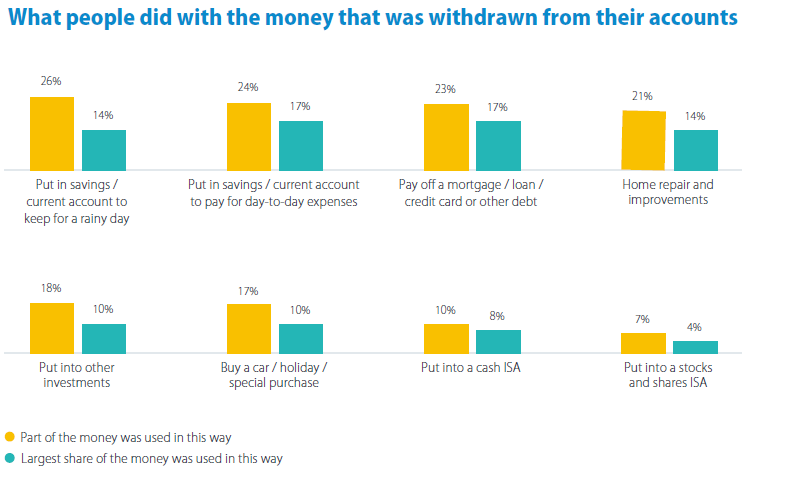

What to do with the money[7]

People accessing their pension are not blowing the money but are using it in ways, such as keeping it in a savings account or cash ISA, which could reduce their long-term retirement income: 22% said they had saved the largest share of the money they withdrew from their pension in a savings account or cash ISA and 14% said that they had invested it elsewhere.

Again, the effect upon state benefit entitlement can be very large. For those making withdrawals below state pension age, the effect may be catastrophic in terms of day-to-day income. People who use their withdrawn money in ways that are considered to be deprivation, such as helping adult children, may face profoundly serious problems.

Making plans / before access[8]

- …

- Understanding their income needs in retirement: Maximising income from other sources before accessing their pension.

Income maximisation is a core part of helping people to understand and improve their financial situation. In all areas of money advice, the first step of this process is to ensure that people are receiving all the benefits to which they are entitled. For those approaching retirement this needs to recognise their situation after changes, such as age and the loss of earnings.

Point of access[9]

- Decisions about which type of retirement income product to use: Full withdrawal vs annuity vs UFPLUS vs income drawdown?

-

-

Guarantees: Are people aware of and do they take up any Guaranteed Annuity Rates?

-

Tax considerations: How much tax will be paid on the money they withdraw?

-

Investment options: Where is their pension invested?

-

How much to withdraw: What are people’s views regarding sustainable withdrawal rates?

-

What to do with the money: What have people done with the money they have withdrawn from their pension?

-

Assessment of entitlement to benefits, when considering making use of DC pensions, should be an important addition to this list.

Impact of the coronavirus on decisions about accessing DC pensions[10]

8.7 million people have already had their jobs furloughed by the end of May, meaning that a quarter of the UK workforce is now covered by the furlough scheme.13 Millions of people will become temporarily or permanently unemployed, reducing their income and prompting some to access their pension. Temporary payment holidays have been granted on mortgages, credit cards and other debts, but these only last until October. Thousands of older people will suffer the loss of a partner and have to re-evaluate their financial situation and retirement income choices.

….

22% agreed that they were more likely to make a withdrawal due to the pandemic, 13% that they were more likely to cash in their entire pension, and 17% agreed that the pandemic made them more likely to take money out of their pension to put in a Savings account.

Many of the people affected by coronavirus will have joined the huge number of people who are now claiming Universal Credit. Withdrawing part, or all, of their pension is likely to reduce, or stop, entitlement to that benefit. If advisers and providers are not able, or willing, to help them to understand the consequences of making use of their pension, at this time, then they may make poorly informed and damaging decisions.

Background on their finances and the relative importance of DC pensions wealth in their total assets and what other sources of income they expect in retirement[11]

The first stage for any person accessing their DC pension will be to take stock of their financial situation, their existing assets and the sources of income they will be able to access in retirement. They will also need to determine or have a rough idea of how much income their assets will generate in retirement. The income they would expect to receive would be divided into two categories:

-

-

Secure sources of income: State Pensions, Final-Salary schemes and annuities which will continue to be paid no matter how long that person lives.

-

Variable source of income: DC pensions, cash savings and income from other investments which, depending on returns and longevity, could run out or need to be reduced.

-

There is a third category which seems to have been ignored – state benefits. Very many holders of DC pensions will be dependent upon state benefits after retirement. This dependency will increase for those where disabilities commence or become more severe and for those in rented housing, if rents continue to outstrip the rates of benefit.

Maximising income from other sources before accessing their pension[12]

Again, there is no mention of the importance of state benefits

Prompts for people to access their pension[13]

…Income for day to day expenses: 28% said that they had been prompted to access their pension as they needed extra income to meet day to day expenses. Those working or temporarily unemployed were more likely to cite a need for extra income to meet day-to-day expenses as a prompt to access their pension (34%) than those retired (21%). However, although accessing their pension was supposed to be for extra income, most reported to have taken lump sums, including 60% who said that they had just taken just the 25% tax-free lump sum. This reflects other research which found that to get a regular income from their pension was only a key motivation for a very low percentage of people accessing their pension by moving into income drawdown.

Sadly, it is not uncommon for people in need of extra income to be unaware of their entitlement to state benefits. Helping somebody to withdraw money from their pension savings, without considering benefit entitlement, would be a very unfortunate activity. Taking the lump sum may be seen as a tax efficient way to realise short-term income for short-term day-to-day needs, but should be a last resort after checking what state help was available.

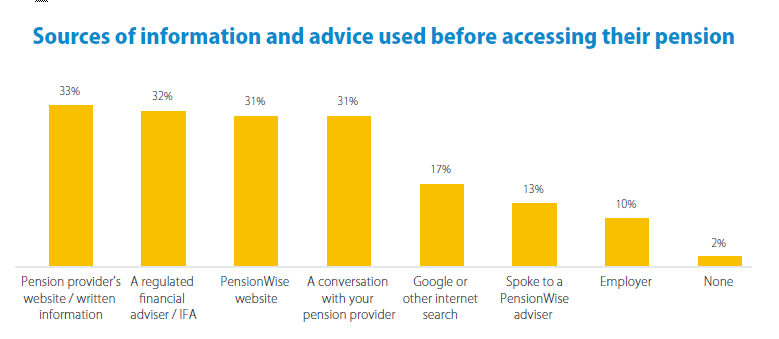

Figure 2

Figure 2, which appears on page 61 of the report, appears to show the sources of information which the author considers to be useful to someone thinking about using their pension savings. It is notable for the absence of any adviser who might be able to offer help about benefits, or other many advice needs. There is no reference to Citizens Advice, welfare rights units or charitable or third sector advisers.

This report does not appear to recognise the importance of holistic information and advice around financial decisions. The best results for customers will be given by those who recognise the complex interactions, in this case, of the pensions, tax and benefits system. If advisers and providers are unable to offer that themselves, then they should ensure that their customers are helped to access it elsewhere.

Tax considerations[14]

Are people at risk of paying too much tax when they access their pension?

Once again, there is a detailed, and important, discussion of the tax implications of making use of pension savings but there is no reference to the risks to benefit entitlement caused by the alternative ways of making use of pension savings.

What people did with the money withdrawn from their pension[15]

Figure 3 usefully lists the ways in which people used their pension withdrawals. Some of these have no effect upon entitlement to benefits while others might have a very serious effect. Failing to consider these effects, potentially on a substantial number of people, misses an opportunity to educate and inform the recipients of this report.

Informing the customers can only happen when advisers and providers are themselves aware of the impact of these types of decision.

Figure 3

The summary of the effects of the way in which people are making use of their pensions, looks in detail, once more, at the tax implications and investment consequences but cannot find space to consider, at all, the effect on any benefits entitlement that there might be.

Overall, our results indicate that most people accessing their pension are not blowing the money, indeed many are saving or investing it outside their pension. But this could still be detrimental for them if it reduces long-term returns or results in them paying too much tax.[16]

People withdrawing money from their pension and keeping it in a Savings account risk taking a number of hits to their retirement income. Apart from the tax-free lump sum, taking money out of a pension will normally immediately reduce the capital saved by 20% or 40%, depending on the amount taken out and the tax rate applied. People could also take a second tax hit on the return on the savings unless they hold it in an ISA or are earning interest below the tax-free personal savings allowance. The returns available on cash are very low and unlikely to be able to keep pace with inflation, and although peoples’ absolute levels of capital will be secure they are more likely to run out of money due to the low returns received. This chance of running out of money will increase further if they withdraw money from their pension during a period of market turmoil after the value of their investments has already fallen.

Taking a tax-free lump sum from a pension and using it to invest outside of their pension (preferably held within an ISA) might make financial sense for some people – depending on their financial circumstances and attitude to risk. Taking a taxed withdrawal from a pension to invest in similar funds outside a pension will not make financial sense for most people. It would immediately reduce the capital available for investment by 20% or 40%, depending on the amount taken out and the tax rate applied. If the funds are held outside an ISA then the income produced from them and potential capital gains would be taxable.

Conclusion

I have no reason to doubt that the report thoroughly and accurately covers its intended area.

I’ve also had a helpful email exchange with the author. He recognises that there should have been reference to the benefits issues and will be amending the content to reflect this. He also wants to make it clear that he was solely responsible for the content and that PensionBee shouldn’t be criticised for any omission.

My criticisms are aimed more at an industry which doesn’t seem to be aware of its own ignorance about low income savers or pensioners.

It seems to completely ignore the existence of any pension savers who might now, or in the future, depend upon means-tested benefits.

That there are millions of such people is not in doubt.

What is in question is why they are ignored by the financial services industry?

Gareth Morgan

July 2020

[1] Page 38

[2] See, for example, https://benefitsinthefuture.com/income-certainty-and-low-pension-savings/

[3] Page 13

[5 Page 17

[6] Page 19

[7] ibid

[8] Page 23

[9] ibid

[10] Page 25

[11] Page 34

[12] Page 40

[13] Page 43

[14] Page 78

[15] Page 88

Comments

I have just read your blog and felt like shouting out ‘yes’ in agreement with each paragraph! I work for a small charity supporting people affected by a neuro-degenerative illness which often results in clients having to stop work early on ill health grounds. Clients’ always appreciate the, often complex, ‘better off’ calculations we do for them to help them consider the best lump sum v annuity options, and timing of DC pension withdrawals etc. in order to maximise social security income. It often irritates me that the pension industry seem to omit this as a factor for consideration, so thank you for pin pointing this so comprehensively in your blog.

Our team strive to provide a holistic service covering welfare rights, debt advice/support and long term planning and I sometimes feel like IFA’s and solicitors have it relatively easy as they tend to deal with one discrete aspect rather than taking the holistic approach.

Thanks again for an interesting read.

Thanks Katrina.

It’s not the disconnect that infuriates me, it’s the lack of recognition or awareness that there is a disconnect.

I agree with Gareth. The report seems to comprehensive in the areas that the author knows about but fails to join the dots to benefits. Like you I would not criticise the author or PensionBee but the way in which the industry does not make what should be a natural link to benefit and support a full part of its considerations and advice.